Which of your product’s roadmapped features will your customers pay more for? Which will give customers a reason to upgrade to a higher tier or purchase an add-on?

By increasing the value we deliver, we should be able to drive greater revenue from customers. But too often, product strategy gets disconnected from pricing. We build & deploy new functionality without considering which features enable us to charge more or give customers a compelling reason to upgrade. Customers benefit from more-and-more value year-after-year, yet frequently continue paying the same annual subscription as in year one.

In this session, Robin shares lessons learned the hard way; shows how to identify the features for which customers will pay more; and discusses that special (and thankfully rare) feature: the one your customers would pay to avoid!

Slides

Find out more about BoS

Get details about our next conference, subscribe to our newsletter, and watch more of the great BoS Talks you hear so much about.

Transcript

Robin Landy

Good afternoon, everybody. I’m going to talk about Finding the Features that your Customers Will Pay For or Pay More For. And while I’m at it, a true but admittedly implausible sounding story.

A few years ago, I participated in a meeting, in a secret power station in a desert far from here. And in that meeting, I gently, but purposefully touched a man’s knee. First gently, then somewhat harder. It was my client’s knee, and I did it for longer than I expected, and definitely for longer than he expected. And surprisingly, this was for his own good and the good of his company, and it came as a consequence of their failure to what I’m going to talk about today, which is identifying the features that your customers will pay more for and how that fits into the way that we price our products.

And along the way, the story of my client who went in the opposite direction and worked on a feature that was so misaligned with what his customers actually wanted, that those customers might very well have paid to disable it. And a heads up at the end of the session, we will open it up to the room, and I’ll be interested to hear your confessions about features that you may have worked on in the past, or even recently, which your customers may have paid to disable if you gave them the option. And a second one, and this one comes with a bonus, which is one of Mark’s inverse of commerce special prizes for anyone who can figure out what the feature was in my client’s product that his customers want to disable, and if no one can guess it, then there will still be a prize for the best answer. So also, for the avoidance of doubt, I am not endorsing anyone to go around touching anyone else’s knees, especially not your customers or your clients or your co workers. And if you must touch someone’s knee, then obviously ask them first, as I sort of did with my client.

Why Pricing Problems Reoccur

I’ve been solving software companies pricing problems for nine years, whether it is overhauling existing pricing structures or building new pricing structures for new products, and this issue of identifying features that customers will pay more for comes up over and over again, and they come up basically in three scenarios.\

The first is where you have a company that already has a successful, hopefully a successful product in the market, maybe it has been around for a few years, and they’ve hopefully found product market fit and a whole bunch of customers, and they’ve done a lot of product development since the day that they launched. But oftentimes the pricing hasn’t really moved that much. Maybe they tweaked it at the edges, or maybe it might even be still the same pricing that they launched with on day one. And there is a growing realization that the pricing is, at best, sub optimal, or at worst, no longer fit for purpose. And in some cases, you see pricing which was initially set by the founders going into a room together on launch day and thinking, Oh, How should we charge for this? And finger in the air, does $1,000 a month sound right to you? Yes, yes or and that’s how they go.

The second is companies where they are launching something new and they’re not sure how to price it. And the third is where you have companies who are making that transition from perpetual licenses over to ARR or subscriptions, or a similar, but not exactly the same case where you have customers, where you have software companies whose customers have been paying primarily on a CapEx basis, and there is a desire to move some of that CapEx spend into the OPEX column.

The Pricing Structure Framework

And when we think about trying to solve these different pricing problems, the tendency, the instinct, is always to go straight to price point, like, Should we start at 1000 pounds a month? Or should we be charging 1500 pounds a month or 2000 pounds a month? But I would say that’s the wrong place to start. In fact, price point is almost always the last thing that you want to look at when you are trying to change your pricing. Because really, what we want to do is segment our customers first we are going to think about rather than trying to price our product, we want to price for our customers. And so customer segmentation boiled down. It comes to this idea that, do we have a group of customers with these particular requirements and us this willingness to pay, and a second group, Group B, with different requirements and a higher willingness to pay. And can we construct a pricing structure which makes it very easy and very obvious for Group B to end up paying us a lot more than Group A?

And so I said, we often start at price point, and that is really the bottom. That is the last thing we get to when we’re thinking about the pricing structure, because there is a whole other set of layers above it before we get to price point. And it’s these layers that we work through, and we’re trying to build a new pricing structure. And so you might start at the top with your proposition, literally, what is it that we’re doing for the customer? So it might be possibly that we are selling a package of unlimited TV shows and movies as home entertainment. And then we might come down to our customer segments. We’ve got to figure out, what are the different customer segments here? And so we might have a segment which is a large family with lots of TVs dotted around the house, and another segment might be a single user with who’s very price sensitive and just has one television at home. And so we are going to start segmenting our customers like that. And then there’s the packaging, literally. What is it that we actually want to sell to these different customer segments, and how do we want to package that up?

And so again, taking the taking this home entertainment example, we might have a package which gives you unlimited access to all the TV shows and all the movies on four screens simultaneously in Ultra HD, and a different package that gives you access to not all the TV shows and not all the movies and only in a lower resolution and only in one or two screens at the same time.

And then pricing model. There’s so many different ways to price things, and often out in our head, we, by default, just go to the most obvious one, which we’re all familiar with, which is a monthly or an annually recurring subscription. But there are lots of different ways that we can price our products with setup fees and prepaid credits, and pay as you go credits and optional add ons, and with some of the newer AI tools, are now shifting over to units of work. So like Zendesk, where you can pay $1 for each customer query that it solves for you.

And there’s nothing to stop us from mixing and matching. It’s rare that you have mutually exclusive pricing models, and it’s only then, once you’ve gone through all those layers that you finally get to price point and you point and you figure out, okay, well, we’re going to sell prepaid credits in bundles of a thousand and ten thousand. So how are we going to price those up? And in all of those, what we’re going to have in the back of our mind is, well, especially when we come to the packaging and the pricing model and the price points, what are these features that are going in that our customers are going to pay more for? And what are the features that some of our customers will pay more for, and how do we want to divvy those up?

The “Monolith” Problem

But what happens when we don’t do that? So I’ve been writing an article about this a couple of months ago, and I kept thinking, I wish there was, like, a really pithy description that would capture this. And I published the article. And then a couple of weeks later, I was reading something written by the Danish pricing expert Ulrik Lehrskov-Schmidt, and he had coined this term, “The Monolith”. And I thought “The Monolith” is absolutely perfect for this. It’s very evocative of 2001 Space Oddity, and The Monolith slurps up all your new features, everything that you are building, you’re not gonna You don’t monetize them properly. You don’t try and put prices up. The monolith slurps up everything, and you don’t end up increasing the prices. And you don’t diversify the pricing structure. And so you can end up getting stuck with a single value metric for your pricing, for example, $100 per seat per year, or $10 each time you use a service, or half a percent transaction fee, and it’s just this one thing which you’re charging for.

And there are some consequences of having a monolith, and I want to say like the monolith is almost a caricature of bad pricing, and it’s unusual -ish to see it in such an extreme format, but I certainly see like slightly weaker versions, where the pricing structure hasn’t really been diversified, and more and more features keep getting poured into the product proposition. And the consequence is that you deliver ever more value for ever less money, because you keep piling more and more features in, and your customers are having a great time because the product gets more and more useful each year, but they’re not actually paying you any more money, which is fantastic for them. But then it creates a second problem, which is all these new customers that you’re trying to acquire, they start to resent paying you for features which they don’t think they’re going to use, maybe they don’t even want, and that creates an issue for your sales team, because they’re having to deal with customers who are pushing back and saying, Well, you know, I’m not going to use half of these features. Why should I pay for it? And the sales team end up making more ad hoc discounts.

And there’s a further thing that comes along with this. And you don’t necessarily need to have a monolith to have this problem, but you can certainly have pricing, which is too simple. And this is counterintuitive, because I think instinctively, we want to have simple pricing, like the idea that it’s simple, therefore it makes makes it easy for the customer to figure out what’s for them and then to buy it from us. It’s quite a powerful instinct. But actually, the pricing can be too simple, and there’s a couple of reasons for this.

One is what I’ve been talking about so far, which is you can which is you can’t segment by value. So let’s say you’re going on this $100 per seat model, and you have Customer A and Customer B, and they both buy 1000 seats from you, and Customer B is getting way more value from the proposition than Customer A. Well, how are you going to charge them for that? It’s the same price for everybody.

But the second thing, it gives your customers a single target to aim for when they are negotiating the price with you. So the customer comes in and they say, Well, you know, we want 1000 seats, but we know that’s a lot of seats to you, and we would like to have a lower price. And this is especially a problem if you are dealing with enterprise customers, because enterprise customers will typically have procurement managers, and they don’t care about your product. Even as little bit their entire job is to negotiate the lowest possible price that they can for their employer. And they are just if you just have one price, then you’re giving them one number to target. Whereas, if you have a more complex pricing structure, then there are lots of other things you can do. You have levers you can pull. So they come in and say, well, actually, we want to pay $80 for each seat. And you can say, okay, I can, I can shift a little bit on the on the cost of each seat, but actually, you know, there’s going to be a lot of onboarding and support fees, and I can’t move on that. Oh, and you want to buy 1000 seats all in one go. Okay, well, then our platform fee is x thousand dollars for that, and it gives you another lever to pull on as you are dealing with these enterprise customers, who, for sure, their procurement managers have done this every day for many, many years, and they are very good at pushing those numbers down in order to erode your margin.

Ways to Get Customers to Pay More

At the beginning, I talked about the idea of getting your customers to pay more and identifying those features. And although it might seem superficially obvious, I think we should make it quite explicit. What do I mean by getting them to pay more for some of these features?

So the first thing we can do is simply raise prices on all our existing customers in one go. We can say, well now this product, over the last year, we’ve added these great new features, we’ve increased the value that we are delivering to you, and as a result, we’re going to push the prices up by 20% this year, whatever happens to be. So that’s one way to do it.

Another way is that we are going to segment it a bit more, and we’re going to keep the special new features that we’ve added and put them into our most premium tier, and then we’re giving our existing customers a reason to upgrade, and end up paying us more for that premium tier. We might even make the premium tier even more expensive than it was the previous year.

A third thing is that we add a new package or some description. It could be a new tier, it could be an add on, it could be in the form of credits, but we are basically giving our customers something new to buy, which they didn’t have before. And so that’s a third way of adding it.

And a fourth way is getting the new customers to pay more than the old customers. And sometimes what we might do is put all the prices up, but we will offer something like grandfathering, where we go to our old customers, and either they’re just locked in anyway for a period, or we say, you know, if you renew your contract now, you can keep your old price for another year or two, whatever it happens to be, but the new customers end up paying a higher price.

What I don’t mean is doing what my client did in that secret power station in the desert, which was to find a feature which his customers probably would have paid him to avoid.

Case Studies: Misaligned Features

Let’s take a case study. So this was from a project I did, and it was a vital capability, which customers didn’t know about. So this was for a leading B2B SaaS. They’re the leading player in their particular vertical market and great product and a strong team, and everyone that buys this particular SaaS solution basically buys it for a primary use case that they all have in common. But it turns out, if you have that primary use case, you also have a secondary requirement which is slightly different from the primary use case, so you have a secondary use case as well. Everyone who has the primary use case also has a secondary use case. And I was interviewing a whole bunch of customers, and this is where it started to get weird, because they all told me about the secondary use case, but many of them weren’t actually using this feature in the software. In fact, many of them didn’t even know it was there. And it got even stranger. Then I said, Well, I know you have to do this. So how are you fulfilling this requirement? And some of them were going away, and kind of bodging a solution together in Microsoft Office, which is always like the default fallback, if you don’t have the right SaaS for the tool, it’s like, okay, somebody in my office will put something together in excel and do some document assembly in Microsoft Word or whatever.

But here was the craziest bit, some of them were going out and buying another SaaS solution for the secondary use case. They’d already paid for it in the first use case, but they were going off and buying a second product for this. And it’s worth just taking a step back and thinking about what was going on here. The customers didn’t know that the secondary use case was supported in the SaaS. The vendor didn’t know that the customers didn’t know that the secondary use case was supported in the SaaS. The vendor didn’t know that the customers weren’t using it. And the vendor didn’t know that they had a whole customer segment who would pay more money for that use case. Those customers thought they were just paying for the primary use case, and they were happy to go and pay more for the secondary use case.

And I think it should be hopefully intuitive here, that this was a big opportunity to do something with the pricing, because they had this big feature, and certainly possibly they could have just raised the prices straight out for everybody, or at the very least, they could create a premium tier, which delivered the secondary use case at a higher price. But this was a classic example of not understanding what it is that your customers are willing to pay more for.

Another example, another B2B SaaS, and they were a desktop only SaaS, and pretty successful with it, and they had had some feedback from some of their customers that they would like to be able to use the product on their phones. And the company spent a lot of money making sure that the product could be used on phones. And then I went and did a whole bunch of customer development interviews with their customers, and over and over and over again, this feature was ranked literally dead last. This was ranked the least useful feature in the entire proposition by almost everybody I spoke to. And when I kind of tried to find out what was going on here, basically got the same feedback from almost everyone I spoke to, which was it was like, yes, it will be nice to use this on my phone. But in reality, anytime I want to do this, I’m either got my laptop with me, or I’m in front of my desktop at work. And the chances of actually doing this on my trip, on the train or whatever, are pretty slim.

And so in this example, this would be a classic example of, firstly, a product feature getting misprioritized, which speaks to some of the talks we heard from this morning. But secondly, you know, the customer was hoping that they, my client, was hoping that they could charge more of this ability to use things on the go. And of course, it turned out that they couldn’t, because nobody valued this feature at all.

The Desert Power Station Story

All right, let’s go back to the secret power station in the desert. And what was I doing? So my client was developing a new SaaS to streamline the administration of turbine maintenance in power stations and other heavy equipment. And I was supposed to be there to develop the pricing structure for this new proposition, but I had also been asked to accompany the CEO to some meetings in that country, both with prospective customers and with prospective investors. And it had been, if I can be permitted, a little digression here. It had been quite an arduous journey to get to this power station. I can tell you that.

Firstly, I had to fill in a visa application, which many of us have done, I’m sure, when we’ve gone on our travels, but I have never filled in a form like this. This was the first form where, in big red letters, it was stated plain as day that the penalty for me supplying inaccurate information was death. And that was something I was keen to avoid, that I felt that would be a sub optimal outcome, especially for my client, and so I tried to avoid that.

The second thing was that my client had given me, what I wish I could say was a list of do’s and don’ts, but was, in fact, entirely don’ts. And it was a list of don’ts that would hopefully keep me out of jail.

So for example, I’m just cherry picking a few here. Do not celebrate your birthday. This was like a biggie, and yet it was not really a problem for me. It was not going to be my birthday while I was there, and I wasn’t going to fake one. But fair enough, this was an easy and self enforcing. The second thing, do not discuss human rights with taxi drivers. This was not a habit I was about to start. I felt okay. I can comply with this one. The third one, a bit of an odd one. You are forbidden to fraternize with women who work at night for a high hourly rate. Now, I still don’t know what my client has against corporate lawyers, but I decided no corporate lawyers for me. And then the fourth which was the most difficult for me to comply with. Let’s keep in mind that. This was a hot country full of sand, no shorts under any circumstances. Mark would never be allowed into that country. They would have captured him on the visa form, and he’d be in trouble.

So yeah, I did find that quite difficult. But so I’m there in the country, and I was going to these meetings with a CEO. And there was one feature that he kept talking about that I really felt was undermining his pitch. And we would go in to these meetings, and I when he got to that bit of it, I could just feel the energy being sucked out of the room, and I knew that the customers didn’t want it. It wasn’t to be clear, the whole proposition was actually pretty good. It was just this one feature was really a problem. But the other thing I knew was that the investors he was pitching to, those investors also knew that the customers wouldn’t want this. So this was a dual problem, and I spoke to him about it while we were traveling to a meeting, and I said, Look, I think this is, this is causing a problem. This is a great proposition, solving real problems to these customers, but this one feature, I think, is undermining everything that you are trying to do. And he explained why, and he replied that actually, this was a feature that he was personally, very passionate about, and he didn’t want to take it out, and that, as it happened, it was quite well, very well aligned with a big government initiative which was occurring in that country at that time. And he thought that that could be helpful.

And I said, All right, and I don’t know why I came up with this really terrible solution to the problem, but I said, All right, in these meetings, I usually sit next to you. And let’s do it on a meeting by meeting basis. If I read the room, and I think this is not a group that’s going to react well to this feature, I’m just going to tap you on the knee under the table and then you’ll know to skip that bit of the deck and not bring it up. And he wasn’t, you know, bowled over with enthusiasm, but he he reluctantly agreed.

All right, how did I get to this secret power station? And even, how did I know that it was a secret power station? The thing was, they wouldn’t tell us where the secret power station was, which made it quite difficult to get to and so it was so secret. Nobody would give us the location, and instead, we had to go on this ludicrous plan like out Scooby Doo or something, where we had to take a flight to a nearby city, then take a taxi to a nearby town, and then get picked up by somebody from the power station who would drive us there, and which was a surprise in itself. But then the other issue we’ve got is, well, what is the problem, in principle, with a secret power station? The main problem with a secret power station is that it looks exactly the same as a normal power station. That’s not an actual photo. It won’t surprise you know, I was strictly prohibited from taking photos anywhere in the country. But I got chat GPT, I described what I could remember in my head and and that’s what it drew. And it that is a reasonably close facsimile, at least to my memory.

So this thing was like enormous metal, gleaming smokestacks, like going up into the sky with this huge area in between these massive concrete buildings and loads and loads of pipe work, and, you know, spread over the area of several football pitches and a power station, even a secret one is not something that you can hide like like a kid with some vegetables hidden under a pancake or something. It was ridiculous. And then I was in the power station, and it was so secret that they hadn’t taken our phones away from us. And I thought, well, hang on a second. I’m just waiting for this meeting to begin. I just pulled out my phone and I opened Google Maps, and there it was, power station. It’s literally on the map. And I wanted to shout out to my hosts, guys, and it was all guys. Guys, I think your secret is out.

But on second thoughts, this did not seem to be the best way to either please my client or ingratiate myself with the hosts. And I don’t know, I’d been given so many warnings about all the things about all the things that could get me sent to jail, that was just being very careful.

So we start the presentation, and we’re getting to the critical point, and and I put my just gently tap my client on his knee, and that tap, he didn’t stop. And so the tap turned into a squeeze, and he didn’t stop. And then the squeeze turned into more sort of a clamping motion, I think. And that didn’t stop and and I went a stage further. I think my was sort of melded to his meniscus. By this point, the meniscus meld. And I think if he was aspiring to any kind of. Sporting career, I believe I ended those aspirations that day.

Methodology: Points Allocation

All right, so that was a failure. However, what was not a failure is the technique that I’ve used several times, more than several times across these projects to identify the features that customers will pay more for, and also the ones where which won’t earn you any extra money. And this is a boring sounding tool which many people will have heard of, but is, I think, criminally underused, which is points allocation. And I’ve used points allocation a lot, and I’ve added my own sort of tricks to it, which I have found have made it useful and more effective way of applying it. So how do I do points allocation? Is it is a boring name for an incredibly useful exercise.

So I do this in customer development interviews, and I give the customers a list of features. And to be clear, this is specifically features, not benefits. And I know often, especially when we’re talking about product management, that we try and make sure that we’re very reliant, but we’re very focused on benefits and solutions and not getting bogged down in the Malaysia feature. So why do I use features? The reason is that I don’t want to spoon feed the customer how they’re going to benefit from this particular feature. And when I get them to start talking about these features, they often open up and give you a huge amount of context about the internal workings of their organization and how they visualize this feature turning into a benefit or not turning into a benefit. And if they completely don’t get it, then obviously I can give them a nudge in the right direction, but it’s very unusual to have to do that.

And what I also do is put emojis to the left of each of these features. Now the features are usually a mixture of features that are currently in the product, features that are roadmapped but not yet deployed, and a few features often which the senior management team is having a discussion about, like, maybe we’ll build this, maybe we won’t. But no decision has been taken yet, and obviously I randomize the order each time, and why the emojis there? So I reckon, like, 10 seems to be the magic number. It’s also a nice round number. 10 to the magic number for the number of features, don’t go above 12. In my experience, once you get to 12, the interviewees start getting confused and bored, and those are both bad things.

The emojis are there because it simply makes it easier for them to recognize which feature is which. They’re often going back and forth and allocating points, because they’re going to be given 200 points to allocate to these features, and you’re going to say, Well, you’ve got 200 points, and I want you to allocate these points based on how useful each feature is within your organization, or would be if you had it. And if something is completely useless, then you can give it zero points. And if it’s going to be amazing, give it as many points as you want, and you have to spend all 200 points. And the emojis are just there, because as the customers go back and change their minds about how many points they want to allocate, the emojis make it much easier for them to remember which feature was which, rather than having to manually read it. And after I started doing this, I just noticed an immediate improvement with how people were doing the exercise. And also, if there isn’t a relevant emoji that kind of fits with the feature that you’re you’re asking about. Then now we are truly blessed by Apple with genmoji, finally, actually a use for that. And you can create your own emoji to go there. And you get a little calculator in the corner, which which counts how many points have been spent and how many are remaining.

And a crucial thing to ask each each customer to do is while they’re allocating the points. You’re doing this, live with them. While they’re allocating the points, they need to give you a running commentary. This is John Motson, one of this country’s most beloved, now former ex football commentators, but they need to give you a running commentary. Oh, I noticed you’ve just gone and allocated more points this new feature then you allocate it to the primary feature that you’ve already paid for. Why is that? Tell me about it. Sometimes, I’ll tell you anyway. Other times, you’ve got to prompt them, but you constantly need to make sure that they’re giving you this running commentary.

And then at the end, you’ll end up with something like this, which is a list of those features, and the points have been allocated to each one. And after you’ve done this, however many time you’re doing with all these custom development of these, you get quite a nice table out of it, and you can start trying to segment it, which I’ll come to in a minute. Yeah. Yeah.

So just to be clear, you would not be actually writing potential feature number two, you’d be summarizing the feature and you would, yeah, you would have these completely in a different order each time, so that doesn’t, nobody’s going to get confused.Aand the customer doesn’t know what’s roadmap and what’s a potential feature? I mean, they probably know which features are already in the product, but they’re the difference between the road map and the potentials.

Why is this so useful? The first is that it helps us understand how each feature is perceived, how valuable is this perceived by each of our customers. And depending on what you’re doing, this can be a mixture of existing customers, potential customers, and if you’re very lucky, you can, if you can persuade them, sometimes ex customers as well. And it gives you an idea, firstly, of how valuable each feature is. And part of the commentary and part of doing these probing questions is to get past a throwaway comment. If someone’s going to go and allocate half their points to one feature, especially if it’s a new one, then you really want to know, was this a throwaway comment, or is there something stronger behind it? And in particular, is the reasoning linked to something like it’s actually going to save us time, or we would need fewer employees to complete this task, or we can drive more revenue as a result of this, or it’s going to drive these particular KPIs, or help me hit my OKRs, or it’s going to save us time, or drive volume. You can really start to plumb down into why is this perceived as so valuable?

Secondly, how valuable are they relative to each other? And this is why it’s so important to have your current features, like your maybe your top one or two features, which are the primary use cases of the product in the list, because now you can benchmark it against them, and especially if you have a whole bunch of customers all telling you, oh, this particular roadmap feature is actually more useful to me, I’m going to allocate more points to it than the one I’ve already got. That is a big, big discovery.

Thirdly, why is this feature more valuable than that feature? You’re not just finding out in terms of absolutely, why is that feature valuable? But why is it more valuable than this other feature? And fourthly, because you can start segmenting. Sometimes you do these customer development reviews, and everybody you speak to absolutely loves road map feature number two and allocates loads of points to it. But more often than that, you’ll have a group of customers who really like it, not all of them. Then you and then you can say, well, hang on, do I have a segment forming here around this particular feature? Can I group these together and say, Ah, customers who, there’s a group of customers over here who have these requirements and this willingness to pay, and I can charge them more to have this feature, this one is going to go off into a premium tier.

Assessing Willingness to Pay (Van Westendorp)

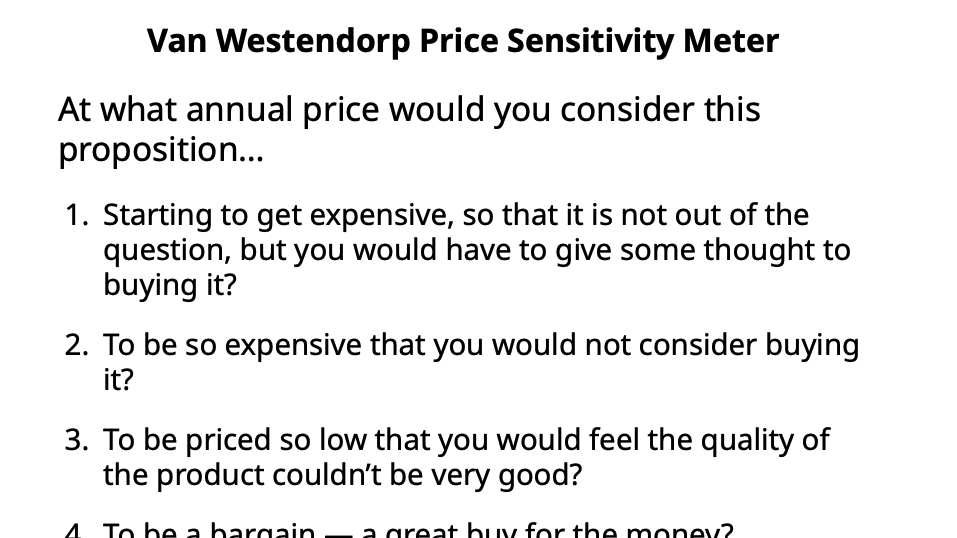

Okay, the other thing that I often use is, I want to assess willingness to pay. You can go a very long way with points allocation. I’ve used it over and over, and it’s great, but oftentimes you also want to try and contextualize that within, actually, how much are you willing to pay for that? And there are a lot of different approaches and to this, and I’m not it would be a whole other session by itself. One that I often use is the van Westendorp Price Sensitivity Meter, and this is a tool which is both, which is blessed. It is a blessed tool. It is blessed with a name which is probably the wankiest sounding name for any tool that I use. And it’s also almost impossible to spell. And if you Google it, Google will know what you’re looking for. But it is very handy. It’s not a silver bullet for pricing. It doesn’t work for everything. And I’m not going to over claim for it, but it is useful. And why is it useful? Because something that we might be tempted to do is to say, Oh, great, you really like this feature. How much would you pay for that?

And the problem is, asking people how much would you pay for something almost never results in useful feedback. Customers sometimes want to be nice to you, which isn’t that helpful, and sometimes they think that you are doing kind some kind of stealthy price negotiation with them, and they think that if they answer honestly, then they’re going to get screwed in a year’s time. And Van Westendorp is not a silver bullet for this, but it is a very helpful way, and it’s certainly a massive improvement just asking, how much would you pay for this?

And Van Westondorp is a series of four questions, and it’s saying, at what annual price? Assuming that you’re going for it, let’s say this is annual billing, but it doesn’t have to be. You can reformulate the same questions if you want to do it based on credits or one off fees or whatever happens. At what annual price would you consider this proposition starting to get expensive? So it’s not out of the question, but you would have to give some thought to buying it.

And then number two, at what annual price would you consider it to be so expensive that you would not consider buying it? And then number three, that it’s priced so low that you would feel the quality of the product couldn’t be very good. Question three is always an interesting one, because it’s almost oftentimes, it’s almost like the customer hadn’t considered this possibility that it could be priced too cheaply. And there’s tends to be a difference between consumers and B2B on people answer this. Sometimes people just saying. I’ll take it for free. And other times you get more thoughtful customers, especially on the B2B side, was like, Well, if you’re only charging me 1000 pounds a year for this, there’s no way you’re making money on this. So, you’re to charge me more than that.

And then the fourth one is, what price would you consider to be a bargain or a great buy for the money? And again, with this, after I’ve got them to answer, I asked them, I try and probe a bit deeper and get them to talk about why they gave the answers which they gave. And I tend to add a fifth question, which is, if it was priced between the point at which it starts like the between the price of which is starting to get expensive and the price which you consider to be a bargain or a great buy for the money, then on a scale of one to five, how likely would you be to buy it? And that also tends to get a very interesting response. It’s not an official van Westen dorp question. I’ve just added it, and I found it’s a handy way to complete it.

And then you can do some analysis in Excel, and this is a heavily redacted output from a VWPSM, sorry, Van Westendorp Price Sensitivity Meter plot, and it gives you a zone of acceptable pricing in the middle. And I said, this is not a silver bullet. It does not let you get an archery target that you can say, Yes, that’s what I’m going to go for for this particular package that I just asked them to price. But it certainly gives you a good, solid indicator for where you want to head.

Just as an example here, this was a really interesting one. So I’ve completely redacted and anonymized this. This was a company, their customers or enterprise customers, and they were launching both big new additional capabilities to their primary features, plus a whole load of new features. Now I’ve actually got new features here going from A through to G, and this might sound like an implausible number of new features to be launching in one go. In fact, what they were doing was, there was a and again, I’m deliberately anonymizing this, but they were adding a major new technical capability that was not AI to their product. And through this major new technical capability, they could quite easily launch what were effectively six really big new capabilities in the product, that was where this was coming from.

And what was amazing about this was the six new features. Over and over again, their customers who were spending a lot of money with this company told that, said that the new features were actually as important, or more important than the main feature that they had bought the product for in the first place. And this was extraordinary.

And what was a big takeaway from this? Well, my client had originally been planning on just united there was an underlying new technical capability. And my client had initially been planning to just sell that underlying technical capability to their clients. They pay us this fee, and then you get these six solutions out of it. But what we were finding was, okay, this customer wants likes new feature A, and this customer likes new feature C, and this one likes both E and F, and is placing a high value. And hardly any of those customers wanted all of them, and some of them were placing very high values on on these new features. And it was like, Well, yes, we definitely want to charge for this. But rather than just charging for the new capability, we are going to split this now into six separate solutions and charge for them separately. We might choose to have a bundle in which you can buy all six together, but we are going to charge separately, and this will drive much more revenue than just giving away this underlying technical capability to our customers.

Naming “Anti-Features”

So coming back to my friend in the desert, I had failed utterly to stop him from talking about this particular feature. But I did think about it afterwards, and I was thinking, Well, this is a kind of a special category, a feature which is so misaligned with your customers interest that they would pay you to disable it and like, what are some other famous examples? I know you can probably think of some yourself. The one that came immediately to mine was, of course, Mr. Clippy. Anyone that was using Microsoft Word in the in the 90s or the noughties will remember that. I think Microsoft Windows auto updates. I think when you turn if you’re a Windows user, you turn your laptop on in the morning and you have to sit there for 10 minutes. That will be another one. The craze from about I know it was 15 years ago for 3D TVs, where, if you didn’t actually have a 3D picture there, then your picture ended up way, way worse than a regular TV but you couldn’t turn off the 3D-ness. And for me, one that was the the default wellness applications and notifications that come on the Apple Watch and my iPhone, which drove me absolutely berserk when I first got it, and I could not figure out how to switch them off.

And I was thinking, Well, okay, this, I feel like this is a special category of feature, and it really needs a name. And rather like, I couldn’t think of a pithy name for that, for the monolith, I couldn’t think of a name. And I was thinking, Well, user experience designers, they have the concept of dark patterns or anti patterns. Could I call this a dark feature or an anti feature? And and then I thought, no, that doesn’t sound right to me. And then inspiration hits, thanks to Business of Software’s very own Bob Moesta, who I heard on Lenny’s podcast. And now suddenly the answer was obvious, these are Jobs Not to be Done. And that was the answer to that, the jobs not to be done.

All right, over to our over to our confessions. I have two questions to ask today. What special feature, what job not to be done have you worked on, which your customers might have pay to disable? And based only on the clues that I have dropped in this presentation, can you deduce what my client’s special feature was? All right, got somebody right at the back.

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

Confessions & Q&A

Audience Member

So my feature was in my new app, I have these very pretty blocks that move in as you go into the page, and I have this beautiful image of them being some kind of amazing design. And some people love them, but some people deeply hate them, to the point where we have a check box now in the settings that you can just turn those off. So I’m refusing to remove them entirely. And then the special feature I was thinking that would be really bad, would be maybe like a carbon emissions tracker. So it would publicly list the carbon emissions being produced as you run the factory.

Robin Landy

I love the idea of a carbon emissions tracker. I think that would have been extremely unpopular with the customers, and even my client was not threatening them with that.

Mark Littlewood

I think definitely a good category of great answer, not the right answer.

Robin Landy

Yeah, it’s a good answer, not the right answer. Location finder for the secret power station? All I needed was Google Maps. But yes, location finder.

Audience Member

My take on question two would be, like an automatic government report or something, or government back door into, like, analyzing the data.

Robin Landy

That is a good one. It’s possible that in that country, the government already have that, I don’t know. All right, Have we got any more confessions?

Audience Member

Not a confession. It’s just I was trying to think of the feature, but would it be a birthday reminder?

Robin Landy

That’s the best. That’s amazing. Yes, no, it wasn’t that, but that would have been awesome.

Audience Member

Yeah, this is my attempt to win the prize question too. Two solutions. One is you can control the power station from your mobile phone. And the other one is, how many women worked at the power station?

Robin Landy

I did not see any women working at the power station. I have heard, actually, that things, to be fair, I have heard that things have improved in that country in the last few years since I was there, with regard to that point. But yeah, I didn’t see any women working there.

Audience Member

Was the feature being able to put the accountable person for the last piece of maintenance?

Robin Landy

Sorry, for the accountable person.

Audience Member

Recording the Accountable person’s name for the last piece of maintenance.

Robin Landy

It wasn’t that but you’re not a million miles away, inching closer here.

Audience Member

Okay, so my feature that clients really hated was actually a pricing feature. So we were selling a piece of hardware that was internet connected. And my investors really, really wanted us to be a SaaS company, so we were trying to sell it as a subscription, and they would have gladly paid me three times as much up front just to buy offers. So that was a feature that customers didn’t want. And my suggestion was remote data logging and access.

Robin Landy

Oh, this right. There’s one answer after another. It is heading towards the right track, but still very wrong.

Audience Member

It’s not actually my confession. It’s, I think it’s Dom and Marine’s. So I’m gonna fess you up. It was when we were at Redgate, and it was a down tours week, and I think you guys hacked in a funky 404 page on the website. And then about two days later, we sent out a massive mail shot to about a million people with a broken link in it, so all of the customers clicked the link in the mail shot and landed on this 404 page that was, like, quite viscerally shocking that they put in for the lols and the sales team got calls, basically, from a bunch of, like, really serious SQL backup customers going, what the hell is this? And what are you guys? So not quite a feature, but feature adjacent, good, fast, but sorry, fasting on your behalf, not mine.

Audience Member

So you had zombies and kitten, and you need to kill kitten with the zombies as a 404, and people thought that we’d been hacked.

Robin Landy

All right, what was that my client’s feature? It was a pretty bulletproof audit trail. Remember, this was turbine maintenance. And in turbine maintenance, the money is in the maintenance. Sorry, the turbine in turbine business, the money is in the maintenance. And the issue with this software was that it would create an audit trail that would make it quite clear if someone had been awarded the contract, not for reasons of quality or price. There’s another story there, which I can’t tell in public, but trust me, this was a deal killer. So, yeah, that was the problem. All right, everybody. Thank you very much.

Mark Littlewood

I got time for some questions or some more confessions.

Audience Member

My confessions are tomorrow, so we’ll have to wait for that. So a question. So the one thing you didn’t mention in the pricing policy was any reference to competitors. I wondered if you felt that was something you could ignore, or if that was actually something you would deliberately either understand or choose to play on and go against. So for example, if everyone’s giving something else for free. Might that impact what you did on the feature? So I just wanted your thoughts on how competitors came into the pricing model.

Robin Landy

So the issue of competitors tends to be important, but its importance varies across different products. So I tend not to work in products or in industries which have been extremely commoditized, where essentially the lowest price is always going to win, because there you there’s basically a whole bunch of undifferentiated products, and there’s you’re very limited with what you can do with price. What I’m looking for more is, how is this proposition differentiated in the benefits that it delivers and the perceived value for the customers against its competitors.

Robin Landy

And how is that differentiated? In other words, is there a customer who’s at, is there a competitor who’s basically doing the same thing and charging a lower price? Or is this a real benefit which is really distinguished from that, and for which we can charge a higher price? Competitor pricing, it can leave you super boundaried, where it’s like, okay, this other company is doing basically the same thing over here for the $2,000 a month, and somebody else is doing it for $1,500 a month, and we’re a bit stuck in the middle. But if we can identify those points of differentiation, and if we can show by using, for example, points allocation and Van Westendorp. But actually, this is a really valuable benefit that we’re about to deploy, and we’re quite confident that somebody will pay an extra $700 a month for that, then we can kind of bust out of that being being stuck in that silo between those competitors. But I think it’s a good question, and the annoying answer is that it varies massively from one product to another.

Audience Member

Thanks again. Very interesting. I’m curious about same same cases that like the point scoring and location. How many people do you ask to and how do you generate? Because imagine that you have responses given different segments, and this is what you’re after. So do you segment first and then ask the same questions to individual segments? Or do you ask eons of people hoping to find your segments as you do the things? And how many people do you interview?

Robin Landy

So for the points allocation exercise, it does vary again, project to project. Typically it’s between 12 and 25 and I think as a valid criticism of this to say, well, this is mostly qualitative research, even though you are deliberately collecting numbers because the sample size is quite small.

Robin Landy

But the flip side of that is that most of the time, you get very strong signals coming out quite quickly. Either you have all the customers basically pointing in the same direction, or certainly the majority of them, or you quickly get segments emerging. And I’ve certainly done projects where it was like, Okay, we want, we’ll do another bunch of interviews afterwards, just to make sure that we’re not being misled by this, especially if you’re working on a fairly small sample size. If you want to have something more statistically valid, you can, of course, go and do it as a for example, like an email survey and send it out to a much larger number of people, and that is another approach. The downside to that is that you miss all the commentary, and you also end up with like, selection issues and sampling issues, whereas like, who are the who are the people that are actually agreeing to spend 10 minutes doing this exercise versus the people where you having like these in depth interviews.

It’s annoying because it’s like both sides have their pros and cons. I prefer to do the customer development interviews, even though the sample size is is smaller, and with the Van Westendorp, I’ll often have a couple of different propositions that I want to ask them about and get them to price it up. So I’m not just testing one proposition. I can do two different things in one.

Audience Member

So when you’re having these sensitive conversations, you nodded to customers being worried that any information that they divulge is going to be used to stiff them on price. Like how do you reassure them? And I may have missed the detail here, are you primarily working with people who are existing customers, who feel like they can renew at their existing price, so that allays them? Are you talking to prospective customers, which is kind of what I associate with customer development, especially in that case, how do you make them comfortable enough to be willing to share any of this information with you?

Robin Landy

That is a good question, and sometimes it is a problem. So especially with B2B customers, sometimes there are customers who are like that and are reluctant to divulge too much, especially around the numbers. So there’s a couple of things.

The first is that as an outsider, as a consultant who is working with the company, for some reason, you immediately get a some sort of veil of credibility. And even though the person I’m talking to knows that I’m working for their vendor, I’m somehow more independent and more trustworthy than the vendor, and that it doesn’t work every time, but it works a lot.

The other issue is sometimes you can repackage the questions to make them more acceptable. So take Van Westendorp as an example. I definitely have had some interviewees who just wouldn’t answer the question. And it’s like, okay, I’m not gonna, this is definitely not a thing where, like, hammering them on the head over and over is gonna get get what I want, but then I’ll revisit it later in the interview, and I’ll try and repackage the question in different ways.

So for example, if we are some same questions, but think about it as a percentage on top of the price that you’re already paying for the main package. And simply changing it from an absolute value to a percentage suddenly unlocks a whole bunch of these people that wouldn’t answer the question in absolute terms. That doesn’t always work either, and sometimes you do have interviews where they just they’re not going to commit to any number or any percentage, and then there’s really nothing you can do.

But not all is lost, because even at least in my experience, even those people who are most reluctant to discuss the numbers will still give you an amazing amount of insight about what’s going going on inside their organization and why this would be perceived as useful.

Another trick that I found, sorry, this sounds like it’s a list of like nine annoying tricks that you can use to do. It should be a listicle on Buzzfeed, but, but another thing I found is. Of course, just gone out of my head. Oh yes, is when sometimes they are customers of an adjacent product which is not directly competing with you, but is something similar enough that you can get them to talk about that product and their reactions to pricing that product. And you still can’t ask them the question you really want or get the answer you really want, but they’ll give you some really helpful feedback. And I think this is still useful, because this is not, this is very obviously not a purely quantitative exercise. There’s a lot going on to the qualitative feedback here and and you can get a lot out across these, let’s say, 25 interviews that you’re doing. Sorry, that was a bit of a rambling answer.

Audience Member

How much do you weigh in the benefits to the customer for, like, simple and predictable pricing? So sometimes, like, I don’t know you gave the example of like units, and so that might not be something that is easy for them to work out, but something like the users might be more predictable over time.

Robin Landy

So predictable pricing is important, and definitely, especially amongst B2B and enterprise customers. Nobody wants a nasty surprise. But I think there are degrees of nasty surprise, like you could have a nasty surprise where it’s 5% more expensive next year than it was this year. And they didn’t predict that. But it’s probably not the end of it, end of the world for them. Versus like this, oh my goodness, we thought this was going to cost us $20,000 and now telling us it’s costing us $60,000, that’s a nasty surprise. And you definitely want to have predictable pricing. So there can be the planned nasty surprise, which is where you just say, Oh, I’m going to put prices up by this amount for everybody. But I think the one you’re talking about is where you talk about accidental overconsumption,

Audience Member

Yeah, something like that. There’s certain things that they know is predictable, but then there’s other things which take a lot of maths to work out, and they’re just, I’m sure there’s a lot of unknowns with that.

Robin Landy

So I think this is really the one way where you can, where you can have accidental over consumption, and it’s going to vary a lot from case to case. For example, is it that difficult to figure it out? And in particular, if you go over an agreed threshold, is it going to trigger an alarm? And so especially with with pricing that’s based on the consumption of a certain amount of credits, whether we’re talking about API calls or whatever AWS credits, you might want to then say, well, yes, if you go over this limit, we’re going to notify you. Or you can, as a customer, you can set what those limits are, in case you discover that you’re using more than you expected.

Audience Member

So earlier in the presentation, you’ve mentioned different used cases about customers not being aware about certain features existing. So one of the used cases was a company has a feature and also has a secondary feature, and the customers used that feature, but they were not aware of its secondary feature. And so as a result, they pursued different tools, different SaaS to kind of fill that niche. Sorry, that niche to meet their needs. And I was wondering, sorry, and one of the things you’ve mentioned is that, how can companies take advantage of that? So one of the things you’ve mentioned was introducing, like, a separate tier that would essentially, you could price this feature differently from the main one. And my question is, how would you go about doing it if the company already has this feature, but it’s not, I suppose, advertised well enough.

Robin Landy

That is a great question, and I addressed that actually in my recommendations I gave. Because there were really two parallel failures going on in that project. One was a pricing failure, which I addressed in the presentation, but the other was really a customer success failure. That nobody either the product basically, the product analytics wasn’t working well enough. It wasn’t granular enough for them to see that they couldn’t see what the customers were actually using it for, and nobody was even aware that they couldn’t see it. And so some of my recommendations for that project was actually implementing a different product analytics solution on the product, and then changing their way their approach to customer success, so that they would be monitoring this and they could see if their clients and specifically which customers were not using these features, and then deploy their customer success team to sort of follow up with those customers. Because in this case, all the customers who had the primary use case also had the secondary use case. There was really no excuse for not using the secondary use case. So yeah, in that scenario, the how do you know about the hidden features is is a customer success problem and one that can be addressed.

Mark Littlewood

Nice. Robin, thank you very much.

Robin Landy

Pricing & Product Strategy

Robin Landy solves pricing problems for SaaS, AI and software-enabled service companies by developing pricing for new products, and improving it for existing ones.

For 9 years he’s developed pricing for companies of all stages & sizes, in industries including legaltech, martech, edtech, comms hardware, operations, gaming, retail, e-commerce and ERPs.

Robin previously founded & led a startup which amassed millions of downloads, and was acquired in 2013. His experiences at that startup and then the company which acquired it, laid the foundations for his pricing consultancy.