It’s well known that moving your user base upmarket is challenging – but it can be done. Shopify Plus was launched in 2014 to offer large & hypergrowth businesses a customizable enterprise platform without the cost of existing options. Having created and dominated the online storefront market for SMBs, this was a key part of Shopify’s strategy to build a business to last 100 years.

Hana discusses how repositioning and retooling marketing at Shopify Plus resulted in remarkable growth for the business, something that created major prioritization challenges. She shares how Covid drove a tectonic shift that forced the company to abandon roadmaps, reassess, refactor and change every part of the business.

You will learn how positioning and prioritization are essential elements in building successful breakout products and why marketing, absolutely, at all times, has to align with company goals.

Slides

Find out more about BoS

Get details about our next conference, subscribe to our newsletter, and watch more of the great BoS Talks you hear so much about.

Transcript

Hana Abaza: Thank you. Florence and the machines. Saw her in concert recently, highly, highly recommend. Hey, everyone. I know that I am the last thing between you and happy hour. So I’m going to try and make this worth your while, and if it’s not come, let me know. I will buy you a drink at the open bar. So I’ve been in B to B SaaS for over a decade, on the lower end of the market, with more of a plg motion, and all the way up to really big enterprise strategies and tactics and everything in between, and largely on the marketing side, mostly running marketing growth teams.

There’s no such thing as a marketing problem

But today we’re actually not going to talk about marketing strategies and tactics specifically, because more and more I’ve become convinced of one thing when it comes to the big needle movers, there’s no such thing as a marketing problem. There are only business problems. And time and time again, when I talk to founders, CEOs, startups, execs at bigger companies, what they think is a marketing problem actually has to do with an underlying business issue that they need to solve. Something needs to happen that’s more cross functional, that’s in the fabric of the company, the product of their go to market, that is actually impacting the efficacy of their marketing. And this comes up a lot when I talk to companies about how to move up market, which is what we’re really going to focus on today. So I get it. I get that a lot of companies want to be moving up market, and the reason they often want to move up market is because it’s really sexy and appealing to get those big logos, less customers, more money, big, big buckets of money, right? They’re stickier, they’re less price sensitive, they’re more rational buyers. They’re not as emotional, sometimes, not all the time, right? They’re also a huge pain in the ass. A lot of time. Yeah, I could add some nods here. A lot of you have definitely experienced that.

And here’s the thing: I’ve done this now a couple times. I did this when I was at Shopify as head of revenue marketing for six years prior to that, I did it at another company that was on the B to B side. This is the number one thing that I talk to startups and founders about, and there’s a couple of things I now know to be true.

The first question is always, how do we go upmarket? The first question should be, why are we going upmarket? Should we go upmarket? What is the actual opportunity for me upmarket? We’re going to talk a little bit about that and how to identify the white space there, because the grass is not always greener on the other side. Time and time again, founders underestimate how much they need to invest in order to be able to compete at the enterprise level. The other thing that became painfully obvious as I moved through some of these companies is there is no linear playbook to do this. So you’re not getting a playbook today, sorry, folks. What you are going to get is some hopefully helpful frameworks, insights, lessons learned over the last couple of weeks to help you make the right decision as you’re moving up market. And by the way, this also might be helpful if you’re already in that space, but you’re feeling some of that friction as you’re trying to grow and actually sell into that user base. But first story time.

So I’m going to talk a little bit about how Shopify started to transition into this, into this market. Now, I think most of you are familiar with what Shopify does. Yeah. Do we need an explanation? Ok, so initially, Shopify grew really, really big, really, really fast by targeting small businesses, solo entrepreneurs, tiny, tiny businesses, helping them come online. And something really interesting happened over time, those small businesses started to turn into really big businesses. They were doing 10s of millions of dollars, hundreds of millions of dollars in revenue. And one of two things would happen once they got to that phase. They would either churn to some kind of like Enterprise E commerce platform, or they’d figure out a way to make it work on Shopify. So the question was, what is the thing, the product, the service, the offering, that is going to help keep them on Shopify longer? And that was really the first iteration of what we called Shopify Plus, which was that offering to help keep those merchants on Shopify.

So what did all of this look like? Let’s take actually, a look at that sort of first five years or so. So 2012 Shopify was doing 24 million in revenue. By 2017 it was at over 600 million in revenue. This is when Shopify, plus started to get a little bit of traction and really started to succeed in upgrading those customers into that larger plan. But something really cool happened. What we started to see was these customers were upgrading, but customers that had left were actually starting to come back. Because, hey, guess what? Shopify now has this enterprise plan, and by the way, we did what every other startup did, slap enterprise on a pricing page. That’s where it started, right? So as these customers were migrating, the more you looked at that enterprise space, the more it became really obvious there was actually a white space in that market, right, initially in the early days. Now it’s a little bit different in the early days, really Shopify was moving into that mid market. It wasn’t until a couple years after that we stretched into enterprise but in that mid market, there was one other player, arguably mediocre software, mediocre on prem software, right? Or you were looking at really, really, really big, expensive, clunky enterprise white space in the market.

So what did this look like? Well, fast forward to 2021, and you’re looking at about 5 billion in revenue. Now, the thing that I need to call out here in that last year is we definitely had a few covid tailwinds. We’ll talk a little bit more about that and how to adapt to that, but that white space in the market was a key part of driving growth over those years, because we were able to identify those so here’s what I think the trifecta is, when you’re looking at moving up into enterprise number one, you’re in a space and this was true for Shopify, and this is true for a lot of really successful companies as they move up market, the alternatives in the market are super shitty, right? And there’s something really interesting that happens with enterprise software. There’s like, an inverse relationship between the price of the software and the quality of the software. I don’t know if anyone’s ever noticed that before, but it’s really bizarre, and that’s what ends up happening. And a lot of times it’s because the platform gets bastardized over time, and they customize for one off customers, and it turns into this really gnarly thing that just slows everything down for people, super shitty software, it’s super expensive, right? Because, the way often enterprises price is not based on the value it provides. It’s based on what the customer is willing to pay. It gets to be really, really expensive, and people buy it anyway, if you have those three things, that is gold, right? And we had those conditions that we could, that we could actually step into and succeed.

Now the last thing that is really important to call out is that Shopify had this insatiable demand. There was this market pull that was almost palpable. You could, like, feel it. I know that sounds really weird, but you could totally feel it. And having that, or identifying that place in the market where you’ve got this tidal wave of demand, versus trying to come in and into a crowded market and display stuff that already works. Are two totally different ball games. In the first scenario, everything’s working, everything’s clicking. You get momentum, and the demand starts to really come to you. In the second scenario, it’s like pushing a boulder uphill. So that market pull is really what you’re looking for, and whatever slice of the market makes the most sense for you. So I walked into Shopify, we’re working through this all in the early years. I had like, a ton of B to B SaaS experience. I done this moving up market thing. I was like, Don’t worry. I got this, lots of low hanging fruit, right? I could see where things were broken. I just had to fix a few things. Change a few things. No worries. Three weeks later, this was me. Six weeks later, I felt like I was chasing a fucking fire hose. And here’s why, there were three really big, gnarly problems that we had to fix, and part of this is because Shopify had already gotten to a certain scale and already had a machine running right.

Problem number one: market perception. Shopify brand all about small businesses, all about entrepreneurs. So how do you combat that brand? Right now? You may have noticed when I initially started story time, I said that we were working on stretching up market. That was a really deliberate term that we used. We weren’t moving to focus the entire company up market. We were actually really deliberate about continuing to focus on the small entrepreneurs. That was the core of Shopify mission. The intention was to stretch but still maintain that focus. So we couldn’t rebrand or reposition the entire company. We had to come up with a different solution to signal to the upmarket buyers that, hey, there’s actually something here for you, right?

Really, really different problem that we’re trying to solve here. Internal systems. Shopify was not tooled from a people perspective, a process perspective, tech stack. Any of that stuff was not tooled for B to B was tooled very much for a plg motion and the internal perception. So you had market perception, but the internal perception was one that we really had to figure out from a culture perspective, because Shopify is incredibly mission driven and is rooted in enabling entrepreneurship, and all of a sudden you come in and you hire a sales team, and you start selling a big enterprise. Ooh, confusing for your teams, right? And trying to reconcile the mission with that decision was one that we really had to work through.

So I’ll talk a little bit about each of these, and really what it came down to when we really were trying to figure out what it is we need to do, came down to three bigger buckets. Number one, positioning at its very core was the most important thing, positioning, not only for the market, but positioning internally, for how we wanted our people to understand and relate to the product and the moves that we were making at market.Number two, we needed to totally re engineer our go to market, right with the really unique advantages that Shopify had, which we’ll talk about, and of course, we had to retool internally. Now, the thing about these things is they are all interrelated. Right? It is not a linear do this check, then do this check, then do this check. There’s a lot of interdependencies between these things and feedback hoops that need to be created.

(re)Positioning

So we’ll touch on those as we go through it. So let’s first start off with positioning. Now we are super lucky because we have, I’m going to put her on the spot. There she is. I love how, like five people pointed at you, April, we have the positioning guru in the room, April Dunford, who’s talking tomorrow morning, so definitely come to her talk. And I think, like, we’re not going to talk necessarily, but how, if you want to learn how to do positioning by April’s book. But what I do really want to touch on is, like, what’s the core of what we’re trying to do here? And also, what are some of the problems we’re trying to solve across a few different companies.

So first a quick definition. I actually did these next few slides at a talk I did a few years ago. When I did them, I emailed April and I said, hey, send me your best definition of positioning. I want to use it on a slide. She’s like, cool, cool, cool. Here it is. Marketing is about making it easy to find, evaluate by your product, and positioning is figuring out what your product is in the first place, pretty easy to grasp, right? Great. I’ll use it. Two minutes later I get another email from April. Hold on hold on hold on I got a better definition for you. Marketing can polish a turd. Positioning can turn turds into fertilizer. If you know April at all, this is very on brand for her, just like stick with the toilet humor theme.

Problem #1: How Do We Change Market Perception?

But, but really, this is what you’re trying to do. You’re really getting to the essence of what the thing is that you’re trying to do where I’m fine as I go through and as we moved up market. The toughest part is to actually isolate the problem that you’re solving for as you’re looking through this. So what positioning problem are you solving? Let’s go through a couple of examples here at Shopify, at Shopify plus, specifically, we were solving a market perception problem, right? There’s a lot of ways to solve that problem, but at its core, people knew who Shopify was, for the most part, right? As we moved upmarket, they maybe knew a little bit less, but they kind of still knew. They knew enough to say, oh, no, you’re for small businesses, right? So we needed something to signal that, hey, no, we’ve got something for you. The direction we went. And there are a lot of ways to solve this problem is, hey, we need to have an explicit thing that’s got a little bit of separateness from the Shopify brand, which was going stronger and stronger and heavier and heavier into this entrepreneurship segment from a brand perspective. And we need to tell them that, hey, there’s actually investment going into this area of the business. It’s building for enterprise. It’s called sub brand, separate product. Lots of different ways to do this, but that is what we were really solving for here.

Now this did two things for us. Number one, it allowed for a little bit of internal separation to help people understand and distinguish between what was for enterprise, and it allowed us to not dilute the message to that initial core merchant base. Now the caveat here is there’s pros and cons to this strategy, right? As you grow and as you scale, it becomes more complex over time, but in the early years, this was absolutely a really effective way to signal to the market that we’ve got something here that you can actually dig your teeth into that’s being built for you, right? We went through and we evaluated the context, right? So really understanding, if you’re on either extreme the market, what the big differences are here, I just want to call it a couple things here that are really important to understand the competitive alternatives between the smaller merchants and the large merchants are wildly different. Intuitively.

The thing that’s really interesting, though, and you’ll take a look at it at the bottom here, is when we got to Shopify Plus, sometimes the decision was, is it Shopify versus Shopify? Because you had those people come in that were like, right on the cusp. It’s like, oh, they could go either way. So you’re actually kind of positioning against yourself, which was an interesting thing to talk. Sales teams through the other piece of context that’s incredibly important, that sends a signal to the market is pricing you’ll see here at that time, Shopify class started at 2k a month. At that time, enterprise customers would come to us and say, We don’t believe you. There’s no way you can do what we need for 2k a month, because they’re used to dealing with these massive enterprise brands that charge them tons and tons of money, right? Because most software’s not priced on value at that stage. It’s priced on what the customer is willing to buy. I think that’s true. Patrick might disagree with me. I’ll ask him tomorrow. He agrees. Amazing. I feel validated. So that was actually a real thing we dealt with. We lost deals because they were skeptical. They were like, but, but we don’t get it. We don’t understand, how can you do this for 2k a month? Well, we’re not on prem, it’s SaaS, right? And all of these other things that we dealt with. And of course, from a product perspective, on the one extreme, they want an all in one solution.

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.

On the other extreme, Shopify is part of a system, right? It’s got to integrate with a bunch of things. Security becomes important. Customization becomes important. The context that your buyer is really living in matters a lot here, as you’re working on your positioning. The other thing that matters a lot is the customer’s wildly different. This is a real thing that the director of E commerce, that a massive DTC brand, said to me, the worst career move I can make is choosing make is choosing Shopify and being wrong. It’s a real thing, right when you’re selling to those up market buyers, it is their jobs that they are putting on a line. How could something that works for 10 person company be the same thing that works for a 10,000 person company? This was a CMO of a division at a massive CPG, skeptical, skeptical because of price, skeptical because of what we were pitching was too good to be true. We did win that deal, by the way.

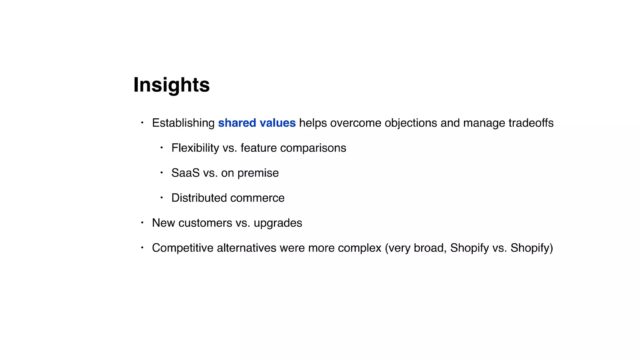

The last one, this is, I think, my favorite one, because this is the whole, like, you don’t get fired for buying IBM, right? It’s like, go with the safer options. Go with SAP, go with Salesforce, go with Oracle. They’re safer bets, says the VP of technology, right? This is the stuff that you’re up against. So what did we learn as we were going through this? So number one, we learned that establishing shared values is incredibly important. Actually helps us overcome the objections and manage trade offs. The best way to get at what these are is actually listen to sales calls, right? I spent days and days and days listening to sales calls initially, not just Shopify at every company that I go to. I listen to a whole bunch of sales calls. Do this. If you haven’t, right, you’re going to want to cry. Like, legitimately, you’re going to want to cry listening to some of them, but there’s going to be some great ones and some bright spots. And we had one sales rep got on a call. This is beautiful. It was us against one of those big enterprise vendors. And he said, Hey, I know there’s a Delta from a product perspective. And there was a very real one at that time. There’s like a 10% Delta, big, fancy enterprise software vendor had ABCD features that we just didn’t have. One of them we were maybe rolling out soon. The other two probably not. Who knows. But what he said to them was, hey, do you agree that what’s most important is that you’re able to move faster and roll out the campaigns that you want to roll out, the products you want to roll out, the experiences you want to roll out before your competitor does? Their answer was yes. They agreed that was a huge value of that customer, and that made it really easy agreeing upfront to that made it really easy for them to say, OK, we’re OK with that trade off. We’re OK with missing these features in order to go with this other thing.

The other insight that we learned was there was still this really strong held belief that on prem was better than SaaS, which is wild to me at the time. I was like, Really, are we still talking about this? I don’t get it, but not a thing I would have even occurred to me had I not listened to all those sales calls and then really understanding what customers wanted when we were talking about distributed commerce. And this was really sort of at the philosophical level, how they were thinking about their market, how they were thinking about customers, and aligning on that really aligning on that really, really helped.

The other thing that came out of it that really informed our positioning was understanding the delineation between net new customers that were coming in from a competitor versus upgrades, and how we needed to position slightly differently there, and what that process looked like. And as we talked about earlier, the competitive alternatives are super, super different. Sometimes it’s Shopify versus Shopify. Sometimes it’s Shopify versus somebody else. So what were the outcomes of this?

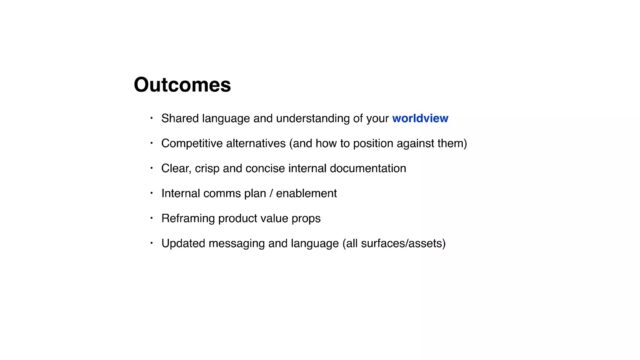

Number one, we actually pulled through, and the biggest, most valuable thing was a shared understanding of what the world view was, and really internally, all of us getting pointed in the right direction, so that we are able to communicate that to customers better of alternatives, we understand what it is, really crisp and concise internal documents, a comms plan. I know that sounds like straightforward, but I don’t know how many people actually do it, but like a really good comms plan, super duper important.

Another thing that’s really important is reframing the value prop of your product. So a while ago, Shopify actually rolled out a product called Shopify pay. It’s evolved since then. It’s like a different thing now, but when Shopify pay rolled out, the value prop was really crafted for those smaller merchants, and it was really around network effect. Can I take that value prop of like network effect and apply it to the big merchants where all the networks are coming from, probably not that value prop needs to be really, really different and re engineered for them. And then, of course, updating the language and messaging across all of your services and assets.

Problem #2: WTF Are You Anyway?

And this is where, like, I want to start to move into a little bit of a different thing. The language that you use matters a lot. And this brings me to problem number two, many of you might not have a market perception problem, because market doesn’t know who you are or what you do, right? And the problem is actually, what the hell are you in the first place? I have no idea. And as a company based in Toronto, it was B to B Tech. They focused on content marketers at these really, really, really big B to B companies. When I first joined, it was super tiny, 20 people. We thought it was going to be really early stage small business. We were totally wrong. We actually ended up moving way, way, way up market and targeting sort of these enterprise buyers. And that’s when we really saw traction, and it really started to scale. But as we were going through this, there’s a lot of jamming on what this should look like. Kind of thought we had our positioning. We started to talk about, okay, how do we what language do we use? How do we talk to customers about this? One of the founders puts up his hand, and he says, I’ve got it. We are a lightweight CMS for content marketers, for targeting enterprise buyers, right? Let’s break this down a little bit. We are a lightweight CMS for content marketers. What do enterprise buyers hear when they hear the term lightweight, cheap, hacky, shitty, not robust enough for my big, bad enterprising needs? Yes, exactly. So that’s problem number one. Problem number two, we’re lightweight CMS for content marketers. Imagine a sales rep getting on the phone, Hi, we’re a lightweight CMS for content marketers. We use WordPress. Click, right?

Because people already have a frame of reference to what a CMS is, and then the sales rep is like, no, no, we integrate with WordPress. It’s not the same thing. Come back. It’s too late. It’s too late, right? So the intention here I get, but we’re a lightweight CMS for marketers, is what they said. What enterprise buyers heard was we are a shitty version of WordPress that part of your marketing team might use. This is what they heard, right? And and what we actually started to realize is, like it wasn’t actually about the content marketers, because this was about lead gen and ROI, and that’s what the product actually helped to propel. And we actually had to target a different part of the marketing team that kind of oversaw some of the content marketers, and then it took us down a whole rabbit hole.

Problem #3: Why Should I Pick You?

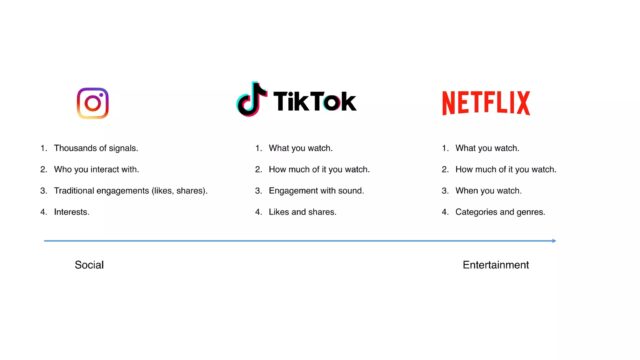

So the language that you use is incredibly important be cognizant of that problem number three, why should I pick you. Differentiation is probably one of the biggest problems and the hardest nuts to crack here. So being really honest about how you’re different, I do this thing when I talk to startups, or when I join a company where I’ll pull up the websites of, sort of all the competitive alternatives in the market. You put them side by side, and something really interesting happens as a market starts to mature. You start to get this sameness in the market, right? And it basically gets to a point where you actually can’t tell the difference between all the websites of all the competitors. They’re all saying the same thing. So imagine you’re trying to pick, there’s a ton of buyer confusion there, right? And one company called DASH Hudson, I’m on the board of that company, and they’ve been working through this themselves. It’s social media analytics software, and they basically got to a point where the market was super, super saturated and the competition got super intense. They hadn’t repositioned in a while, but the landscape had drastically shifted, right. Tiktok was getting a lot of traction. How BTC did? Social media was changing a ton, so they had to step back, and they had to actually take a look at the market and think about, how do they position themselves in the changing landscape? And they actually did something really interesting. They actually took a much broader lens than I initially would have thought of so when they were looking at, OK, social and where is social going, they actually have this spectrum now that they’re thinking about, and you might be surprised to see Netflix there.

But when we look at social media as we understand it, social is on one side. This is like Instagram that we’re all used to. As you kind of go down the spectrum, and especially with Tiktok, you’re starting to move from sort of traditional social to more entertainment. And when you actually talk to Tiktok, they don’t consider themselves a social media platform. They consider themselves an entertainment platform. Their competition is Netflix. That understanding that changed the way they thought, but how they needed to position to their customers. Their customers are. Trying to entertain, not just drive social engagement. So they actually made a whole bunch of changes. You can go check out their website if you want. It’ll give you a little bit more context there. But they repositioned across all of their services and assets. Retrain their sales team. They’re starting to see some really great signals that it’s working. An increase in pipeline across both marketing and sales driven pipe. They’re seeing qualitative feedback from partners and customers, and most interestingly, they’re actually seeing a ton of adoption on this proprietary sort of entertainment score that they came up with being used as a key KPI across these massive B to C brands. This was the unlock for them. This is what went from I feel like I’m pushing a boulder uphill to OK, we’re getting some momentum here, right?

Problem #4: There’s a Global Pandemic… Now What?

Problem number four, there’s global pandemic. Now what? Right? So we all went through this. This was a really interesting positioning problem to solve, and, I mean, I’m hoping we don’t go through this kind of problem again. But this is an external factor that is out of everyone’s control that has serious impact to you and your customers. So we won’t go through the whole thing. There are really three things that happen here. When we were at Shopify and we had to go through this really rapid repositioning. Number one, we deleted all plans. Nothing mattered anymore. We went through a very rapid start, stop, continue, of everything that was happening, the key value prop that got pulled out of that was speed to launch. Right? The faster you can get online, the better. Whether you were a small business or a massive retailer that had zero online presence. There’s a ton of those, right? If you’re a CPG that doesn’t sell online, right, huge amount of those. And we had to reframe all of our messaging and all of our assets go from aspirational messaging, we’re going to help you grow to hey, we know most of you are in survival mode right now, and we’ve got your back.

So how do you do all this? Like I said, I’m not actually going to tell you, so please buy April’s book. That’s the thing that’s going to tell you how to do it all you do need to get clear on the problem that is really something that you need to understand through that deep dive, and do not throw it at the marketing team. We’re actually going to drill into this a little bit, because this is what happens at a lot of companies. They’re like, Oh, positioning. Here you go. Marketing catch. Positioning is not a marketing thing. It is an everybody thing. It is a company thing. Is a leadership thing. It should be a cross functional exercise. And what happens if you throw it at marketing is you get back to marketing, trying to make it a marketing thing, instead of solving the root of the business problem. And unfortunately, having run marketing teams a whole lot, this is often what happens somebody on the marketing team sends a calendar invite that says, brainstorm session, literally the most dangerous word in the English language. If you get that calendar invite, decline immediately, right? And then a bunch of marketers get into a room with whiteboard, and then they start to speak in this really flowery terms and glowing language, and they start talking about unicorns and ice cream and rainbows, and then they just start puking rainbows. We’ve all talked to these marketers before, and then the next person starts puking rainbows. And then it’s marketing, so they’re really good at spreading the word. So then everybody’s talking about unicorns and ice creams and rainbows, and the narrative and this and that and is not rooted in the actual business problem that we’re trying to solve, because there’s nobody else in the company involved, and we don’t have the right inputs to actually fuel it, so you just end up with a bunch of puking rainbows that miss the mark, right? I’m going to click away from this because it’s really distracting, but it has to be a company that can’t just be thrown at marketing, right?

Reengineer your GTM

OK, so you’ve done it, you’ve repositioned. You’ve figured out how you need to actually talk to your customers and how you need to actually position internally. How do you think about your go to market now? So as you’re thinking about your go to market, I’m going to say something obvious. The best product doesn’t always win. Do we all agree? Awesome product that wins is the one everybody uses. That’s the one that wins. And that’s what makes it really important to actually invest in the commercial arm of your business. One of the things that’s biggest pet peeve of mine is when people try and label a company, are you product driven? Are you sales driven? Are you this? Are you that? And some companies identify as that. And don’t get me wrong, I am a big fan of product driven orgs initially, but I think a company needs to be whatever it needs to be at that moment in time. If you need to be product driven at the moment in time, then that is where you invest most. If you need to be commercially driven, that is where you invest most.

The product that everyone uses is the one that wins. So I stole this from 2021 I really like this slide because it actually shows a lot of sort of plg companies. It started on a plg motion. And what did they get to a point eventually where they actually have to layer on more growth. And how do they do that? They move up market? Do. Yeah, this is the thing that everybody gets to, to a degree, right? You know, Shopify is on there, as well as a whole lot of companies. And what this does really well is it shows you the high level go to market motions. You’ve got there, you’ve got product led, you’ve got sort of sales assisted in that mid market, and you’ve got sales led in the enterprise.

What this misses, though, is the market context. And what this misses is the nuance, particularly in that middle that gets a little bit messy, where it’s not clear cut how you should actually structure your go to market at the end of the day for all these plg companies. And it was this way at Shopify, and it’s this way at a lot of those companies, there has to be a mindset shift what you are optimizing for changes at the top end of the market, maximizing the number of customers versus maximizing net revenue is a totally different thing, right? And while that sounds easy conceptually, it’s actually in practice, tough for people to get their heads around it. So really making sure that you’re pointing people in the right direction. There characteristics. I mean, at a high level, at the lower end, you all probably know this. It’s large, it’s broad. It’s casting a wider net. There’s less steps. The drivers are usually marketing and growth. It’s usually self serve. There may be a bit of a human assist there. And then you go all the way up to the end of the spectrum, where it’s largely human centric, that middle piece, though, that middle piece is where it gets a little bit messy, and that’s where the context matters a ton.

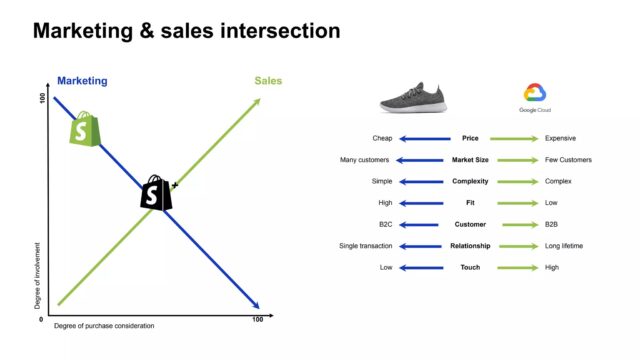

So I like to kind of flip on its head and look at it this way. So on the bottom axis, there you have the degree of purchase consideration, sort of vertically, you have sort of the degree of involvement when it comes to marketing and sales. And I kind of plotted Shopify on here, just so that you have a little bit of context. Now, again, intuitively, all know this. At the extreme ends of the spectrum, you have, you know, something that’s like low consideration, super, cheaper, easier to buy. Toothpaste is a great example of this, right? Just grab it off the shelf, and then you have the very high end. This is very high consideration. It’s very high touch. There’s a lot of thought that goes into the into the decision. So where your degree of purchase consideration is is really going to actually inform how you think about structuring your go to market teams, right?

So when you look at Shopify plus, in the early days, it was in the middle, right? There’s very little outbounding happening. There’s a lot of growth in marketing going into propelling the go to market for that. Now what you want to start to think about is, how do the different segments need to the different buying process? I said to you before we had sort of a new business segment coming in, we also had an upgrade segment coming in that were on previous Shopify plans, we started to see something really interesting with the upgrade segments. Once we got our tooling and our telemetry correct and we can actually get visibility into it, there were a bunch of signals that were telling us, hey, they might not need a sales rep team. Was like, Cool, can we sell $2,000 a month software without talking to a human. Let’s try it, right? Turns out you can, turns out you can sell $2,000 a month software without talking to a human. Because what we were seeing is super short sales cycles, very, very transactional conversations. The sales reps were order takers, right? They were order takers. So what we did was we actually were able to move that intersection over when it came to the upgrade segment. We were able to expand the pool of upgrades. We got smarter about it, because it’s all automated and driven by the signals that we were seeing and how they were using product. We increased efficiency. We had a higher velocity, we lowered CAC, we reduced operational load. Most importantly, we moved the human beings to higher value deals. Everybody makes more money.

So factors to consider: what’s your starting point? Degree of consideration? What signals are you seeing in the buying process when you’re looking at reaching your buyers with your go to market at the end of the day, you all can read this slide, the most important thing is where the rubber hits the road, which is in actually, how you craft the execution of it. I was talking to a founder that’s based in Canada the other day, and he thinks he’s ready to go to market. And he’s like, I’ve got it. And like, my board keeps asking me for go to market plan. But like, isn’t it just as easy as like, finding out where your customers are and like showing up there. I’m like, yeah, uh huh. That’s easy. The problem with that is that is not a go to market plan. Why? Because you can slap that statement on every single one of your companies. Doesn’t mean anything, right? What actually matters is, what are you not going to do? Right? What decisions are you going to make now, how do you balance short and long term investments?

So it’s more about the trade offs than it is about anything else. Where we invested, if you’re curious, initially, we invested in a partner program that was a huge part of our growth. We shifted our channel mix. We ramped up database marketing. The most interesting lever that we had was actually throttling back volume to our sales team, and yes, they totally flipped out initially, but here’s what happened once we got the right tooling in place, throttled back volume and we were actually able to identify good leads, quality leads, not just sending them a pipeline full of shit.

Retooling

This brings me to my next one. Wouldn’t have been possible without retooling the entire company. So this is an entire talk in and of itself. We’re just going to touch on some of the most important concepts. At the end of the day, what you’re really looking to do here is build the systems and processes to enable speed the telemetry to know what’s working, and you want to give people the ability to make great decisions. This is what your underlying systems need to really do. When we’re talking about speed, we’re talking about it in a couple of different realms. We’re talking about systems and tech stack. We went through a huge retooling of our tech stack, and at Shopify, we had this sort of plg motion that was on a totally different tech stack than the B to B motion. They didn’t talk, which was a huge problem, right? And we really had to figure out how that worked. We had to shift how we were actually managing our tech stack and what tools we were using.

But that resulted in two things that had massive impact on the business. Number one, faster marketing execution, right? The first version of our stack, it took three days to ship a webinar. In the next version of our stack, it took three hours. Right? In the first version of our stack, it took forever for a lead to get routed properly to sales. And the second version of our stack, fast, fast, fast speed to lead matters increases conversion. Right? A big part of growth is fixing shit. So really understanding, how do you enable speed? And then the other place where speed tends to be a bit of bottleneck is in process and operations. The bigger you get, the more approvals get put there, budget approval, deal, approval, et cetera. Watch out for that, because it sneaks up on you. Our former VP of engineering, del Mathers, she said this in relation to platform building. She said, as you scale, you get slower, slowly, and then bam, it becomes a major problem overnight, and everything is really, really slow. I don’t know if there’s any product people in the room that can resonate with this, but this happens with people processes as well, right? You get slow, slowly, and then all of a sudden, it’s a huge problem. That’s a major roadblock for your people. When it comes to telemetry, if you’re flying blind, you’re going to make poor decisions. That’s really what it comes down to.

So how do you make sure you’re investing in the right telemetry in order to unlock your team’s ability to make decisions and when it comes to your team, which is the other component of retooling, go back to that mindset shift, clarity on what you’re optimizing for, really pulling out the interdependence between teams and really understanding that cross functional model for us, what was really helpful in changing people’s mindset is a couple of visuals I’m going to give you these. Use them if it’s helpful, right? Explain the difference to folks. On one side, you’ve got more of a plg motion. On the other side, you’ve got more of a traditional B to B funnel. I have very love, hate relationship with the whole concept of funnels, but it’s fairly easy, so we’re just going to use them for now. But the key thing is, like, what is their product experience? Plg motion. They’re in the product. They’re experiencing it. You’re converting them while they’re actually there. But on the B to B side, you are now selling an abstract idea. You’re selling a thing that they are hoping will work, fingers crossed, or maybe I should buy IBM, right? It’s a very, very different motion.

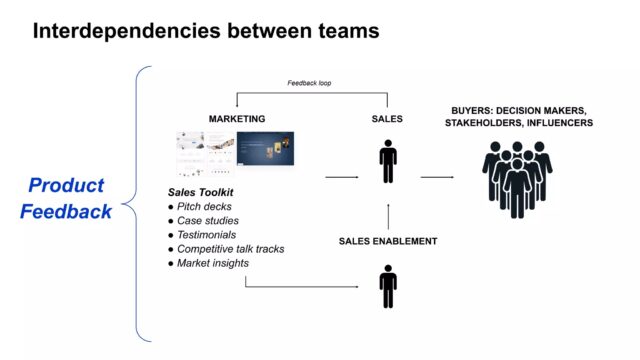

There are lots of interdependencies between teams. This was an unlock moment to really show leadership, how the teams needed to operate together. Your process might look different as you build out marketing, sales, sales enablement, how that loops into the buyer. The piece that gets missed most of the time is, how does this feed back into products. So how do the insights from the commercial team actually make it into product? How does product feed into commercial and last, but certainly not least, how are you aligning across all of these groups in B to B, the interdependencies between your cross functional teams are way more acute and way more apparent to the customer, and sort of that journey that they’re going to right, sales is super dependent on marketing. Usually, marketing is super dependent on sales, and there’s a whole bunch of teams in between that are working together. And what ends up happening is this right bunch of you, CEOs and leaders, y’all align at the top with your teams, nobody tells their teams, and then nobody aligns across the lower layers. And then you’re all confused as to why nothing’s happening. They’re all confused as to why you’re yelling at them, and then you stall out right alignment needs to happen at every single level.

However, be really cautious of: How you do this? What you want is a way to have rapid alignment across the really big decisions that will help you make good decisions faster. What will slow you down is spinning your teams into consensus. What you don’t want is people spending six weeks trying to get alignment.

Recap

So let’s recap. Number one, get really clear on your positioning problem and the desired outcome. This is going to be the thing that is your launching pad to your go to market, to your retooling, and then it feeds back into this.

Number two, think about the context when you’re engineering your go to market right. Think about the buyer and the level of consideration they’re going through. That’s going to tell you how you need to craft your go to market. How much human involvement needs to be there, what levers you can pull in order to reduce friction, and number three, retooling, try and enable speed when you can right. Invest in the telemetry to measure what works and give the people the ability to make really great decisions, because at the end of the day, your company is only as good as the decisions that you and your people make, thanks.

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.

Q&A

Mark Littlewood: Don’t you go running away. Yes, I think there are questions, lots of questions.

Hana Abaza: I think people want a drink.

Mark Littlewood: Let’s see. I know this has been like, it’s been the April Dunford show today, hasn’t it?

Hana Abaza: I heard a rumor that she appeared on a few slides. Yeah,

Mark Littlewood: Just like, contractually, she has to be. I know for all the slides from the afternoon, Martin. This is Team Canada here.

Audience member: I just wanted to, where did you come up with a 2000 and given that so many were telling you it was too low, did you consider raising the price?

Hana Abaza: Yeah, our pricing went through a few iterations. The 2000 was actually a bump up. And it happened just as I had joined Shopify, it was actually even less expensive. Prior to that, we hired an external consultant to actually help us go through this, like, big pricing study. They went through this, like massive, like, I don’t know, Patrick can probably explain what they do better than I can, and they gave us back some recommendations, and Shopify decided actually we’re going to price lower. And the reason for that was actually more philosophical than it was, what can the market handle? And the nuance was we weren’t pricing. We didn’t want to compete on price, per se, but what we wanted to emphasize was the idea that we believe that no software has infinite value, and that, you know, one priced it in a way that was accessible and made sense for the mid market, while still providing Shopify with profit. Now that was the starting point there. That was the thinking there. It has evolved a bunch, right? So after you get to a certain volume, for example, it switches to variable and platform fee. So I think it’s going through another iteration now, but TBD on that.

Audience member: Thank you for a wonderful talk. You alluded towards the end to the retooling part right, which connected to a number of beats in Tiffani’s talk earlier today. And I was wondering if you could expound on a bit, because she was really laying on the importance of thinking about how we’re tooling, particularly the sales systems, which, of course, is exactly what you all did. You speak for just a couple minutes about, like, what you were doing and what the what those initiatives look like as we think about the software.

Hana Abaza: Specifically how we retooled, as we built out. Plus, sure, so, I mean, initially, when I walked in, there was really not much built out, right? And the tooling and tech stack that existed as Shopify prior was a combination of like a, b to c, marketing automation tool and a bunch of like, homegrown, shall we say, stuff that people had been hacking on, a bunch Yes, and also just engineers and Shopify building stuff. It’s great. And so when I initially came in, I think they had just sort of started using CRM for the sales team. We had started off using HubSpot. Huge shout out to Dharmesh and HubSpot. It was like exactly what that team needed at the time to get up and running at the rate that we were scaling. It was actually really difficult for us to scale the tooling, partly because at the time, candidly, HubSpot hadn’t built out some of the features that we needed at the time. I think since then, they have, you can. Dharmesh about that, but our bigger challenge actually, was the rest of Shopify.

So let me give you a really specific example. We had lead gen things happening that would go into HubSpot at the time. There were other Shopify lead gen things happening that would go into exact target at the time. It’s not called that anymore. What was it called Marketing Cloud and people may unsubscribe from either of those tools, but those tools don’t talk right? So somebody in Shopify built a thing called bouncer, so when somebody in one tool unsubscribes, it bounces that information over to the other tool. So what had happened was there was a bunch of like, hacky things being built in order to make all of these tools talk to each other. And then what happened, specifically for the plus business, was we were experiencing massive delays and confusion and how we were routing leads to sales. So we went through this entire sort of re articulation of our stack, and it became, you know, what is sort of the Shopify core ARM using, what does the plus arm need? And then where are all the other data silos at Shopify? So there’s a data warehouse, right? That also wasn’t talking to all of these tools. So what it really ended up being was, first, what are the needs of the business? Second, how can we make sure all of these things integrate and talk to each other? It is a long, long, long journey, right? So we’re in a place now where it’s better. We migrated to Salesforce and Marketo, I believe that is being reevaluated at some point as well, and we really rebuilt the tooling in order to maximize for the teams and their ability to do stuff, but also things like speed delete, right? Because nothing else in Shopify routed leads to sales. So we had to get a thing that did that. Yeah.

Mark Littlewood: It started so well.

Audience member: Hello, Yeah, hello, okay, cool. I have a question related to internal perception, because I can imagine that, for example, sales reps didn’t have, like, full bind, because essentially, Shopify blast was very similar to standard Shopify, and suddenly, like you wanted to sell that for n times more. So did you have that problem also internally? And if so, how did you overcome that?

Hana Abaza: So sorry, as a question, did we have the problem internally? To get internal buy in? Yes, yes, yeah. 100%

Audience member: Yeah. So how, like, what are your thoughts on overcoming that? Yeah.

Hana Abaza: So this is a tricky one. So, yeah, initially, the way we were, the way we overcame, it was structural, right? So when I initially joined Shopify. I think we were like maybe 1200 people, right? But the plus team was this like pirate ship over on the side. So there was all of Shopify that was structured functionally, and then there was, like this little pirate ship over here that was like a couple 100 people, right? And we were empowered by the executive to go do what we needed to do in order to figure out this whole mid market to enterprise thing. And like, shout out to Lauren palford, who was a GM at the time. He was my boss. He was a GM of Shopify, plus he was ruthlessly focused on just that thing. And like, he cleared paths for us with the rest of Shopify, then you had the rest of Shopify. Was like, What? What? Like, what’s happening over there? Wait, what? There’s another marketing team being built over there. There’s a marketing team over here. We don’t get it. Why do you need another marketing team over there?

So initially it was very much structural, and like, go be a pirate ship and figure it out. Part of that was to optimize for speed and autonomy, right? So if you optimize for autonomy, we can move faster. If we’re empowered to do so, it’s easier to do, which is a big part of why we were able to do that. The other part of it was, I’m going to use the word protect. I’m not sure if it’s the right word, but to protect sort of the focus of the rest of Shopify down market. So that was the first thing that we did that worked really well, but came with a whole lot of trade offs. And the trade offs are, then you kind of get this us versus them thing, right? And then when you restructure, it’s actually tough to reintegrate. When you have the entire core product team sitting over here and a commercial team, mostly, there was a little bit of R and D on the plus side, but mostly a commercial team jumping up and down being like, you need to build these things, these guys over here. What things? Why? Why should I build a thing that’s only for like, a couple 1000 customers, when I can build a thing that’s for millions of customers? Right? So.

So there is very much, I talk about that mindset shift, and I talked about it in the context of, like, growth and marketing, but that mindset shift actually has to happen across every function, right? I mean, I could probably talk about it for hours, so I’ll stop there, but it’s not an easy problem to solve, and candidly, very few companies are as broad as Shopify, right? Like a couple of them are, but like, you’ve got everybody from, you know, a kid in their basement who doesn’t even have a product to sell yet, but he’s setting up a Shopify store to like the biggest brands in the world.

Mark Littlewood: So I’d love to ask a question, if you’ll indulge me, covid hit, Shopify plus had a big growth before that, but then everybody had to be online, and you suddenly became remote, and Shopify made a massive bet. I mean, a reasonable, strategic bet, which has turned out to be not necessarily the outcome they were expecting. I’m less interested in the kind of change in share price or whatever, yeah, when that, when the pandemic hit, you’re kind of in the middle of this. We’ve got a scale like mad. We’re all remote. Yeah, we’re doing all this stuff together. Yeah. Does anything change for you.

Hana Abaza: I mean, yes.

Mark Littlewood: What were the kind of highlights of that? Great was a good time? Was it fun?

Hana Abaza: It was everything. I mean, so, so when the pandemic hit, as you alluded to, Shopify had a huge amount of tailwinds, right, and every part of the business right? So you did really tiny mom and pop stores that sold like offline that were like, our livelihood depends on this. We need to get online all the way up to again, those really big brands that have never sold online, that needed to get online. So the influx of demand was like crushing, like it was palpable on all of the teams right and leading through that, during that amount of chaos, on top of being in a global pandemic. So everyone’s dealing with pandemic, right? Everyone’s getting covid, left, right and center. Business continuity plans go out the door, because you just do the best you can, on top of which you’re also trying to figure out a whole new way of working. Was incredibly taxing on all of the teams. So your job as a leader became part leader, part therapist, part all the things everybody was taking on more because some people couldn’t right. And at the same time, there was this really intense attachment to the mission. We would hear support calls every single day of small businesses calling and crying and thanking us because we helped them get online and now they can feed their family, right? So it was this weird, like ebb and flow and highs and lows of like you felt like you were contributing to something meaningful, and you also felt like your soul was being crushed a little bit, yeah, yeah.

Mark Littlewood: And how long did that go on for?

Hana Abaza: I mean, I would say that that was like through both of 2020, ebbs and flows. I would say also like there, and I think a lot of companies probably experience this. Everything gets heightened during that period, right? So, you know, there’s stuff going on in the news and like, people react to it internally, and even though maybe they shouldn’t, and that just gets heightened. Emotions are heightened. People’s sensitivities to things, everything just gets more acute. And I would say that probably started to maybe level off towards the end of 2020, and then we decided to do massive reorg.

Mark Littlewood: Perfect. Wow. So what’s next for Hana?

Hana Abaza: Oh, I am taking time off my friend, not much. I think I alluded to this earlier. I actually left off a couple of months ago. So I’ve been enjoying life, thankfully, and we will see awesome.

Mark Littlewood: Thank you, Hana thank you. Fabulous.

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

Hana Abaza

Global Head of Revenue Marketing, Shopify

Hana led marketing at Shopify Plus for four years from early 2017 before becoming their Global Head of Revenue Marketing in 2020. She joined to reinvigorate and scale the enterprise-facing operation. She led the product repositioning process and redesigned marketing and sales processes resulting in incredible growth. Prior to Shopify, Hana led marketing and growth and has a proven track record for scaling teams, revenue and customers.

She’s the perfect combination of hippie chic, tech geek and entrepreneurial hustler. Hana left Shopify in June 2022.

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.