Your features don’t win deals. Your ability to negotiate pricing does not win you deals. What wins deals is being really clear about why customers pick you over the other guys. How can your sales team make your differentiated value obvious to the right people? Your differentiating value will allow the champion of the deal at a prospect to sell that to everybody else. The better your story, the better the story travels around the world.

That’s what wins deals.

In this talk, April discusses why she thinks determining your differentiated value and making it real for customers are the two fundamental questions that help you build an effective sales story. She shares terrible and terrific examples that reveal why most sales pitches get it wrong. You’ll be walked through her approach to building a sales pitch that demonstrates your unique value and closes deals.

You’ll learn:

- How to clearly define and communicate your product’s differentiated value.

- Why product walkthroughs often fail as effective sales pitches.

- How to make sales conversations more helpful and less self-centered.

- A structured way to pitch that builds trust and reduces buyer indecision.

- Why small companies can shift positioning faster – and how to use that to your advantage.

Slides

Find out more about BoS

Get details about our next conference, subscribe to our newsletter, and watch more of the great BoS Talks you hear so much about.

AMA (Ask Me Anything)

Transcript

April Dunford

So I’m April. So, it’s a bit of an experimental talk. This is not just about sales. It’s about sales and your feelings, particularly your feelings about sales. I’ve worked with a lot of founders and a lot of companies back when I was inhouse. I did seven or eight different startups as a VP Marketing, and then as a consultant.

I’ve worked with over 200 companies now. And it’s interesting to see the commonalities across companies. So one of the things that I see that’s very common is that founders generally don’t find sales easy or natural. Most of us come from the product side of the house, or we come from the technical side of the house. So sales kind of isn’t our jam, and we have to figure it out as we go along.

It’s interesting when you see the way we sell in software companies, we tend to have a bit of this, if we build it they’ll come kind of mentality. So when you go in and see sales pitches, the pitches don’t actually look like pitches. The pitches are product walkthroughs. And in fact, a lot of the time when I talk to founders, they’ll be very adamant about that we don’t pitch. This is not a pitch, this is a product walk through. We will show them our genius product in great detail, and it’s just the facts and then you customer will figure out how amazing it is and want to buy it. And that’s how it works.

So I go thinking about why are we so against selling? Because we are doing a pitch, whether we admit that’s what we’re doing or not. But why do we want to make it not a pitch? There’s this idea of I’m not selling, I’m not trying to sell anything here. And when I talk to founders about this, what I get is, we just don’t want to be that guy. We don’t want to be that stereotype of the used car salesman, like this fast talking, lying, cheating person that’s just trying to get my money no matter what – we don’t want to be that.

And so I got thinking about what is it that we hate about the used car salesman? And I think there’s two things like that we that we dislike about sales:

- So the first one is the lying. We have this impression what we hate about the used car salesman, the stereotype of sales is they’re lying to us. They’re telling us something’s good and it’s not good. They’re telling us, oh, this thing will work and it doesn’t work. They’re telling us, oh, we can do ABC, and then we get it, and we’re like, No, we can’t actually do ABC. And that really sucks.

- The second thing that we don’t like about sales, or at least the used car salesman stereotype, is this kind of greedy selfishness. All they’re trying to do is get my money, they don’t actually care about me and what’s good for me, and what kind of car do I actually want, or whatever. They’re trying to trick me into buying something, because what they really care about is the cash. They’re not trying to be helpful or solve my problem. They’re just trying to take the cash out of my pocket and stick it into their own pocket.

It’s interesting, in my career, I’ve actually seen a lot of amazing sales interactions, like sales interactions where the customer loves the sales person, sales interactions where everybody feels good at the end of it. And so I’m like, okay, is there a way we can ensure that we never sound like a used car salesman? And that we never actually cross that line into doing sales that we sort of feel gross about. This is what I want to talk about today.

Differentiated Value

I think that differentiated value, being able to really deeply understand our differentiated value, and then knowing how to communicate our differentiated value is the key to doing sales that customers actually love.

What is it? So let me start by defining what I mean by differentiated value.

Differentiated value is the unique value, or the thing that you can do for customers that no other alternative on the market can do. Put another way differentiated value answers the question, Why pick us versus the other guys?

So you would think, we actually really know this a lot, but I’ll get into why this doesn’t always work out the way we think it does. In my mind, again, getting really tight on that differentiated value and figuring out how to communicate it well, is the difference between sounding like a used car salesman and and being a guide for customers.

So let me go into each one in a little bit more detail.

So first of all, there’s this idea of lies like it’s funny. I’ve never met a founder that was lying to customers on purpose, not once. I have seen a founder tell a lie though a couple of times. I’ve actually never seen a salesperson lie on purpose. And let me tell you, I’ve seen a lot of lying in sales conversations. And so here’s how I think this works out.

If we don’t understand differentiated value, meaning we don’t really really understand why a customer should pick us over the other folks, two things happen: The first thing that happens is we sound like everybody else.

This happens a lot when we’re not really clear on the differentiated part of the differentiated value. We come in and we say, Hey, we’ve got this thing. It’s amazing. It’s going to help you save time. And the customer is like, so does everybody else. Oh, but we’re going to make it way easier to do, x, y, z. And the customers like, well, so does everybody else. Like, I can do that with your competitors. So what do you got? And we, you know.

And then we’re tap dancing a little bit, and what we have is just kind of a void. And what happens is folks will just start to kind of make stuff up a little bit. That’s where we get into trouble.

The “Misrepresenting it” Example: IBM vs Oracle Databases

Let me give you a couple examples of this, because whenever I say this at the beginning, everyone’s like, no, no, we’re never telling any lies. And it’s like, yeah, okay, well, we just will see about that. So the first time I got really conscious of this, I was working a big company at IBM, and I was responsible for a database product, DB two. If you know that product and the way database products traditionally got sold, when we talked about value. We talked we often talked about the ITYs, which was scalability, reliability, interoperability. There were a bunch of ITYs, and then we talked about performance.

So whenever sales reps were talking about our database, the customer was there and they say, Well, why should I pick you? We’d say, Oh, we’re scalability, reliability, interoperability, blah blah performance, blah, blah, blah. But here’s the thing ,we’re up against Oracle, and they were good at all of that stuff too. In fact, you had to have a microscope to figure out how our scalability was any different than theirs, how our reliability was any different than theirs.

We kept doing benchmarks. We’d have a benchmark, we’d be a little bit better than them. Two weeks later, they’d come out with a benchmark, and they’d be a little bit better than us, like there was essentially, as far as a customer was concerned, there was no difference.

So if you sat in these meetings, we were never answering the question, “Why pick us over the other guys?” We were just going, blah, blah, blah, ity, ity, ity and it was really interesting. Because databases at the time super super commodity software. If I was to sit down and make a feature function checklist between those two databases, virtually the same like 92% of the same features.

The differences were, if I listed them as features, they didn’t seem like a big deal. But if you translated it to value, it was. So when we went through this exercise, what have we got that they don’t have? And why should a customer care about that? Here’s what it boiled down to.

Oracle was really into this full stack. They felt like the job of a database was to be really tightly integrated to middleware and applications and everything came in one great big bundle. We had a fundamentally different point of view about that. So we felt at IBM, we were really into open systems, open standards, openness. And the idea was, database is just a piece part, and it should just play nice with everything else, including things that aren’t from IBM. And that’s how you get innovation. Something new comes up. You can swap things out, and everything plays nice with each other.

Oracle, when they talked about the value of what they did, the value was total cost of ownership, being able to get it deployed really quickly, and stood up really quickly. And so if you looked at who we were selling to, we were selling to the biggest of the big, giant companies. They really, really disliked the idea of lock in with a vendor. And they really liked the idea of being able to swap things in and out and have some agility and were able to respond to things. And so our value proposition was actually really, really different.

So we stopped selling on the -itys, which was kind of a lie. We weren’t faster than them, we weren’t more reliable or scalable or anything else than oracle was really and started selling on this idea, as we’re a database platform for innovation. Which was very clearly differentiated from Oracle and answered the question for customers, why pick us over everybody else. So that’s the first one.

The “Stretching it” Example: Watcom SQL and “ANSI-Standard SQL”

The one you see a lot is this one, which is the stretch it. We’re just telling the truth, but we’re stretching it. So my example here is, I worked for a little startup, again, database stuff called Watcom SQL. What we did was an embeddable database for mobile devices. So our big value that no one else could deliver, we were selling against spreadsheets and Microsoft Access. This was a long time ago, and at the time, we were the only database that you could fit on a laptop that you could do SQL with. Meaning we could write little store procedures and triggers and things. And because it was SQL, it was interoperable with the big database at headquarters, you could do stuff on the laptop out in the field, come back, plug it in, everything, sync up. That was a genius idea back in whatever that was, late 90s. So we had that. It was working really good.

We had a handful of sales reps, I think three or four. They had been with us since the beginning. They really understood well how all of this stuff worked. Everything was going good, revenues going up into the right and then we got acquired by a big database company in the valley called Sybase. And so we’re acquired by Sybase. They’re the number one database in the land. So they said, April, you’re going to have to train all the sales reps on how to sell this Watcom SQL. I said, Sure, no problem, but you’ve only got, they gave me two hours and there was 200 sales reps. So I was going to go in and do a training session in North America, and then one in Europe and one in Asia. And they gave me two hours.

In there, I’m trying to explain this interoperability thing. The way it worked was we had this ANSI-Standard SQL, and Sybase had their own version of SQL. I think they called it transact SQL, and it was also ANSI-Standard SQL. But you know how these things work? Like, Sybase had a bunch of extensions and stuff, and yes. So the deal was, you could write something new to run on the laptop, and it would work with that thing over in Sybase land, but you couldn’t just take the code that was in Sybase and plug it on this. It wouldn’t work because you would be using some of these extensions.

So I’m trying to explain this. I think I got it. I explained it to the sales rep, and the VP sales said to me, Lady, don’t worry. These people are database experts, they know everything about databases. I don’t know what it’s like up there in Canada, where you guys come from, but we’re here in Silicon Valley, and we know what we’re doing, these guys. You don’t have to worry about these guys not knowing how to said database. So I get my two hours, I train them up. Everyone’s taking notes, yep, yep, sounds good. We’re going to sell tons of that. I go to Europe. I do the same thing in Europe. Two, three weeks later I go to Asia, I do the same thing in Asia. And so by the time I get back to North America, it’s been like a month.

So I’m going to go out on a sales call with one of these reps that I’ve trained just to see how it’s going in sales. And so we’re pitching a giant bank, and the rep comes in, and he’s got a relationship with this bank. And so the senior guy at the bank is like, Hey Johnny, so good to see you. You know, Johnny comes in, sit down. They’re all like, how’s the kids? How’s the wife? You know, they’re having that conversation. And I’m like, okay, great, you know. And I’m supposed to be fly on the wall, right? So they didn’t even, guy doesn’t even introduce me. So I’m saying, so Johnny’s over here, customers here. I’m kind of hiding at the back. I’m just fly on the wall watching this. So Johnny gets up and he’s pitching our thing, and he says, oh, so the great part about this thing is it’s fully compatible with with Sybase SQL. And I’m at the back going, not really fully but okay. And then the customer says, customer says, so wait, you’re saying that this database, this new mobile database thing, if I’ve got stuff running over on Sybase database, it’s going to run on the mobile database thing. And the guy says, Oh yeah, and I’m going to back going, Oh, this is not going good. And then the guy says, So you’re telling me to the rep. So you’re telling me this little database thing runs full transact SQL? And I’m hiding behind the guy, and I’m going like this, and Johnny’s like, oh yeah. And so I’m behind it, and I’ve got this look on my face, like, No. And I’m going like this, no.

And just then the customer turns around. Around, and I’m like this. And he turns around, he says, Who are you? And I said, Oh, Hi, I’m April. I run marketing for blah, blah, blah, blah, blah, and I came with the acquisition, or whatever. And he goes, acquisition. This came with an acquisition. And then he turns back to John, and he goes, so you’re telling me? That guy is lying to me. He went from Johnny, buddy buddy. How are the kids to that guy in the middle of the thing. And I said, Well, you know, so I went on this long conversation of ANSI-Standard SQL and how that worked and everything else, and it was a very, very, very embarrassing moment. The rep is looking at me like, What are you talking about? We get out in the hall afterwards. We’re having a big fight about it. And so what I realized is that Johnny did not know he was lying. He just wasn’t really paying attention when we I was trying to split hair on this little difference. And we thought, Oh, these guys know so much about databases. So we ended up having to pull everybody back in and doing a half day deep dive on what’s the difference between transite SQL and ANSI-Standard SQL.

The thing was, our value was great on its own. We didn’t have to be fully compatible for the thing to be an amazing product. It was doing hundreds of millions of revenue at the end, when I left there, but if the people don’t understand it, you’re going to have this problem that people are getting into lies territory. So in this case, he understood the differentiated value, but then he started to stretch it, and the next thing you know now, we’re not telling the truth anymore, and customers are very unhappy about that.

The “Not Getting to the Core of it” Example: LevelJump

The last example I’m going to give is what I see most often. So what I see most often in smaller companies, anyways, is that we kind of understand what the differences are. We certainly understand what the differentiated features are. We’re just and we kind of get the value. We’re just not really tight on it.

So this is an example I’ve used a lot. I word did some work with this company. They’re called level called LevelJump Solutions, and what they have is sales enablement software. Recently they got acquired by Salesforce. But sales enablement software, they’re big differentiated features. They’re the only sales enablement software that’s built inside of Salesforce. The rest of them are built outside of Salesforce. So when we were doing this workshop trying to get at their differentiated value, I’m like, okay, so you’re the only one that’s inside of Salesforce. So what? Like why does a customer care?

And the founder said, Well, first thing is that you don’t have to log into another system, like you’re the sales rep. You’re already in Salesforce. You don’t have to go out and log into another system. And I said, Well, you got a competitor that’s doing 80 million revenue. I don’t think logging into that other system is such a big deal. And he’s like, you’re right, you’re right. It probably isn’t, but we say that, you know, people seem to like it like, Okay, well, what else you got? Like? So what? And he says, Well, you know, we actually got we’re really it’s really easy to set up the training the way we do it. It’s really easy. One takes three kicks. If you go with the other guys, you know, it’s quite hard. You have to go out, do a thing, do another thing. I’m like, okay, that’s maybe a little bit better, but I don’t know if it’s all that different. Like, does anybody really care how hard it is to set up the training? You only do that once, how often you do that? So we had this big conversation, and in the end, he said, Well, actually, and then the other thing we’ve got is, because we’re integrated into Salesforce, we have all the data from Salesforce. And I’m like, Okay, so, so what? like? Why does a customer care, though? Well, he says, because we have all the data, then we can tell we did this training, and we know how it impacted the sales data. And I’m like, Well, so what about that? And he says, Well, we can tell whether the time the first deal went down or time to make quota went down. And I’m like, oh, so is that a really good thing when time to first quota gets down? Because actually it’s a giant thing, like, you know, if you look at the data on that like it actually saves you a ton of money. You could make way, way more revenue if you could get that time to make quota thing down. I’m like, that’s a really big deal.

So if you looked at the way they were pitching it when they were talking to customers, they were talking about all these little wee things that were valuable, and then right at the end, they’d hit you with the biggie. And the biggie was, if I’m a person that does sales enablement, how do I know whether or not the sales enablement is working? If I don’t have data from Salesforce, you don’t, you don’t actually know if it works. So we had re architected the whole sales pitch and brought that stuff to the beginning, and that was a completely different story. So this is very common.

A lot of the companies that I work with, they’ll list all this value, and a bunch of it’s really, really small, and they’ve got one real B, and it’s buried in this list of things, often sitting at the end. So again, if we can’t get really, really tight on differentiated value, it just sounds like we’re kind of just everybody else is a bunch of stuff or whatever, and you know, it’s not really like we’re lying, but we’re kind of burying the lead.

How do we actually figure out our differentiated value?

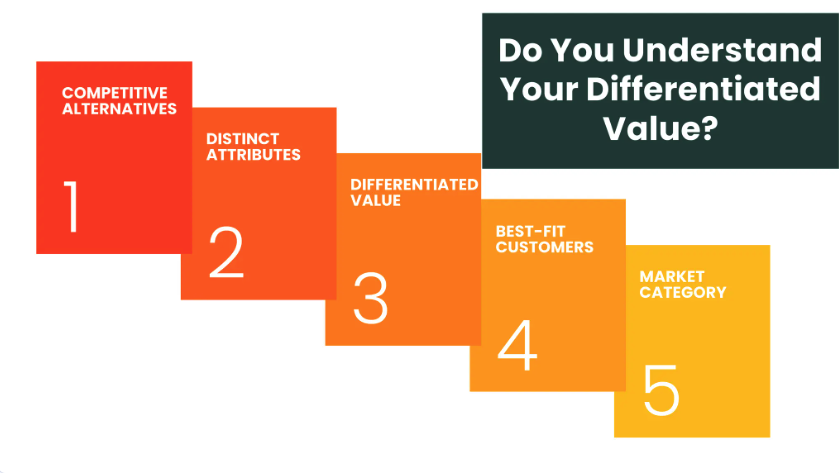

So how do we actually figure out our differentiated value is usually the next question. Most folks don’t do this in a systematic way. If we want to actually get at it, we got to have a process to do it. So in the work that I do with folks, we start by putting a stake in the ground, by saying, Look, if we didn’t exist, what would a customer do? And so that includes whatever the status quo is, which might be, I’m going to use a spreadsheet to do it, or I’ll just get the intern to do it, or whatever. And then it’s also, I’ve got to beat everybody else that ends on a customer shortlist, which, you know, sometimes we understand that, sometimes we don’t, but we need to figure it out so that we can put the stake in the ground and say, Okay, that’s what I have to beat in order to do a deal. And then I say, Okay, well, what have I got that they don’t have – feature function capabilities like, Oh, we’re integrated into Salesforce. Oh, we’re the only one that does this. Oh, we’ve got this great interoperability with other things in the stack. And then you got to make the translation to value. So you’re looking at that feature and you’re saying, Okay, we’re the only one that’s got this thing integrated into Salesforce. So what? And we have to keep saying so what, until we get at the nut of what this differentiated value is.

Well, we get to that spot. If we do that in a systematic way, we often come up with something different than what we’ve been saying in sales calls, where we’re just trying to walk through everything and we’re trying to throw everything we’ve got at the customer. Instead, what we can do is deeply understand the differentiated value, get right at that, make sure that everybody in our sales team really understands it, and then we’re orienting everything we say around that one thing. So that’s the first part. That’s how we deal with the lies.

The second thing is this idea of selfishness. So some people think of the used car salesman archetype is that, you know, they’re just being greedy. But I like to think about it as selfishness, because a lot of what I see happening in sales calls actually feels kind of selfish. So most of the time, I think, particularly when founders are selling is they’re so worried about seeming pushy or salesy that they end up being not very helpful at all in a sales conversation. And so what I mean by that is a typical product walk through demo is usually all about us, and it’s not really about the customer or what the customer decision the customer is trying to make. So we almost never talk about alternative approaches or how we’re different than alternative approaches. So we’re going through the walk through demo and saying, Here’s a feature, here’s a feature, here’s a feature, here’s a feature. It’s up to the customer to decide, are you the only people with that feature, or does everybody have that feature? Why do any of those features matter? So we leave it to the customer to figure out how to translate that feature into value. So I’m integrated into Salesforce. You figure out why that’s important. You figure it out it’s not for me. I’m not selling you, not being a gross salesperson here. And it’s kind of selfish in a way. And so the question we should be asking ourselves is, what is the customer actually trying to do, and how can we be more helpful in a sales conversation?

How can we be helpful in a sales conversation?

So one of the ways to think about this is to put yourself in the customer’s shoes. If we’re selling B2B, often, the person that is purchasing our software has never purchased software like ours before, ever.

So we’re sitting in the office, eat, sleep, drinking, database stuff, and then the person comes to buy a database, and we overestimate what they understand about the state of database technology, the state of database vendors, what’s possible and what’s not possible. I’m not saying customers haven’t done their research before they come in to talk to us in sales. They absolutely have, but there’s a lot that they don’t know, and we’re there’s a lot that we know that we’re just not sharing. We’re like, we’re just not going to tell you that. You figure it out. We don’t. We don’t want to be we don’t want to be salesy. So that’s the first thing.

Customers never bought a product like yours before. Consider that.

The second thing is that making a decision is risky, way riskier than we think. So the person generally sitting across from us that we’re selling to is worried. They’re worried that if they make a mistake and they buy something that doesn’t work, or the team doesn’t love, or their boss disagrees with that’s going to look bad on them personally. So they’re worried about, oh, gee, you know, if I make a mistake here, something bad might happen. Maybe I’m not going to get a promotion, maybe I’m going to look stupid in front of my boss. Maybe the rest of the team is. Going to hate me.

So this worry is weighing on them. If you look at the stats on this, it’s terrifying. So if the statistics tell us that 40 to 60% of B2B purchase processes end in no decision, when you scratch at that data, the no decision isn’t that they looked at all the alternatives and said, Oh, yeah, you know, we’re using Excel, and that’s just fine, and we’re going to stick with that. Typically, it’s not that at all. Typically, if you scratch at it, what happens is that the buyer can’t figure out how to confidently make a choice, and they’re so worried about making a wrong choice that they make no choice at all. So they go back to the office and say, You know what, now is not a good time. We’ll do it next year. We’ll make the decision the year after that. And so they do nothing. So we need to actually have the attitude that we’re there to help.

This is from a study that was done a couple of years ago. I love this one where they went to B2B software purchasers, and they said, What do you wish was happening in a sales conversation? Like, what would you like to get from a vendor when you go into a sales conversation? And the top two things were, I want perspectives on the market, meaning not you, but you and everybody else, and where you fit relative to everybody else, because I’m trying to make a choice. And the second one is, help me navigate the alternatives. What are the pluses and minuses of the other alternatives? Are we doing any of that in a typical sales call? A lot of us – no.

So if we really wanted to have the attitude of we’re here in sales to help a customer make choices, we would do a very different set of things in a sales conversation than what we’re typically doing. So we’re not there to try to trick folks into buying. We’re also not there to just say, you know, here’s the stuff. You figure it out. Our attitude should be, well, we’re here to help, so let’s do the best job we possibly can helping you make a choice.

So if differentiated value is, why pick us over the other guys? What we actually need to be doing in these sales conversations is confidently communicating our differentiated value. So we’re trying to teach the customer what we think is important when you’re making a decision, and what things aren’t so important.

The second thing is what you have choices. Let’s look at the other choices, and here’s what we believe the pluses and minuses are to different choices, and then we should be making a recommendation for what we think is the best choice for that business, even if the best choice isn’t us. So let me look at how we do that. So I have a methodology for building a sales pitch, and it’s based on something that I learned when I was at IBM a long time ago. But it actually doesn’t look anything like that now, because I start up a fight it and used a version of this with 100 or so different startups. And so it looks a bit like this, and it’s designed to help this problem. So it starts with instead of starting by just jumping in and doing a product walk through, it starts with a conversation about the market, and then we translate into and then we transition into a conversation about our differentiated value. So let’s break the first part down a little bit, because I think this is the important part.

This is what I call the setup. So before we jump into our product and show you all the stuff, we give you a little bit of a setup. The setup is designed to answer those questions that a B to B buyer wants, which is, here’s our perspective on the market, here’s your different choices, and the pluses and minuses of making those different choices, and here’s our recommendation for what we think a company like you should do, and then we spend the rest of the time saying, here’s how we do that. So let me give you an example.

Example: Help Scout

So you folks, a lot of you know Help Scout, because they’ve been here before and they’ve done talks, but it’s a good example because it’s easy to understand. So Help Scout makes customer service software. So think Zendesk software for your customer service agents.

Now, Help Scout was built very specifically for companies that are digital, so they don’t have stores, they don’t have sales people. And so what help scouts insight into the market is that these digital businesses don’t see customer service as a cost center. So most places like your cell phone company, for example, when you call in, they don’t want to serve you. They see that as a cost center. They’re trying to push you out to the Frequently Asked Questions document, or have you do the chat with an artificial intelligence person. And their whole drive is, let’s get the cost of service down. We’re going to drive you to low cost channels in digital businesses, customer service is actually really different. It’s your one chance to interact with a customer, live in person, and so the data tells us that if you can give them a really good customer service, then that’s actually great for business. It improves loyalty. They end up hanging around more. They spend more with you and so, so Help Scout was built with that insight in mind.

And so if you look at how they do stuff, first of all,they make it really, really easy for the agent to use the software. Secondly, there’s all these features that are designed to give a really great customer experience, like the customer is not assigned a ticket number. The customer is not pushed to a low a low cost channel. So the whole, the whole thing, is structured differently. Now, if you look at Help Scout’s competitors, there’s two things – most little digital businesses start with a shared inbox. It’s great because it’s easy, so everyone can just use it. Things go in there. They decide who takes what. As they scale though they’re going to want prioritizations and assignments and all this customer service stuff, and so if the companies end up having to migrate off this shared inbox into something that looks like Zendesk, like proper help desk software. So that’s the situation.

Now, there’s two ways you could pitch this. You could pitch it with the feature walkthrough, and the feature walkthrough would look like this, Hey, digital business. Ah, hi. We’re Help Scout. This is so great. Let me show you there. Our stuff might log in. Here’s how we log in, and here’s the main interface. Look. It looks like a shared inbox, but we do other stuff too. Here’s how we do prioritization and assignments, and here’s another feature and another feature and another feature and another feature. We keep going until we run out of time, and then we say, Please, decide whether you’d like us.

Imagine I’m the customer on the end of this. If I’ve got a shared inbox already, I’m like that just looks like our shared inbox man. Like that, I don’t know is that different? And then if I start listing all the features, if I stack it up against Zendesk, well, I bet you there’s a lot of stuff Zendesk does that these folks don’t do. So I really answered the question, why would I pick Help Scout over Zendesk? Or why would I pick Help Scout even over a shared inbox? It’s not entirely clear.

Or I could do it this way. I could start with the insight and say, Hey, okay, we’re here to do a demo. We’re gonna get to the demo. But hang on your digital business. We actually work with digital businesses. We were built for that, and one of the things we’ve noticed is digital businesses think about customer success in a slightly different way, so they see it as more of a growth driver, rather than a cost center. And they have a couple of nice slides that show what a good interaction does for your revenue, what a bad interaction does for your revenue. But most companies will say, yeah, yeah. We totally agree with that. That’s true. It’s our only chance to talk to customers, so we think it’s really important. They say, Great, okay, we know you have choices. And again, we work with companies like this. Most folks start with a shared inbox. Is that what you’re using? The customer say, yeah, yeah, we’re using shared inbox now. It’s great, like and you know what’s great about it really easy for your reps to use. And if you didn’t have to grow, you could probably stay on that forever. But if you’re growing, eventually you’re going to have this problem where you need to do assignments, you need to do prioritization. So how are you going to handle that? And so the other thing. So then you end up looking at Help Desk software with probably help desk software. You’re not in shared inbox land anymore. So this is really hard to use. Your folks are going to have to get trained. Secondly, these things were not designed to give an amazing experience. Your customers are going to get assigned a ticket number. They’re going to get pushed out to low touch channels. You’re going to have this thing is just basically not designed to give an amazing experience. So it’s our point of view.

What we think is that if I was a digital business and you want to deliver great customer service, you would have three things. You’d have something that was as easy to use as a shared inbox so your folks can adopt it really easily. Secondly, you’d have all the bells and whistles so you never had to migrate off of that prioritization assignments, all that stuff. But lastly, you’d have a solution that was designed from the ground up to give an amazing experience. That’s what we want, right?

Now, if the customer looks at me and says, right, well, then all I have to do now is show how we do that. So now I move to differentiated value. I’ve established what my three pillars are, and I do a demo that shows that. So I’m not just demoing every feature. I’m saying, okay, easy to use as a shared inbox. Look, we have a shared inbox. This is what it looks like. Your people will know how to use it. It’s a familiar interface. Second one never going to have to migrate off the platform. That’s my second pillar of value. So here’s how we do that, prioritizations, assignments, all the stuff you need, and then lastly, delivers an amazing customer experience. Here’s how we do that customer gets to choose the channel that they interact with you with, never going to give you a ticket number versus calling you by your name.

So these two ways, these two ways of pitching, are completely different. The first sales pitch is just me barfing out a bunch of features. It’s not that helpful for me as a buyer trying to make a decision. This way of doing it, lays out the options, gives our point of views on gives our point of view clearly on what we think is good versus bad, and then we show the customer the product but in the context of our differentiated value.

So I think this concept of differentiated value, if we can get really tight on it and then figure out a way to communicate it well in our sales conversations, what we have is the ability to come into a sales situation with this.

Calm Confidence

You know what my old boss used to call calm confidence. So I had a boss that used to say, the best sales reps come in and they have this really cool demeanor, which is like calm confidence. They know everything about the product. They understand the customer and what the customer is trying to do. They’re not trying to sell anybody that isn’t a good fit for them, because they don’t want to waste time on that. Because they’re they know where they can win and where they can’t.

If we really wanted to channel this calm confidence, like there’s a handful of things. One, I got to really nail the differentiated value. I got to really be able to answer that question, why pick me over the other folks? That’s the first thing. The second thing is, if I understand that, then I should be very willing to fight for business where I know I’m the best solution, because that is the right thing to do for the customer. But what goes with that is, is the ability to just, you should just actively refuse to do business with folks that aren’t a good fit.

So if I’m Help Scout, I get to this thing and I say, hey, you know it’s a growth driver, not a cost center. And the customer says, well, actually, we’re just really worried about cost. You walk away from that deal. That doesn’t gonna be you. You should walk away from that deal.

So lastly, you should embrace your role as a guide. We’re not here to be pushy, pushy sales people. We’re not here to try to trick you into buying something. I’m here to be your guide. I’m here to show you what’s going on in the whole market and show you what we think our value is and and then recommend something to you. It’s still up to you, whether you say yes or no to me, and in some cases, I may actually recommend that you go elsewhere. And then lastly, we should ensure that our pitches are helpful, so we’re not trying to just show you the features and have you do all the work. We’re actually trying to take you along on a journey and help you make a decision or the best decision for your company. If you’re interested in learning more about how to do positioning or figuring out your differentiated value, I wrote a book on that. It’s called, obviously awesome.

The big excitement today is this, if you wanted to learn how to do a sales pitch. And you think maybe you like to look at a structure for that is, I have a book called sales pitch that is actually released today. Very exciting. My gosh, it took so long to get it out. And so, yeah, so, but that’s the end. That’s all I got for you. Are we gonna do questions? Hell yeah. Thank you. Thank you.

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

Q&A

Mark Littlewood

So the way questions work a BoS is that I try to get through as many as possible. So a quick reminder, just wave at me gently, if you’ve got a question, I’ll make sure that they are lined up. I know that one, but I’m just saying there’s one backup.

Audience Member

I had another question, but you said you’re okay with hard questions, so I’m gonna ask you a harder question. So 44% of millennials do not want to talk to a salesperson in B2B interactions. By 2030, 75% of the workforce is gonna be millennials, Gen Z or Gen Alpha, and data shows that sales rep led interactions lead to lower quality purchasing decisions.

April Dunford

Oh, I’ll question that data a lot actually.

Audience Member

Comes from Gartner, not me.

April Dunford

Yeah. So I’ll question that. Yeah, what Gartner has an agenda. So.

Mark Littlewood

Wait, that changes everything.

April Dunford

You know, you’re not exactly. Well so there’s also another trend happening right now, which is so for the past few years, we’ve been in this in this cycle of what we call product led growth. And so, so a lot of companies have tried to avoid this idea of getting into us into a sales situation at all by having the end users adopt on their own and then purchase on their own. And the thing works like that. The problem is that what we’ve seen in the last three years, since we’ve been in a recession, is a great clawing back of that. And so I’m not saying that product led growth is going away, but what we are seeing is those companies when they attempt to move up market where there’s a purchasing department and an individual can’t make a decision to purchase. So this isn’t $99, this is a $2 million deal that crosses the entire organization. One individual can’t make that decision.

Do you know what the number one I got this stat from somebody at I was at an HR conference and it was bunch of HR individuals, and they were looking at roles in big companies that because not everybody’s hiring right now, the one, the number one role that people are searching for right now, head of purchasing. So in most big companies, even though the millennial may not want to talk to a sales rep, in most big companies what you’re actually what you actually have is a buying team of five to eight people, and it is almost impossible to get that deal done with nobody from the company helping the team move through the purchasing process.

So I think where we can get away with it and not have a salesperson, we should absolutely do that. But the minute, we start moving up market, and now we have purchasing and buying controls, and now I’m dealing with a buying committee. I don’t think sales goes away. I actually think we’re going to see a lot more of it. And you’re seeing a little bit of this, early stages of this, in some of the very product led growth companies that were the first wave of that are now actually hiring big sales teams and going, there’s a famous quote from Stuart Butterfield that they made it to 200 million with no sales people. And he said, I think I can grow a billion dollar business without ever hiring a salesperson again and that was in 2016. Two years later, he had 700 sales reps.

So so so I don’t think this is quite going the way like I think this is the dream, right? The dream for people that are uncomfortable with sales is that sales just disappears. But I think the reality, I think, I mean, I got that dream too, right? But I think the reality is, if you’ve been inside an enterprise, where there’s a buying committee, it’s very hard to get those deals done without a team. Even when you’ve got a buyer that doesn’t want to interact with sales and wishes they didn’t have to, you’re still going to have to move through that thing like even to do pricing is complicated, right? So anyway, so I appreciate the comment, but I don’t I think that’s I think we are about to see a wave, probably unjustified, of backlash against product led growth, because I think some people went so in on it, and then I think where we’re going to come back to is something a little bit more in the middle.

Most of the good companies I’ve worked with that did product led growth, like Postman is great example A to what do they have? Like, 2 billion active users, something crazy. And so what they have is product led growth motion. Everybody on the user side adopts the thing, and then they have a sales team that comes in over top and sells at the CIO level and says, Why don’t you just have a license for everybody in here. Look, your people are already using it, and they’re selling a different value proposition at the management level than they are to the end users. So they’re letting the end users freely adopt but that doesn’t mean there isn’t a sales team that comes in over top and sells over top. So I’m seeing a lot of that. So I don’t know. None of us can predict the future, but if I was a VP sales, I wouldn’t be worried about my job for the next 10 years. Let’s put it that way.

Mark Littlewood

Great. Richard and white on the other mic.

Audience Member

About a third of our business is public sector in the UK, and very driven by procurement, etc. How do you nuance what you’re referring to, which makes absolute sense, but where you have a buyer who doesn’t engage in that, you know, in a way, you say clearly, logically explained as being the optimum one, and instead tries to make it more dispassionate and at a distance and in writing, etc.

April Dunford

Yeah, you mean like they’re giving you an RFP, and you have to respond to the RFP and do it that way. So, so I spent a lot of time selling big database systems to banks, and so the way the banks will do it is they’ll put in our out an RFP and say, These are the questions. And this is, you know, just answer the questions. Don’t give us any your sales spin buddy, just answer the questions and submit the thing, this was very hard for us as a small company, because the RFP was generally written with somebody like Gartner, and so it was Gartner’s point of view on what was important and what wasn’t. And so in order for us to get past that stage, we had to spend a lot of time in the RFP, and then outside of the RFP communicating our point of view. So for example, we would get an RFP that would talk about, you know, a bunch of stuff that we didn’t think was important, and it wouldn’t mention anything that we thought was important. And so we would find ways to work it into the RFP. And so we spent way more time on RFPs than we should have. We also spent a lot of time inside these accounts making sure that people understood our point of view. So assuming we could make it past the RFP, in some cases, you don’t have the choice, because you’re selling the government, but in some cases, we would just not even attempt to. Increase the deal if it was RFP, and we knew we couldn’t, there wasn’t any leeway. Often those RFPs, like I worked at IBM, and so when if we were in with a big bank, like we’d write the RFP, and nobody had a chance to come in and sell against us, like we wrote the RFP with the company. But now government’s different but I think the key is you’re going to have to spend a lot of time to make sure they understand these differences, and you’re going to have to be answering questions that they didn’t ask in the RFP. So we’ve spent a lot of time doing that, like when they ask this, we explain this and say why this is important. If we can get their attention on that, generally, we can get a meeting to talk about that stuff, and then if we can get them to understand, then we can get them to change it. But I don’t envy you being in that sector, because that’s like the worst.

So this is why your taxes are so high.

Audience Member

So quite question about, like, a situation where you’re selling into a fragmented industry, where maybe there isn’t a common view of the market, we’re going in with, like, a POV, something like this, and insight where there’s gonna be a lot of different opinions. They use a lot of different language about this. About addressing that without kind of having to do a one off view.

April Dunford

So this is the really so a lot of companies that I work with will come in with that idea. They’ll be like, look like, you know, we sell the banks, but we also sell insurance companies, and we also sell the utilities, and they’re all really different. So how could we possibly have a standard sales pitch that works for all these really different things? So there’s a few things to think about there. So one is, typically, before we get into a first substantive sales call, typically, we’ve done some kind of qualification, so we understand before the sales call that they have a problem that we can probably solve. You know, I’m talking to the right person. They probably got enough budget. I’ve done some kind of like qualification, then we’re coming in and doing a sales call, but we haven’t done discovery yet, meaning I don’t actually know that much about the customer situation and what they do. So I got two choices there. I can either have a meeting that is just discovery, which your customers think is a giant fat waste of time, because all it’s doing is you asking them questions and taking notes and saying, Okay, now we’re going to get back to you with our custom pitch next week, or we can go in and attempt to meet the customer where they are, do a bit of a bit of education while we’re doing discovery and present our best differentiated value across the segments. If that isn’t enough to hook them, then I don’t know, right, like so, so the wave. So I’ll give you an example.

When I was at IBM, I had 700 million revenue. I had a database. There was a lot of different sectors. We had one first call pitch deck. The second call was completely custom. So the second call, now we know all about you. We know what you’re looking for. The second call, we would talk about stuff, but the idea was, if you didn’t care about the things that we thought were really important, that we weren’t going to get you on the second call or the third call or the fourth call, you were disqualified at that point. So that’s the first thing. The second thing is, often it looks like our differentiated value should be really different for these segments, but if we’re a startup, the reality is, the product only does so many things, and so if we are successfully selling to these different segments. There is common differentiated value. If there isn’t, then we have a bigger problem. And the bigger problem is my differentiated value here is nothing like my differentiated value here, and what these two people want from my product in the future is different. So there are different products. I have different road maps, the thing is going to split like this. So I’m going to have to make a choice, because I can’t deliver this value and this value forever with one product.

So I’ll give you an example. I worked at a company in Toronto called Data mirror. So when I got when I joined as the vice president of marketing, the sales reps were doing very custom demos for every single customer. When I looked at the data, we had two big segments, so one was utilities and the other one was retail. Really different, right? So I thought, Okay, well, maybe we’re going to split utilities and retail, but when I went in and talked to the customers, what we had was essentially a tool that allowed you to do really seamless, fast recovery from a big from a big failure across databases. And so in the retail situation, what that meant, the value was, we’re going to keep the cash registers on so you can, you know, keep transacting business. In utilities, it was the exact same thing, except it was, we’re going to keep the lights on. So what we ended up doing with the pitch was we would come in and present our insight on the market, which is that, you know, in business critical systems should never go down. And right? So right, business critical system should never go down. But that’s really hard to do given the plethora of different database systems we have and blah, blah, blah, blah. So if we really want to do disaster recovery, we’d have a system that could do all that thing. Here’s how we do it when we came to the example. So we had a customer example near the end. If I was talking to a retail company, I would show the retail example, which was Tiffany’s, and we’d walk them through that. If it was utilities, I would show them utilities, and I’d walk them through that, but the first call pitch was the same.

So I don’t know. I think we have to be what we should do is actually go back to the positioning and look and see, is the differentiated value different, or is it actually the same? And so sometimes on the surface, it feels different, but when we scratch at it, it isn’t. If the differentiated value is actually different, then I think we need to do some thinking about, do we actually want to pursue both these paths, long term? Because long term, what these customers want is really, really different things. It may actually be two separate products we’ve got, rather than just one.

Audience Member

And would impact your addressable market.

April Dunford

It would absolutely impact the addressable market.

Mark Littlewood

I am going to trust that Allison has got a brilliant question.

Audience Member

Don’t do that to me. April, you also have an excellent podcast, which I’ve really been enjoying. And on one of those episodes, at least one I’ve heard you talk about the need to, you know, reevaluate your positioning as time goes by. I’m curious if you have any experience shares, not about how to make the new positioning decisions, but changing both internally and externally, the view of the positioning, like mentally, how those changes, how easy or difficult it is for folks to make those changes mentally.

April Dunford

Yeah, so one of the biggest advantages you have as a small company versus a big, big company is the ability to shift your positioning. So when I worked in companies, and often we did big shifts in positioning while I was there, because, you know, if you were hiring me, I’m the positioning lady. So, you know, we’re I’m coming in because your positioning is crap, and so we’re going to fix it.

So so so I came in, and then we’re doing this big shift in positioning, and internally, everybody get really stressed out. What are the existing customers gonna think? Right? So we sold them a thing, and we called it a database, and now it’s not a database. It’s, you know, this other thing, and they’re gonna freak out and go move my cheese, and, you know, call us and say, You suck, and you know people are going to cancel, and there’s this great worry internally. And the reality was customers did not care one bit, like, not at all. Like, zero. It was funny. Can you know why? Because they already bought your stuff. They don’t go back to your website. They’re not reading your marketing. They’re not exposed to your stuff at all. They basically only have two questions. The first one is, is the price going up? And if the answer is no, they’re cool. And then the second question is, if you promise them something on the roadmap, and, you know, and they get wind that things have changed, and be like, wait a second, does that mean I’m not getting that feature that you said I was going to get? And again, if the answer is yes, they’re cool. If the answer is no, well then maybe you’ve got a problem. So there’s that.

And then usually what happens is, you do the shift, and everybody knew coming in. I mean, you’re small, so they didn’t know you before anyway. So everybody’s, oh, you’re this okay, like, you flip the switch, everybody knew coming in is, like, totally cool, because they never knew you from the old thing anyway, and the people that did know you, they’re not looking at your marketing or consuming anything, so they don’t care that it’s changed. It’s amazing. Now, when I was at IBM and we attempted to do that, everybody knew coming in said, you know, we’d say, Hey, we’re this new thing. Then they just go, No, you’re not. You’re this other thing. But no, it’s new now, yeah, sure, it is. No, it’s that other thing. And so there was such pervasive brand perception about what we were, and the positioning was so entrenched in the market, was very difficult to make the switch. Whereas smaller companies, when I say small, like I did this once at a company that was 80 million revenue, and we just went bloop, and no one cared, like, we just moved it over. And everybody knew coming in was all cool with the new positioning. Well, guys, literally, occasionally we get a call, Hey, like, what, you know, you guys were this, and then does my is my pricing changing? Oh, we grandfather, dude, you’re good. Okay, good bye. Oh, we love you. Bye. Love you too.

No one cares. No one cares. Whereas, you know, IBM, we tried to do this with the database business and all the companies were selling to already had our stuff, you know that we had already 100% penetration. We’re trying to do expansion in accounts. They’re like, No, you’re not that. You’re this. Oh, it’s terrible. But you should think about that. If you’re up against the big guys, it’s really hard to shift your positioning. I was listening to a. Um, the other day, was on LinkedIn, and Dharmesh was there. He’s spoken in here before, and he was talking about the impact of AI on CRM. And I was thinking, you know, that’s really interesting for HubSpot in particular, because Salesforce cannot not be CRM. They can’t they’re the market leader. They’ve been the market leader there for decades. There’s no way they can stand up tomorrow and say, Oh yeah, we’re not CRM now we’re this other thing. Good luck with that terrible HubSpot. On the other hand, is think they people think of them more as marketing automation. On the CRM side, they’re a challenger, so they actually have the ability to flip the switch and make that CRM something else, which would be super interesting to watch that go down. I would love to see that fight, but, but they could actually get away with that, whereas, you know, the big established brands, it’s their greatest strength and their greatest weakness, right? The greatest strength is, you think CRM, you think Salesforce. The weakness is, you know, if a challenger comes up and says, Hey, CRM, is, it’s irrelevant now that we have AI, and there’s a totally different way of thinking about this, it would be very hard for them to try and pivot into that.

Mark Littlewood

April, we love you.

April Dunford

Oh, I love you too.

April Dunford

April is an executive consultant, speaker, and author who helps technology companies make complicated products easy for customers to understand and love. She is a globally recognized expert in Positioning and Market strategy.

Previously April has run marketing and sales teams at a series of successful technology startups and has launched 16 products into market. She is also a board member, investor, and advisor to dozens of high-growth businesses and is the author of the book Obviously Awesome: How to Nail Product Positioning so Customers Get it, Buy it, Love it. You can find her at: www.aprildunford.com

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.