Best friends Chris Savage and Brendan Schwartz founded Wistia in 2006 with backing from angel investors. In 2017, having considered options including selling the business or raising venture capital, Wistia raised $17.3 million dollars in debt to buy out the investors and refocus on growing profitably and sustainably for the long term.

Chris discusses how the company has developed in the five years since. While the deal gave the team freedom, confidence, and ability to invest in providing value to Wistia’s customers, it has been far from plain sailing. And of course, there was the pandemic…

He shares how his thinking on company strategy, growth, product and people have been turned upside down in a compelling, honest and open discussion about how things changed.

Slides

Find out more about BoS

Get details about our next conference, subscribe to our newsletter, and watch more of the great BoS Talks you hear so much about.

Transcript

Chris Savage: Yeah, I don’t know where that photo came from. Great to be here with all of you BoS. Very excited to be here. BoS is one of my favourite conferences. I first came on a sponsorship, I think either Dharmesh sent us here, or David Scott, when we were like two people. It was an incredible experience. And just like, one of the things that stands out to me from that was being able to ask questions of anybody hitting people in the hallway and asking questions I will never forget, Mike from Fresh Books, gave a talk. And it was like, was such a sick talk, that I had all these questions that like, what do I do? And I just, I just went up to him in the hallway and asked him and asked him about and he gave me advice, I took it and it worked. That doesn’t usually happen. And so I encourage you, like, if you have questions for me, at the end of this, please ask me questions. If you want to catch in the hall meet hallway, ask me questions like this shit is hard, like building companies is hard. So happy to share whatever I can, whatever I’ve learned.

I’m gonna be talking about company life after investors. I have discovered this is a little bit of a misnomer because some people think this means what happened after we raised money. But actually, this is a story about what happened once we bought out our investors. So what happened on the other side? And let’s see here. Okay. In 2017, we at Wistia, we raised $17.3 million in debt, to do a leveraged buyout of our own company. And this is a big moment for the company, it was not something that I ever expected to do. It’s not the thing that normally happens in tech. So I’m going to share the story today, uh, basically, like, how did we get here? Why did we do this? And then what happened next?

How Did We Get Here?

So how do we get here? Let’s start at the beginning. We started the company in 2006. I’ve been doing this for 16 years, that’s my co founder, Brendan, he’s in our very fancy office. It’s not fancy. Well, you know, it’s it’s a 10 person house in Cambridge, Massachusetts, the office is in his bedroom, we were very bootstrapped. When we started this business, we thought we would do this for six months. And then we would sell the business and be rich. That’s called being naive. Or, we would fail in obscurity until no one that we ever tried. That was our approach. And happy to report still going. But the we saw at the beginning was basically a huge shift that was happening with online video. YouTube, it started in 2005, it blew up. My experience in college was in film and video, I made lots of videos, it was all about keeping things in the highest quality. But when you put it online, it was really confusing back then some of you might remember RealPlayer, quick time, it was a terrible, terrible, terrible experience. And one of the key insights that we had was that YouTube was doing all the encoding for you. And they’re using open source tools to do the encoding. What that meant is you didn’t have to know anything about video. But you’d upload it and we’re just work. So we saw this like, this is going to be huge. This is going to change everything. And we quit our jobs, we started the business were bootstrapped. We had a meagre savings from our first couple of years of working, maybe a little online gambling in there, too. And we got to work. And it obviously took much longer than I was expecting.

This is four years later. Look at how professional these two look. Come on. Look at this. So four years later, we’re still only four people. And we had raised a total of 1.4 million in Angel financing. We never raised venture capital for this company. This is the only equity we ever sold was for about 1.4 million in Angel financing. And, you know, had taken longer than we thought to get to this point, but things were starting to work. So we were excited at the opportunity. We were doing all these demo calls out of our house in Cambridge. And you know, roommates were walking into the living room and we couldn’t be on a joint call at the same time as disaster. We needed help. Some of our first customers were really big companies. Cirque du Soleil was an early customer. They’re like customer number five. We had a $2 billion telecommunications customer that was like customer number six like It was wild. So we raised money. So we could go after this opportunity.

And we started burning cash to try to grow the business. This is when I kind of figured out what angel investing was and once we did that it was stressful to be losing money. And so we raised that second round. We told our investors look, give us 800k. Our goal is to be profitable, we think we can do this. And they’re like, We don’t believe you. Nice try. But we liked the fact that you’re growing, and we’ll give you the money. But we set out we’d gotten so far with just four people that were like, We can do this a different way. We can be lean, we can be creative, we can do different things. And our goal was to become profitable. And that happens. And the interesting thing, when I look back on what happened when we became profitable, is that we started being able to do different types of projects and different types of work than we could have before. So when we were losing money, it was hard to imagine investing in brand investing and culture investing in, you know, taking long term risks, once you’re profitable is easy.

So this is example for a piece of content we made back in that era. It was a video that we made shot with an iPhone, we edit with an iPhone, we lit with an iPhone, and it was all to prove the point that the gear that you use doesn’t matter. And we’d start to make videos and get questions from customers about this. And the interesting thing was, I would describe our business at that time, like as video hosting analytics, like, we don’t have a tool to help you make videos, we don’t have anything to help you with that. But we felt confident that we could do things that were farther afield, because we were profitable, like Yeah, over the long term will probably help someone with this content, they’ll come back and find us. Once we became profitable, we started taking, we started investing more in culture, taking more risks. This is we had a confetti cannon that we had brought in for one of the pieces of content that we were making, the team was starting to go. And we were just feeling like confident and excited. And we I didn’t realise until later.

But what had happened in this period of time is we also just became our own customer. So we started using our platform, started making videos to market ourselves. And the thing that was really interesting about that I think about that a lot now is like our customers had all these challenges. And we had the challenges too. And so when we thought of like, can we make something to help us, it would end up helping our customers. And it’s just like natural cycle that went faster and faster. And so when I look back on, like, the all the things we’ve done with Wistia, it’s actually this era is probably why, if you’ve heard of us before, it’s the stuff that we figured out in this era. And these things compounded, we hit 10 million in revenue, with 3 million in EBITA. We’re growing really quickly. I was so proud. I was so excited. I was like, Look at me, I can do business. This is sick. And then of course what happened is, I talked to lots of other entrepreneurs, I talked to investors, and everyone I talked to was like, Hey, Chris, sick, it’s awesome that you’ve gotten to 10 million, but you’re probably too profitable. You know, if, if you’re growing that fast and not profitable, you’re probably missing out on growth. Growth is what matters. And the first time you hear that you’re like, Haha, cool, like, but then you hear it over and over and over and over. And I’m a first time entrepreneur and the imposter syndrome kicks in and it’s like, oh, maybe they’re right. And I’m wrong. Like, maybe we should be investing more in growth. And it’s stupid to be profitable.

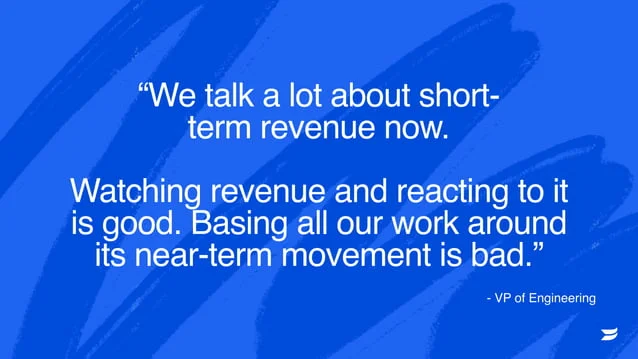

So we started running at a loss, we started saying yes to more things. We started turning on more projects, we started, you know, just doing much, much more. And the funny thing was from the outside, I think it looked pretty good. I would go to events, and people going, oh, man, I saw that new production directory you launched. I saw that new project over here. I saw that over here. And I’m like, oh, yeah, thanks. And they’re like, how many people on the team? I’m like you hopefully, there’s 35 People that like go sick 35 people, like you’ve grown so much. And I was getting all this external, like validation. And I was thinking, Yeah, I’m good. This is sweet. But the truth was, on the inside, it was it actually was starting to look pretty rough. We had a lot of like, chaos occurring. We have we had what I would describe zombie projects. So a zombie project is like, this idea for something new. That seems cool. And someone’s like, Yeah, I think it’s gonna help us grow. I think this new thing is gonna be sweet. Alright, what should we do? Let’s hire three people to put them on it great. You hire the three people put them on at the products happening. You do it over and over and over. And you’re feeling like there’s a lot going on. But then a lot of the projects don’t work. And you have, you know, great people on projects that aren’t working. Should you stop the project? Well, I don’t know. Like, maybe we should just keep it going. Like they’re, they’re great people. This is good. But people are getting unhappy. They’re getting confused. And ultimately, it changed what our priorities were. So this is an actual quote from that period of time for my VP of Engineering and an email. He said, we talk a lot about short term revenue. Now, watching revenue and reacting to it is good. basing all our work around its near term movement is bad.

I think we can agree, basically all your decisions about the near term movement of your revenue is bad. And we had never said to everybody, this is the plan. We never said, hey, just get really short term focus. That’s our goal. We’d actually been really long term focused and really creative. But this had just happened. And I want to talk about why this happens a little bit. So you know, we’re running the business negative. And you build a plan, you build a growth plan, you’re trying to grow quickly, you’re you look at your year, I don’t know if you’ve ever done this, and you say, alright, January, February, March, April, we’re gonna launch these new projects, they’re going to be sick, they’re going to start to impact us, at the end of the year, revenue is going to tick up right from those early projects, we’re going to hire more people because our revenues higher. And so this will be the cycle of planning and growth we go through, I’ll give you an example. You know, you’re you’re basically imagine you’re doing $200,000 a month in revenue plan to lose 50,000 A month you’re spending 250 total, you model that you’re going to add 30k Each month in revenue. So first month, 202nd, month, 230. Next month, 260. Next month, 290. Well, let’s put it match up to reality, what actually happens, you grow a little bit, but you raised your expenses. So now you’re losing 70k. The second month, you go a little bit more, you but you added more expenses, you had that plan you’re gonna do now you’re losing 95k, the next month.

And you can see what ends up happening is without meaning to everyone gets short term focused, it’s almost impossible not to become short term focus. When this is happening. We didn’t have to say it out loud. In fact, I mean, no, I said before, the things that we differentiated. That’s the reason people know us, we did all these creative things, we took all these risks, we invested in culture, that’s all long term stuff, yet, we got really, really short term focused. And let me give you a snapshot of where we are at about this time. 10 years in starting 2016 2016, but 17 million in ARR, losing 4 million a year EBITA, negative EBITA formula and 82 employees. I think most people look at that. Pretty good, why not? Right? Like, especially if your growth is there, which it was, this seems really good. But for us, and the way that we had figured out how to run the business, it was not feeling good. It was feeling bad. Everything, right? Like that example, from the VP of Engineering is one, I was prepping for this talk, I was looking for another and I found an email I had sent to the team that said, Hey, we’re looking for ideas for the next 30 to 60 days, which are going to increase revenue, please submit them to this spreadsheet. And prioritise these things. And I went look, the ideas were kind of good. But it was such a distraction from creating the core value for our customers, right?

Lots of things are obvious when you’re focused on the long term. And they are not obvious when you’re short term focused. And it was at this exact moment that we had three different companies approach us and say, Hey, we want to buy your business. And there have always been companies that approached us and said, Hey, we want to buy your business. If you’re in SaaS, you’ve experienced this, this happens. There’s always a financial return to be had. There’s always someone poking around. We’ve always said no, in the past. This time. We’re pretty, I think, unhappy. My co founder Brendan and I, we haven’t really said it out loud to each other yet. We’re just internalising it, we’re just you know, angry and upset inside. But we get these offers to sell the business. And it forces us to reflect and say what do we actually want to do. And we went for a walk around Cambridge, Massachusetts, where our office is about three miles from here. And we started to ask ourselves the question, what would we do if we sold? Like, well, if we sold the business? We’d probably spend two years doing earnout and then we’d leave? Okay. And then what would we do? Well, Brennan and I work really well together. We have this unique partnership, we didn’t think we’d be working together for 10 years, but we we do enjoy working together. We think we’re really complementary. We’re gonna start something else. Okay, what space we’re gonna get into? Well, it turns out we’re pretty early in our video market. There’s a lot of opportunities still in video we want to go after, we should probably start something in video. Okay, what type of brand will be built, we’ll build a really creative brand we’ll build it will build a culture. That’s long term thinking. Who we hire, oh, I know. We’ll hire this person who works with us and this person and this person, so basically, if we sell our dream will be to rebuild this company.

We sat on this loading dock, shout out to Google Maps for having Street View, get all the way into a parking lots really brought me back. We sat on this low loading dock and had this realisation we shouldn’t sell we should just fix the company. It’s broken and we can fix it. And it’s funny how when you know what you want to be when you grow up? It’s so common. Like, I can’t tell you the second, we made that decision on that loading dock. I was like, oh, yeah, that’s what we’re gonna do, we’re gonna be long term focused, where you get profitable, that’s going to make us creative again. And we’re going to do the best work we’ve ever done. And we’ve learned these hard lessons, and we’re going to figure it out. And so at this moment, we’re losing about $300,000 a month. Where did that money come from? We’re profitable for a few years in there. So we’re spending down the money on that we’ve hired tonnes of people, we have zombie projects, we have other stuff, it should be really stressful. But instead, I was calm, like, Ha, I understand like, this is this is what we need to do. But what do we do? We have all these other stakeholders, we have these individual angel investors that invested 1.4 million, there’s 11 people who invested, we have 82 employees, we gave them stock options. We told them someday we’d sell this business for 100 million bucks.

The Buyback

And now we’re turning down an offer like that, what are we gonna fuckin do? And what we realised, as you can imagine, this is the moment we get to the buyback. So we hit on this idea, what if we raise debt, we’ll raise enough debt will put kind of pull future profits forward. And we’ll use a debt to do a buyback. And the buyback will mean that anyone who wants to sell can sell their shares, employees can sell their options, early investors can sell and get a return. And then we’ll tell everyone we’re gonna do, we’re just going to be long term focused, we’re gonna get back to being profitable, we’re gonna get back to being creative, there’s going to be a different type of business. And we did something called a tender offer. I’m not gonna go too deep into this now, but happy to share this with anybody in more detail later. It’s a very simple idea. You pick a price, you tell people what the price is, you give them like a packet of information, like, here are your financials over the last year, here’s some stuff you’re going to do. Everyone gets the same thing. They just get to decide how much or how little do they want to sell. In this, we, you know, our investors had had preferred shares, because we were trying to do the right thing when we set things up earlier.

But it’s 10 years later, we said, Alright, we’re going to convert everything from preferred to common. So if you stay in, you have to understand Brendan, and I will be by far majority shareholders in control of this business. That is what you’re getting if you stay on. This is also a very bizarre experience, because you’re not allowed to legally you really shouldn’t market at tender offer. So I’m really excited because we’ve decided what we want to do. But we can’t tell anyone really why we’re doing this, we just tell them, this is happening. Make your own decision. And literally, we presented it at an all hands meeting, and just walked out the door and barely came in the office for a month because we just didn’t want to get in trouble with like, trying, I was too excited about I couldn’t tell people anything good or bad about it. So we did that tender offer.

Realignment and Profit Sharing

And the realignment began, people knew what we were going to do. You know, I’m excited at this point, I’m so pumped, I can’t believe this is actually happening. You know, we had a loss of about $300,000 a month, we’re going to slow we didn’t let anybody go. We kept everybody on the team. We said we’re just going to slow some of these crazy investments we’re making, we’re going to prioritise. That’s our plan. And we also introduced profit sharing. So we said we’re going to take a percentage of EBITA. And that percentage of EBIT up will just be for the team, you’ll participate in it based on your salary. We’ve all the systems for auditing salary, making sure payment paying people fairly and equitably. That’s why we ended up on this. Happy to tell you more about that later.

And I’m feeling really good, right? Because we did a tender offer. Everyone’s got a big check, like we sold the business. And now we’ve got a new bonus programme, which is like, Okay, if we get profitable, you’re gonna get rewarded. And almost like, morally, Brendon and I looked at this, right? Well, if it all shits the bed, at least we took care of everybody else. Like we’ll be the people who are screwed, but that’s okay. Like we’re this is a little bit selfish. Like we’re trying to build a company we want to work for. It’s alright. So we did that. I’m excited.

Painful Reality

But the reality the reality was pretty painful. And I’m gonna tell you a little bit about this. I haven’t shared any of this stuff publicly before I’ve written about the buyback. I’ve never told this story. So I don’t think I’ll get emotional. But if I do, that’s why okay. The reality was painful. It turns out debt is confusing. It’s not a thing that most tech companies do. If you’ve never bought a house with a mortgage, leveraged debt confusing. So the some people were confused. Some people were upset.

This is a glass door review from that time: “One star Sinking Ship do not work here. I don’t recommend the company don’t recommend the CEO.”

That’s me.

“I don’t recommend the business outlook”

“Pros: offices is cool. There are some snacks.”

Now that was true. I want to be very clear, very great snacks.

“Cons: This company and its management are a sinking ship. There has been a huge amount of turnover throughout the last year, because employees are underpaid, underrepresented, and there are absolutely no career growth opportunities, the once great culture of Wistia has since eroded. Team, teams throughout the organisation are very cliquey, you get the idea. Also, advice to management, you should have sold the company when you had the chance, treat your employees better and focus on growing the business, instead of which type of coffee should be in the office.”

Now that hurt because I care a lot about the coffee. Okay. No, this, this obviously stung. And this was unexpected, right? Like, I was so optimistic. I’m like, Well, you’ve just got a big return, like you sold the business to join, and you have profit sharing. And we’ve told you this business will be and I had experienced being profitable, and being long term focus. And I was like, we’re about to enter the golden era of this company, don’t you understand? But it turned out it was really confusing. People didn’t get the full message. I mean, to be clear, we’ve been transparent with the team to we told them we decided not to sell. We told them, we said we’re gonna get the return. We told them, we’re going to do the debt, we brought them on the journey. So I thought we’d be in a different spot.

Getting Through: 1:1s with Everyone

I just want to share a little bit like how we got through this. This is one of the simple things we did. Brendan and I did one on ones with everyone. At two people. We post up at a coffee shop. We said Come on, in every 45 minutes, a new person asking them like, how’s it going? What do you think? What are you worried about? What are you concerned about? What should we do? What’s wrong? And what we saw was, yes, there was a group of people unbelievably upset, and people were quitting. Right to be clear. So some people were quitting because they got the payday some people were quitting because they’re confused. Some people were quitting because other people were quitting. Then there was a group in the middle there was like, I’m not really sure what to think this can be cool. Could be bad. Like it was almost like, a pretty good portion of folks were like that. And then there was the final group who was so pumped, they were so excited. They were so animated and motivated, but we’re gonna do an interesting thing was they’re clearly the A players. Like they were the best of the best that we had on the team. They were like, I love this challenge. I want to do this. And I think like this release, and having this conversation, people really started to help us like move through this process. And I share this, I’m also in the desert. It’s so simple. But like, honestly, just talking to your team makes a difference. I think it’s the same thing. We talked about talking to our customers, it’s the same thing. Just spend time with them. Okay.

Positive Changes

And we’ll talk about the positive changes. So we’ve always been a very transparent open book company, with are our financials every month. And it used to be the chair of financials. Any questions? Crickets. Once we did the buyback, here are the financials, any questions? Everyone’s hand up. And the questions were like, things like for my infrastructure team, and like, Hey, I’m gross margin, we can make it better. Do you want us to do that? I’m like, Well, how long do you need it? Like three weeks, two weeks? Like, okay, sure. Sounds great. Or we have too much office space. Can we consolidate? sublet, some of it? People started saying stuff like this. They were acting like business owners. Right, that what ended up happening is suddenly, people started asking the same questions that previously just Brian and I were asking, they’re asking about balance, like, yeah, we want to grow. But shouldn’t we also be profitable? Or like, can we cut here costs here and prove things over there. And it was really exciting to see these changes start to happen, and extremely motivating.

Our culture, which had become quite confused, started to come back. We started to invest more in the team. This is an example we did this event. We’ve done this event for a few years, just called storytelling night where people get up and present on stories in their life to like, help build empathy across the team, I highly recommend doing this. You can do it on Zoom, and all works, stuff like this started happening. We started doing retreats again. And I think retreats, it’s really easy to look at them as like a perk, or like a luxury. But I look at them as a way to connect people across teams you don’t usually work with. And that had not been happening was the easiest thing to cut when we were losing money. And it came back pretty quickly once we started being on the road towards being profitable again.

And we started taking creative risks again. So pretty soon after we did the buyback, we were just edging up to be profitable. And we had this really cool opportunity presented itself, which was we’re working with a production company in LA called sandwich video. They’re famous for making launch videos for tech companies. And we had we worked out a thing where we would give them $111,000. And they would make three ads for us. One ad would have $1,000 budget, one ad would have a $10,000 budget, and one ad would have $100,000 budget and we wish to a document the creative process and try to write like a blog post or something about the difference in budgets and how it affects creativity. Could we have done this and we’re running at a loss? Absolutely no way in hell. But now we could do it, it was still kind of scary to do. I remember when we signed on to do this is like a little stressful. The guy in charge of it called me like 10pm. Tonight, he’s like, can we still do this? Is this okay? I’m like, It’s okay. It’s fine. We need to take creative risks. Again, it ended up not being a blog post, it ended up being a feature feature like documentaries, about an hour and 42 minutes, drove a huge amount of traffic to our website, turned into customers, tonnes of customers, we won a Webby Award that year for best branded entertainment, which was bizarre and great. And like this could not have happened, had we not been profitable, but it’s set us on a different path, again, towards our marketing and being different.

Growth came back. Well, actually, I should say it accelerated our revenue growth rate accelerated that right after the buyback very counterintuitive. gross margins improved by 4% that year. And so we had a $10 million swing and EBIT on one year. So we went from negative four to positive six. I was hoping for positive three, I was blown away that this happened. And you might be asking yourself, revenue growth come came back, but you’re investing less How could this happen? Please don’t underestimate the power of focus and telling people what you’re trying to do. Focus turns out makes a big difference. Being able to say no to things is extremely important. It is extremely powerful. And it honestly was like kind of unexpected that this happened. This is not our plan when we were set out to do this.

So we were aligned, and creative and energetic. And we got through that hard period, and people got really, really excited. And then it was smooth sailing since then. Right? Everything’s been crazy easy. So I will point out a couple things that were easier. Hiring: much easier. After we did the buyback. One of most common questions I get is if you don’t have equity, how we’re going to hire people. Turns out a lot of people are burned by equity, it is the exception, not the rule that people make money with equity. And so people came to us and said, how, why will I work here, I was like, we’ll pay you well, like, wow, there’ll be profit sharing cool. You know, like, people came because they want to learn how a business works. It’s very simple idea. Customers use your thing, and that you charge the money. And then you use the money that they gave you to run the business. And this though, was a unique concept in tech at this moment. So so we started getting it, I can’t tell you how much easier it became to get people to join the team. And then we hired a lot of people who believed in independence. And so it just got us like so aligned.

Corporate Structure was Clear, Strategy was Not

So our corporate structure had become clearer. We said what we want to be when we grow up, and I think this is really important, but our strategy wasn’t. And I’m gonna talk a little bit about that. You know, we started back in the day, we’re focused on just video writ large, took us about a year to focus on business video, we did private video sharing for a few years, we expanded into public like embedding and analytics, and all this kind of stuff. But our strategy at this time was basically we’re business video, people would say, what do you do, it’s like, we’re like YouTube for business. And I thought that was pretty clear. And at that time, you know, I’m feeling good, because like, these numbers are moving, I’m excited. Revenue Growth is up, just the energy is back, it is back. We still do actually two types of all company meetings every month, we do something we call show and tells which anyone can get up and present in front of the business on things that they learn things or teams are doing on announcements, stuff like that. We do all hands meetings that are top down. It’s like, Hey, this is leadership thing, and like, here’s our financials. And here’s our plan of what we’re going to do. And then usually I would like have read a book or something. And I think this book is so amazing. Oh, my gosh, Tony Shea loves this book, we should love this book. And I would like try to sell everyone on it.

And I had a friend come and watch this stuff was a strategy expert. And I was so proud for him to see these meetings. I’m like, You’re not gonna believe the energy in these meetings. It’s so great. It’s so fun. And he came in he’s like, yes, there’s, it’s true. There’s a lot of energy he’s like, but I think people are confused. Like, what do you mean? He’s like, Oh, you have people over here that are praising and doing enterprise things. And people are here and you’re doing totally custom things for customers over here. People are making things really cheap. And over here, someone’s working on a side project over here. He’s like, I don’t think anyone knows what the strategy is. I’m like, it can’t be, look, we’re growing. We’re in good shape. Like we’ve gotten through all this stuff. He’s like, Nah, I don’t think people know what to praise and what to punish and your culture. I think your culture is actually not helping you. And I think your strategy is not clear enough. And he did a survey of the team, asking them what our strategy was. Oh, boy.

It was a disaster business video, not a strategy. That’s not a very clear strategy. It’s was becoming far too broad. Our market was a lot bigger than it had been before. And we needed to give people the tools to make trade offs. And he showed me this framework, which I’m gonna explain to you now because it was so impactful for us. And when you think about a strategy, want to think about where are you competing? Which segment of the market? Are you going after? Like, who’s your target customer? And you also want to think about how you’re competing? And how is how is your culture helping you enact your strategy.

And this friend, he’s a professor at Emory is a strategy experts named Dr. Michael sacks fear refined him, if you ever reached out to Dr. Michael sacks, Tom, Chris sent you and call him DMS, because that’s what I call it. And he’ll knows for me, and basically explain this framework to me of like us kind of three ways to compete. You can, you can compete with operational excellence, which means everything you do, every decision you make is about efficiency. And often it’s about making things cheaper and getting to scale. So in a market, there’s usually one cheapest option. And your culture has to reinforce being the cheapest at every turn getting it to more scale at every turn. Another strategy, another way to compete is product leadership. So you build a product that is better and more innovative than the competition, people will spend a lot more for a product, that’s a product leadership, as a product leadership approach, different people value different things, you have to try to figure out which segments are going after. But like in a product leadership culture, you’re going to reinforce and encourage more risk taking more innovation, that type of thing.

And then customer intimacy, from a strategy perspective is the idea that you know your customer, so well, you can solve every single one of their problems using a combination of your product, and your services. And you have to pick between these things, I’m going to show you go one level deeper, just so you really are there with me what your culture needs to do, it has to praise and punish different things within these frameworks. So just to look at hotels for a second Motel Six, they pride themselves on being the cheapest, right? So if you stay at a Motel Six, everything should be about operational efficiency, and operational excellence. If you let’s say you check in your hotel, get into the room, you lie down on the bed, pillows uncomfortable bed sucks, call the front desk, hey, my bed sucks. The pillow is not comfortable. Can I have a new one? The person at the front desk? Did they give you a new pillow? No, they should not they should say sorry, is what it is See you later, that should be rewarded in that culture. Because it’s all about efficiency. If they were to come to your room and try to adjust your bed or give you a new room, whatever, that’s bad, that should be punished. If you’re trying to win on being the cheapest and people are doing that you won’t be the cheapest product leadership. Staying at the W Hotel, their strategy is product leadership. What that means for them is like not only is it a place to stay, it’s a place to do cool stuff. They have sushi bars and jazz bars and outdoor events and all these different types of things at W hotels. So you go into your room you check in, get in the bed, not comfortable. call the front desk. Hey, but that’s not covered with the pillow sucks. What can I do? They’d be like, Alright, check your closet, there should be four different options in there. Do you see this stuff? Is it there? If it’s not, we’ll bring it up. But if it is great, now, well, I have you. You know, we have someone at the piano bar tonight. 7pm, you guys should come down. Make sure to check out the minibar. There’s oxygen in there, this is true. The W hotel has like little canisters of oxygen in the rooms, if you need to get the extra high. And then customer intimacy and this strategy, same thing, you go to the Ritz, and you go into the bed and you’re like this sucks. It’s uncomfortable. You call the front desk, someone’s up there and a second, they’ll do whatever it takes to fix your problem. What what needs to be rewarded that culture is doing whatever it takes, like, they will adjust it, they’ll put you into a new room, they’ll give you a new mattress, they’ll copy you, they’ll do whatever and the next time you stay there, they will make sure that every one of your problems is solved. If you think about what you’d be willing to pay for these different things, you pay really different things right Motel Six, cheapest W Hotel, funeral bucks a night Ritz you could spend 1000s, but people will spend it if that’s how they make the decisions. And that’s what they want.

So we asked our team, where do you think we are the senior leadership team, what’s our mix between these things, because you’re never just gonna be all of one thing. And then we’re like a third, a third, a third doesn’t work. So we defined this, we worked hard, and we figured out and we ended up here, which was 20% of operational excellence. price matters in our market, we have to be competitive, we have to have some we have to have enough process and things to make us cheap enough. We’re going to win with product leadership. So we’re going to win by innovating. We’re gonna win by taking risks, our culture needs to reward failure. You need to be able to try things and have it not work on the road to finding those innovative solutions, and 10% customer intimacy. We have some customers who are a lot bigger, who require different things. We’ll do services for them, but instead of customising our product for them, we’ll try to take the learnings and if there’s something that we should do for everyone, we’ll bake it into the core product. Does that make sense?

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.

Updating Company Valus

The other thing we did is we updated our company values. Now you hear never change your values, you should never change your values. Well, I will tell you, if your values are not helping people make decisions that enact your strategy, you should change them. And I’m not talking about values like integrity, or curiosity. Usually, you can’t take someone who doesn’t have high integrity and make them integrity that to have them have integrity in your company that doesn’t work. Someone’s not curious. You can’t make them curious. Well, really what we realise we need to think about it as okay, what are the intrinsic characteristics that we hire for the things that people walk in with? That we don’t expect to change? Right. So that’s, that would be integrity. That’d be curiosity. That would be intelligence. That’d be inclusiveness. And then what are the decisions that we want people to make when someone’s making a decision in our company? How do you let them make decisions with the values that are on strategy.

Brand Affinity Marketing: Marketing like a Media Company

And this all worked. So this accelerated again, we grew faster, again, we got more focused, it was easier, the business basically became calmer, there was less chaos, there was a lot of energy still, but it was more concentrated on the right approach. This led us this opportunity, we call brand affinity marketing is at this point, we’re profitable or creative, the team is focused, they’re staying close to the customer. And we saw a trend happening with our customers, which is that a lot of a lot of the companies that had figured out production of video, and audio, they had existing creative teams, they were basically, instead of just like, spending all their brand budget on advertising, they were actually making content to build their brands. And to think of it as like, also, because of production costs changing, it was becoming cheaper to make a podcast than advertise on a podcast, it was becoming cheaper to make a show, than to try to find somebody else’s show that you could be on.

So we got excited about this. And because we’re profitable, we’re in this spot, we said, Okay, we’re gonna try to go after this a little bit. And we built a bunch of features that align with this, we built a tool called channel so you can make a Netflix like experience on your website, to present content, we added podcasting into Wistia, because we realised that the people who were making the podcast were the same people who are making the videos of the same people who are doing all of this stuff. And we dug into this really deeply ourselves from a content perspective. It just to show you a little bit of an example of some of these things. We made a series they came out last year called gear squad versus Dr. Boring. It’s an animated series for marketers. It’s about production equipment that comes to life at night. And their goal is to make the marketing that they’re doing more engaging and creative, but evil Dr. Boring is constant trying to stop them. We made a series called show business, which is a 20 video series about everything from like how you come up with an idea for a show to how you make it how you distribute it, I started doing a podcast called talking too loud, which is that a good conversational style show with investors and marketers, entrepreneurs, all this kind of stuff. As you can tell, I talk loud when I get excited. And so we just put that into the show. And we started doing this stuff in like early 2019. It’s all working incredibly well, by the way, we get tonnes of paying customers from all of these channels, talking to us come like a become a top 2% podcast, which is mind blowing to me. And it’s fun to do. And I just share this because like this is still a massive opportunity to market like a media company. It’s we’re on our way feeling really good.

Covid

I think COVID happened. And we all know what happened. COVID was a massive shock to the system, forced everyone to be remote forced everyone to adopt tech that they hadn’t adopted before. And it really changed our market dramatically. So we were feeling pre COVID like our market was pretty mature, you can kind of get a sense of that of like us tackling things like brand marketing. And we were running extremely profitably before COVID. And COVID gave us a lot of growth like we grew more because of COVID. But one of the things that we did is we said alright, we need to we need to talk to our customers, we need to talk to the customers of our competitors, we have to understand what’s going on in the space.

And what we realised was that COVID basically made our market early stage again, the vast majority of businesses have just started to use video in the last few years, there was a lot of people were afraid to try, they’re afraid to get on camera, they’re afraid of public speaking generationally, they just never attempted it. And the things had shifted dramatically and they also changed our customers expectations. So up until this point Wistia is very much like a hosting an analytics platform, a way to display your videos all that kind of stuff. And we integrated with all the other tools webinar tools creation tools, editing tools were like alright sweet if you want to use the way we’ll interface with our market is like will be this like incredible point solution and will integrate with all the other incredible point solutions, and someone can build their video stack and that will be like how we position in the space. But what we’re seeing is that our customers really busy there Just figuring out the first time, almost none of our customers have video on their title. Most of them have marketer founder entrepreneur is the title of someone who’s coming in, and their expectation shifted of like, I actually need your help to make this stuff, like, and I’m expecting that your products will help make this. And so our market became early stage again. Again, I never thought this would happen this deep into building the business.

But we said, if this is happening, we have to readjust like, we kind of know what we need to do. So if our markets early stage again, and the expectations of our customers are really different, we got to update our strategy, we got to update our values, we got to update our employee incentive structure, we also need to think differently about how profitable we should be versus how much we’re investing. And so our strategy switched, we said, Alright, we’re going to be an all in one video marketing platform. We’re gonna help you with everything from creation and hosting and marketing and analysing your content. We started on this journey in 2021, we just launched like an editor in June, so any video in Wistia, you can edit in place, pull the ends off, pull simple things out of the middle, it’s all designed to be seamless and easy. We have major things coming in the next couple of weeks. And we’re really tackling this broader problem, which is very exciting. We’ve gotten folks aligned. And we’ve really clearly defined the strategy and goals around this.

We updated our values. These are what our values are today, last was not showing up, that’s fine. But doesn’t matter what the last one is, it’s focused on outcomes. That’s what it is. So if you look at our values are all about making the decisions to net to align with the culture, what we need is an entrepreneurial culture, where people take risks and they’re nimble. They take ownership over problems if they see them. So don’t just tell me about a problem, find a solution, we need the customer to be centred in everything. And we need to focus on outcomes, which is the last one that’s missing. Basically, to make sure that as we’re scaling and adding more people, we are able to manage this and tackle more stuff at once.

Invest More

We need to invest a lot more. So through that period of time, like the buyback for about four years, we’re rule of 40 business growing more than 20% on revenue, and more than 20% and EBITA. But we realised there were no rule of 40. Now, okay, some of you, I get asked me about it later, if you want more details on it, but the finance community likes rule of 40. They like if your revenue and your EBIT up percentage match up to more than 40 That’s like a top decile company in terms of like predictability, growth, all those types of things. So we were that and we made the conscious choice, like, we’re not gonna be rule of 40, we’re gonna invest much more into scaling the team. And getting us to a place where we can tackle this opportunity. I think it’s the type of thing that if we had an existing professional investors, they would be pretty terrified by this. Because it’s like a lot of companies that end up in this spot and up just like the way you grow as you increase just your average return per customer, as opposed to going more broader in the space or changing what your product is. So we said, we’re going to change all of that.

Reintroduced Equity

And we reintroduced equity. So we went through the buyback, we got rid of equity, interest, profit sharing. And earlier this year, we introduced equity with the team. This might sound crazy. But the reason that we did it is that we felt like in an early stage market, there’s an enormous amount of opportunity for the value to be created. We want everyone to share in it. We have stuff profit sharing, but we’ve adjusted it to make sure that it’s like that’s a magical thing about something like profit sharing to bonus. So we said alright, part of it’s still we’re still profitable part of it still focused on profit. But the other stuff is all focused on strategic goals, how many customers we’re adding all these different types of things. And then we realised, because we’ve done the tender offer, that we had a way to get people to return in the future, which is we do more tender offers. And it’s a very simple idea. But there’s a bunch of private companies that have figured this out. SpaceX actually does this great example, where they are still private, the way they’re private. And the way they use equity is they have external people that come in, they set a price, the new tender offers, and the employees get to decide whether or not they want to sell. And morally, we felt like this was the right thing to do. Because the value created we just wanted the team to share on this. We’ve always been asked the question like what would you do if you sold the business? Like if you did if you didn’t mean to if it happened, and we said we take care of the team. And I think part of the reasoning here was well, we take care of the team COVID shown us that life is much more unpredictable than you think there can be black swan events, like we want that codified and we want that in there.

So we reintroduced equity. And today, since the buyback, we Forex our revenue, and we are turning 15 people we started this year at 130. So it’s been a huge amount of growth as we’ve been investing really aggressively into the strategy.

What have I Learned?

So what have I learned through this? I’ve learned a lot I don’t presume to know your takeaways, but I’ve learned a lot. It’s really hard to predict how long things Nik, I can’t tell you the number of friends I have, who had amazing business opportunities. And they were just early and later showed up and the exact business they’re trying to do happened. I thought business video is going to be the biggest thing in the world and 2007, I was extremely, extremely wrong. But because we I think figured out along the way that persistence, and how you do the work matters so much for your ability to stay on a hard problem for a long time. Like how the work is done matters, the culture matters, doing right by people matters. And I like to think of it as like, if you can find a hard problem and work on it for a long time, probably you’ll win. And then lastly, it’s all about the team. Like always, always, always, it is all about the people, the people who come in, and the people who are excited, the people who believe in the vision and are aligned.

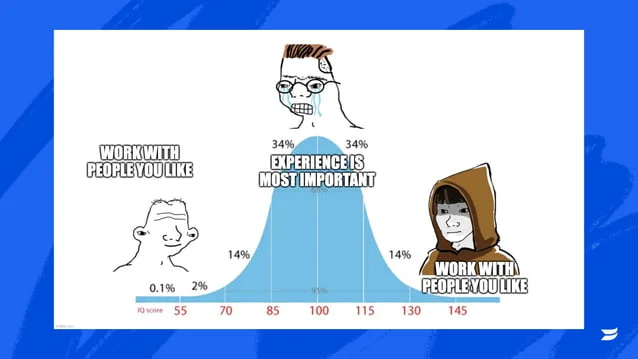

And I think as a constant search for that. I had to put one meme in here. So this is it. And I think at the beginning of my career very much on the left, I want to work with people I like work with people I want to hang out with spend time with. And as we grew a tonne, and we changed a lot, we kind of shifted who were looking for to look more for like people who just had more experience and you hear this advice a lot. Just find people who’ve done it before. Just get them and bring them in and have them do what they did, again, my experience is when you do that, they usually don’t care as much. And it doesn’t work out and you sacrifice, you can sacrifice team cohesion.

And the way I think about it now is like yeah, I want to find people who have done it before for sure. But ultimately, I just need a team that really likes working with each other, and really respect to each other and really has trust. And a team who respects each other and has trust is always going to do better than a more experienced team that doesn’t. Another way to think about this, too, is I think like I think it was Barry Diller who said this, but it’s extremely hard to hire world class people away from another organisation. If someone’s world class organisation knows it. And so they incent them, and they compensate them in such a way that they basically cannot leave, you might be able to get someone else in that organisation. But it’s very hard to get the world the world class people. So if you want a world class team, you have to build it. There’s no other way. And what I’ve seen is that people who are stretching and doing something that they haven’t done before, those are the people who can get onto a path of being world class. Thank you so much for being here. It’s awesome to be here at BoS with all of you if you have any questions you can email me at chris@wistia.com, you can ask questions now. You can find me in the hallway. And I would be remiss if I didn’t share my link tree with you because I’m on every social media. You can find me on Twitter you can find me on LinkedIn you can find me on Tik Tok. You can find the podcast you can find whist yet. Also on be real. That’s it everybody. Thank you.

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.

Q&A

Mark Littlewood: So, as you’re on TikTok, dance monkey boy.

Chris Savage: Oh, it’s not about dancing anymore.

Mark Littlewood: Oh isn’t it?

Chris Savage: Yeah, sorry.

Mark Littlewood: Right questions. We’ll take a couple. Dominic, then Ray. Someone was saying that conference organisers should hire Ray and channel the question that everybody wants to ask.

Audience member: Thank you. So I have a question about that value discipline model. Because we are about to implement that as well, that product leadership, customer intimacy and operational excellence. So could you describe maybe in a little more details how you got from this 30 30 30 to that final percentage, like, what was the process? How you get there?

Chris Savage: Yeah, yeah, we just we basically, we sat down with the leadership team, and then a bunch of that group. And then we also had a bunch of like, senior ICs, and real people that we felt like we’re a players, we said, Alright, let’s get together and talk about like trade offs. And let’s talk about like, two really good things happening that you can’t do both at the same time. And we went through that over and over and over again, trying to figure out like, how could we generate values that would make it so that those trade offs are really clear, like, the way I think about it is the values that are good for us? Should be should be wrong for somebody else was different strategy.

And, you know, we talked a lot about like, product leadership is a good example. Because when we were profitable, it was so easy to look at an opportunity and be like, Oh, we can make this simpler. We can do this different. We can put this into a core product. We could take a risk on this thing, especially if we don’t need it to move the numbers next month. We can get it out there. We can get the feedback and do that. And so we have we just tried to set up All the decision making so that that was like crystal clear, you can see actually our new values and our old values on the site. So if you go to WISA, calm as the old values on it, if you go to Western values.com, you can see the new ones. And I think that version that’s on there and email me if it’s not, is basically all the stuff this, this doesn’t mean, and saying what we’re not going to do. Like I think a big part of scaling is just focus in Dharmesh said this yesterday, but I would say 1000 times over, like focus wins. And if I could go back in time, like some of the things that we got, right, in those early days, I had no idea just how unique and how valuable they would be. And we got distracted with so many other things. And if I really understood that, I think we would probably be bigger or growing faster than we are now.

Audience member: Okay, thank you. All right.

Audience member: Chris, the talk is titled Life After investors. But you didn’t actually get rid of your investors, you traded equity for debt. Yeah, a lot of people in this room sort of look at debt as being a very, very scary thing. Yeah. early stage companies have a very hard time getting it all. Yeah. And later, it looks like a claim, right? It’s a senior claim that the it feels like we rock around your neck. Could you talk about how you manage and continue to manage the the debt obligation?

Chris Savage: Yeah, absolutely. Great question. So I think that the, it’s changed a lot. So there’s like many different forms of debt. I mean, the truth is the global financial situation right now. Not great. So debt is a lot more expensive today than it was a month ago. But I think also huge variability today, we don’t know what’s gonna happen. In our case, we started with the initial debt was from a firm called Excel KKR. And they’re like a growth firm. And you know, it’s funny, I remember, we were doing the deal. My dad had read some like article in New York Times about them was like, these guys are sharks. They’re sharks, they’re going to destroy you. And the interesting thing was they they basically went through like, the most rigorous due diligence who’d ever imagined on us. And you know, every month revenue, customer, by customer, how many people are expanding, cancelling all this kind of stuff. And so they got really comfortable with it.

And I also had done this work internally, we had a BI team, and we’re doing this and I had gotten comfortable with it. And so when we did the closing dinner with them, Samantha is this great person who’s the person to excel who did this, she like, brought up her glass of champagne and was like, we are sure you guys are gonna pay this off. And I’m like, so are we. And that was expensive. It was like about 11%. And it’s because we weren’t profitable, we did the deal. So they were taking a risk on our subscription revenue. I think we, on the one hand, underestimate how predictable and how much understanding you can get on subscription revenue, like SAS businesses. And I think that can make debt a lot less scary. There’s many debt providers now. Pipe founder path, all these different folks who will just give you a check stripe will do this based on your business. And the way I saw it is like the debt Yes, you have the debt is senior, you have to take care of the debt. But if you raise with preferred investors, it’s the same thing like if the valuation of the company, if you raise 30 million bucks, and the valuation of the company crashed and 30 million, you don’t get anything. That’s what preferred shares means. But if the valuation of the company goes to 300, those equity investors still take whatever their percentage is 25%. They wish the company goes to 300, the debt still the debt, nothing changes. So it’s like, it’s a downside that we can understand but limited upside.

And it just, we just believed so strongly, I don’t suggest it for everyone. I mean, that’s not the point of my talk. I’m definitely not trying to tell you, you should all do buybacks or use debt. But we believe for us in our market at that time, that the rigour of being profitable of those decisions of of saying no to some good ideas, we say yes, to the best ideas, that that would be a worthwhile thing. And I mean, there’s an argument that we could have done this without ever doing the buyback, we could have just said fu to the investors. I have friends who are like when I tell them the story, they’re like, Why the hell did you just do that? And I have to say, like part of it’s like the psychological alignment and moral responsibility. Like I think maybe it’d be different if we had institutional investors, but like, these were individual people. And their whole thing, angel investor, you want to return. So that’s kind of what led us this path. And I think you’re always have to manage something. And then just to finish that thought, I’m sorry, I’m going on so long, but the interest rate was really high. Once we got EBITA, that next year to 6 million, we got the interest rate down to like 7%. And then we had two years of data, and we went back again, and we got it down to five and now it’s about 4%. And there’s still some debt on the business, but it’s not very much. And so it’s we’ve been able to run we feel like more independently because of it.

Mark Littlewood: It’s a great answer. I know you’re around for the rest of the world for the rest of the conference. So grab Chris and ask him more questions. Yes,

Chris Savage: Grab me happy to talk about anything pretty cool.

Mark Littlewood: He’s also pretty good about talking about videos. I can talk about whatever I look good in video. Yeah, all sorts of stuff. Oh, thanks. Thanks, man. Brilliant. Thanks, everybody.

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

Chris Savage

Chris Savage is CEO & co-founder of Wistia, the best video hosting platform we know. (BoS opinion, not Press Release).

Armed only with a degree in Art-Semiotics and his experience editing and producing an Emmy Award winning documentary as a recent college grad, Chris and co-founder, Brendan Schwartz, started Wistia in 2006. They raised some angel funding in the early days and since then, have consciously grown a profitable, long term, business that customers and employees love. Wistia now employs over 100 people in its Boston HQ and is focused on building a business for the long term.

Next Events

6–8 October | Raleigh, NC

Join Jason Cohen, Claire Lew and more..

13-14 April | Cambridge, UK

Early Bird Tickets Available

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.