Rita introduces her new research on how strategic inflection points offer an opportunity to disrupt existing players using examples like Dollar Shave Club vs. Gillette to show how changes in technology can destabilise existing competitive advantages. Michael Sikorsky shows how companies create entirely new business models to solve perennial problems and drive growth – how can banks use mobile to appeal to millennials and machine learning talk to talk to your mobile?

Find Rita and Michael’s talk video, slides, transcript, and more from Rita below.

Video

Slides

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

Transcript

Michael Sikorsky: Thank you, Mark!

Mark Littlewood: You’re welcome!

Rita McGrath: Hello, Business of Software! It’s a real pleasure to be back here for the second time. For those who worked with me before, this will be an update on what I presented last time. And Michael and I are co-presenting because we’ve launched a joint venture to integrate strategy and software, as we like to say, smart strategy requires smart software.

Michael Sikorsky: She is business, I’m software!

Rita McGrath: It’s worked well so far! So what we wanted to talk to you about this morning is the concept of strategic inflection points. And this is the next phase of work that I’ve been doing on how do we cope with a transient advantage economy? Just to put that in context, in strategy for years, the dominant idea was that you had a beautiful thing called a sustainable, competitive advantage. That’s a beautiful thing, isn’t it? Bless you if you can find one! Unfortunately in the world most of us live in, what we’re dealing with instead is transient competitive advantage. The sneaky thing about them is they can actually be a trap, this notion of sticking to a business model and competitive advantage you’ve enjoyed for a long period of time can be quite dangerous. I thought we’d share an interview that was done of an executive who kind of got trapped by this notion of sustainable, competitive advantage. Let’s see what he has to say for himself.

(video plays)

I have people ask me did you make that up? Did you stage it? That was an actual interview that was done of Jim Balsillie the former co-CEO of Blackberry. And the inflection point was the introduction of the iPhone and the smartphone as we knew it which essentially saw Blackberry off into the role of being a niche player in what had formerly been an industry it had dominated. I don’t want you to think I’m using him as an example because I want to make fun of him because I don’t. He was brilliant and his company changed the world and transformed the Canadian tech scene and if you look at their stock price chart, that interview was taped in April 2008 so a year after the iPhone was introduced, when we were just getting to grips to what this thing really meant and of course Android introduced the same year. And if you look at that stock price chart and stop the clock at the moment of that interview, you would have seen nothing but success. A few little setbacks here and there, but basically the trajectory was positive and long term. We know it reached its stock price high in June that same year and has been in retreat ever since. The reason it’s important to think about it when you think about how do you navigate intransient circumstances that we need to be attuned to this notion of inflection points.

When I say a strategic inflection point, it was a term coined by Andy Grove back in the 90s and he says; it’s a moment in time in which your fundamental assumptions underlying your business change. My specific definition of it is every business are all formed at a given point in history and there are things that are possible at that point. And you can think of it like being enveloped in an envelope of constraints. When something changes that shifts those constraints that has the potential to be a strategic inflection point and that’s what can destabilise your business.

The good news is inflection points can be dangerous as they were for Blackberry, they can also lead to incredible opportunity if you get them early. Second piece of good news is most things that show up on your doorstep as a strategic inflection point actually were brewing for a long time. It takes time for these things to become widely commercialised. So as an example, back in 1995, there was a fortune reporter who wrote very explicitly about the potential of ecommerce to really destabilise retail. And lots of retailers took this to heart and leapt into websites and selling things online. Back in 1995, how did you access the web? Some of you will remember those times. How did you get on the web back then? You dialled in and it was like that and it was AOL in the US. And AOL sold by the minute and that freaked people out cause they didn’t know how expensive it would be and then they went to a subscription plan which was great for the customer but terrible for AOL cause it didn’t have the capacity and so you got busy signals. The whole infrastructure that was necessary to create ecommerce as we know it just didn’t exist. So hundreds of retailers leapt into this, built websites and said this isn’t real, it’s not happening, we tried that, forget it! And yet the real inflection point took till basically the last years to show up on their doorsteps and that’s what we’re talking about. You don’t want to be too early because the ecosystem and infrastructure isn’t there yet, but you don’t want to be too late as in this example.

The astonishing success of the dollar shave club

Another great story that this brings to mind is a company that took advantage of an inflection point to drive terrific success. I don’t know if you heard of the dollar shave club but it’s an interesting case of taking advantage of new possibilities in the environment. Let’s hear it from them!

Substitutes for our walk on music. Dollar Shave Club had its roots in a meeting that happened by chance between this guy, Mike, the entrepreneur and a friend of his dad’s who had somehow acquired 250,000 razors from Korea and was looking for a way to unload them. And Mike had this revelation, and the two of them got to talking about the shaving experience and what it’s like. The big problem with razors, those of you that buy your razors in a conventional retail outlet, what’s that experience like? It’s awful because razors are very expensive and easy to steal. So what ends up happening, use your imaginations here, you go to your retail establishment and find a friendly person to unlock the razor fortress for you and you pull it out. And I looked it up recently, a pack of 8 Gillette high end cartridges was $28 and that’s a ton of money for a razor. So Mike has this revelation, he says why do I have to subject my customers to that experience? We can send them straight to your door, we will build a relationship and direct to consumer situation going on and burst unto the world with this video which probably went viral.

Let’s take the other end of this inflection point and think about the boardroom of the Proctor & Gamble which in 2005 spent $57 billion to buy Gillette. And they enjoyed a very long and sustainable competitive advantage for years. However the entrance of Dollar Shave Club has had a big impact on them. If you look at their market share in 2010 it was 70% of the domestic shaving market as of 2015 it was down to about 59%. Their market share has been in retreat ever since. So a beautiful example of a transient advantage inflexion point driven shift.

Let’s look at the backstory of this. This is a picture of inflection points, it can take your business to new heights or it can undermine your business. Back in the O’s, three things happened which made this possible. And remember, an inflection point changes the nature of the constraints that operate under your business. So we had the invention of YouTube, a bunch of frustrated engineers says it’s a pain in the neck to share videos. Why don’t we invent a technology that will help us do that? Today YouTube is millions of hours uploaded regularly. Before it, if you wanted to make a video like Mike’s and get it distributed widely, you needed to own a movie studio and global facilities. YouTube dramatically changes that constraint. Then of course we have FaceBook, 2 billion users. If you wanted to get a message to 2 billion people, before FaceBook, you had to own like printing companies or a media empire and satellites. Once you have FaceBook it gets really easy. And then of course we have Amazon web services which now means 2 guys in a garage can do what you had to spend $1000s of equipment to do.

In the beginning, nobody took these seriously, certainly not the suits at Proctor & Gamble. YouTube? Cat videos, seriously? Who cares about that? FaceBook? College students sending beer bong pictures to each other? Who could take that seriously? And yet when you think of the constraints those things are shifting, it dramatically changes what’s possible. So that’s what we’re looking for in a strategic inflection point.

Developing Early Warnings

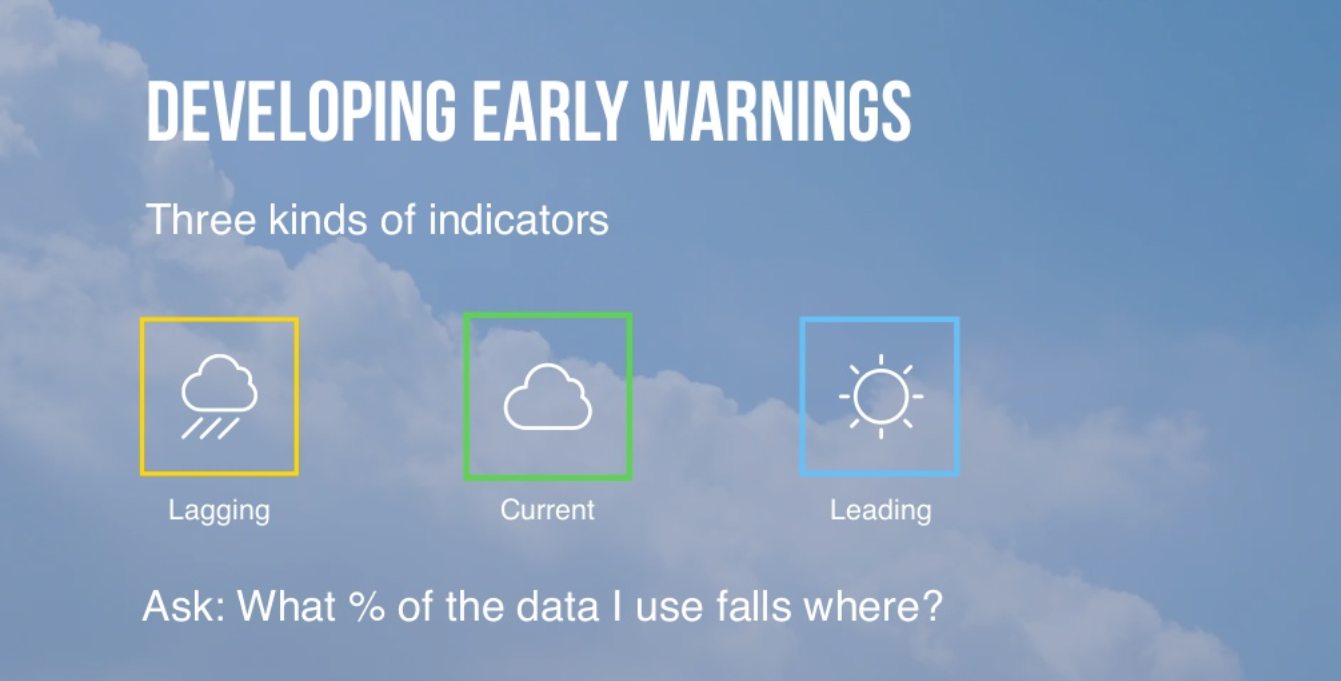

One of the thing we hope to leave you with is how do you develop some early warnings that things are about to change? The first premise is we have 3 kinds of indicators we can look for when we try to understand the data that our business is operating under. They are lagging indicators, they’re great information but it’s too late. It’s already done! It gives you data about what’s already happened and you can’t change that. Most financial records are lagging indicators. Satya Nadella at Microsoft was saying usage is a leading indicator, revenue is a lagging indicator. That’s the mindset. Then we have current indicators, things like your current net promoter score or your sales funnel. People you’re talking to right now.

The hardest thing to get hold of are leading indicators. Why is that? They’re subjective! Reasonable people can disagree about what they mean. They are often qualitative, it’s very hard to quantify something that hasn’t happened yet and most importantly, the power of a leading indicator is not necessarily whether what it predicted came true. I’m not a big believer in prediction, I think that’s a fool’s errand but I’m a believer in awareness and preparation and being ready. So a great example of a leading indicator, back in the mid-90s a bunch of computer people said to save money on storage, computer systems all over the world were programmed with 2 digits for the date and come the turn of the millennium computers everywhere will think it’s 1900 and this will be bad, people! Airplanes will drop out of the sky and nuclear plants will become unstable and we should all move on Montana and stockpile wheat. Do you remember how hysterical those predictions were? And what happened? Year 2000 rolls in, what happened? Nothing happened. Why not? We took the leading indicator seriously and did something about it. Companies built the entire Indian outsourcing business, right? And that’s the nature of a leading indicator. So we want to think about early warnings and we have a specific technique for doing this.

The first premise is information about the state of the world starts off very low level in terms of the strength of the signal, it’s very noisy. Often times, it gathers a lot of momentum and there’s a lot more information until you get to the stage where you have facts, you can take photos and draw outlines. What’s the problem with waiting till then? Too late, we all know that. Here’s the problem. In strategy there’s always a second line and in this case, your degrees of strategic freedom are actually inversely related to the strength of the signal that you’re working on. It’s a difficult issue and you don’t want to be making decisions too early like those retailers who built websites in 1995 and wondered why nobody shopped on them. You don’t want to be too late like retailers today that are wondering where all the people went. You want to move in your decision frame earlier in time, to right around the middle of this chart. I call this the period of optimal warning.

The technique for doing it you say let’s envision a time zero event. An event that’s very concrete that we can think about but it represents something that could have a big impact on our business for good or for ill. It can take our business forward in a big way or really hurt our business. Then you want to be saying that’s time zero, let’s work backward! What would have to be true, 6 months before time zero? 12 months before time zero? 18 months before time zero? And what you can start to do then is you can then work with your team to say who has got data about indicators that has to do with this time zero event? You can often get that bigger picture in one place by doing this.

Here are some examples for you. I was working with an insurance company and they were worried about what is known as stranger owned life insurance where life insurance gets traded on an open market. And their time zero event was; what would we do if 50% of our business was no longer traded through brokers or sold directly to people but was sold on some kind of market? That’s a time zero event. So that’s just an example of what a time zero event looks like. For people in telecoms, over the top services, accounting for a huge amount of the traffic and volume. You want to be explicit and Michael will talk about it a bit.

I took this example of autonomous cars. So let’s say our time zero event, if you’re Ford or General Motors, is that this now is a reality, autonomous cars are available and widely used in everything, and you work backward and you start to see things at the 6 month mark like towns and cities have passed ordinances that say this is ok, the technology has got to a point where it can be useful. You go back 12 months and you’re looking at things like initial regulatory action and so forth. If you go back 18 months, and what you see is the first death from an autonomous car or the first beer delivery by autonomous truck which are all things that have happened now. I was showing this chart to someone at a major insurance company and the room went completely quiet and these guys looked at me and I said what’s going on, what are you thinking? The most senior person in the room said all our models are premised on the idea that this is at least 5-10 years out and if you’re right and this chart is to be believed, we’re looking at maybe 2 years. And he said, on the one hand if we’re not ready that could be a disaster for us, cause it will completely change the assumptions in the insurance business for cars. But if you’re right and we prepare and we’re there before anyone else in the industry that’s thinking on a 5-year timeframe, that could be huge advantage for us! We could shape how the insurance part of this autonomous vehicle equation works out. They left – initially they were franked out – but by the end they were energised. If this works, it could be a huge advantage!

Michael Sikorsky: I will do an example for Amazon cause it was so cool when they bought their airplane. These inflexion points or market signals that you get, they aren’t always bad. So for example, if you’re FedEx, you realise now that Amazon is your huge customer, but Fedex they have 660 planes, Amazon has 1 now. So they are actually behind on our vision on how we move packages. But something different is if I’m South West Airlines, do I think Amazon moving packages has any chance of moving people? If Amazon decide to move people, that’s a time zero event. What would I have to do backwards to understand if Amazon thinks it wants to get in to my business? Cause Amazon is amazing at moving stuff cheap! Think about South West Airlines and all the low-cost carriers, this may be a moment for them to plan backwards and think what does it mean over 1-2 years?

I want to show another picture of Amazon. This is called the Amazon Go store, it’s a trial store and you can see it’s all computer vision. You walk in and grab stuff, it knows what you grab and knows who you are and just bill your Amazon credit card or Prime account. I don’t have cashiers or software systems, I’ve been built on Amazon. I just need the software to tell me what did you walk out of the store with? I think it’s neat! Think about all the scanners – you don’t even need scanners anymore. What’s one of the cheapest things now? Camera. And software is getting more and more powerful. You have all these beautiful examples of this.

This is image synthesis. So for example when you look at this, this is what the input is. So you’re painting like in Microsoft Paint, very basic. So there will be a car logo there and some cars here and let’s see what it used to look like a few years ago. That was the best that you could do. Then this is this year. And think about constraints and things that don’t make sense anymore, I don’t have to shoot this much video. I want some cars, some trees, just cars driving down the road and I synthesised that whole video. What does it mean in our business for hosting and displaying videos?

Testing the boundaries of capital, I don’t know if anyone knows about Initial Coin Offerings so here’s KIN. They issued a coin, it’s from a Canadian company called Kick, a messaging platform. And just to share with you what they’ve done with you so far today is they sold 330,000 Ethereum or ETH. Yesterday that means 95 million dollars. They issued a coin, they’re not raising money, they’re pre-selling a utility idea and they’re inside their company pre-sold this idea there will be this utility token and I have 95 million dollars to go work on whatever that meant. Way out of like left field! That’s interesting from a capital perspective cause you’re not raising equity, you’re getting a whole bunch of clash of clan gold but you can do stuff with it.

This is the market cap of all tokens, so you can see we’re at 75 billion and the part was neat was NASDAQ is 27.5 trillion total market cap. If you want to think about how much more room this could go, 366 times more powerful. That’s a big market cap, and we’re not getting started yet, this is a signal. What signal is this? How we view this is you’re in venture capital, this could be really different for you. If you’re a software company, look at Mike yesterday in Freshbooks, he was like well I didn’t really want to take VC but then I took a bunch and maybe this changes that thing. He could have had that next adventure and then maybe no board.

I had to do some code, cause I love software.

Rita McGrath: He insisted on keeping this slide!

Michael Sikorsky: Rita’s like, I’ve never seen code in a business presentation. But it’s ok this is Business of Software. I know I’m bringing it!

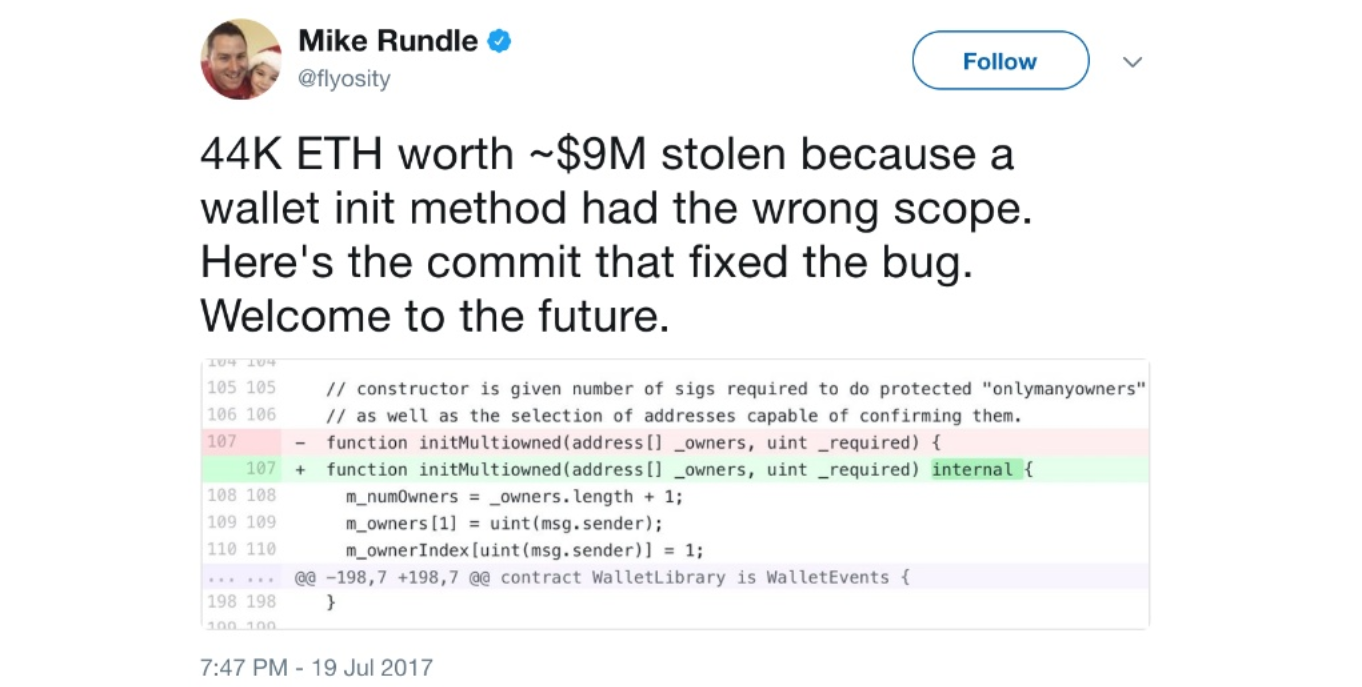

So this is how you program Ethereum contracts, this is my favourite part – especially for you Mark. When you shut down your Ethereum contract, you have to run a destructer which is called suicide. So you actually have the suicide function and funds go to whoever it’s supposed to. This is the example code of running a smart contract conference on top of Ethereum. I thought this was awesome too! Think about… I love this! 44k Ethereum worth or 9 million dollars stolen because of that change. They had the wrong scope so someone could override it and hack the Ethereum contract. That’s crazy! That is so cool!

So people said it yesterday. Mark and Jason – software is eating the world. I love that! The thing I think is a lot interesting is eating software is next. So this is a real software programming platform, you code and looks just like code. It’s a bit more basic and then you send it to MIT, you wait 3 weeks and get a pill you can swallow and will run it inside of you. You think about what constraints does that change? I think a lot. And then one thing was neat to show is that if you think how the body was designed and now I just showed you Ethereum getting hacked, you can hack the genome directly. For example, animal rights this is a specific agenda, you can make someone meat intolerant by hacking the genome pathway. So just I decide I will have a drink, it totally changes what it means to take a drink now. Now I can’t eat meat, I can’t go in the sun, my skin colour has changed, very interesting things in the technology space.

Rita McGrath: Back to business. So here’s one of the interesting observations I would make. In almost every case where a company has been disrupted by a strategic inflection point someone saw it coming. My favourite personal example of this is my dad. My dad’s an organic chemist, brilliant guy, over 100 patents to his name and back in 1980 he went to work for the Kodak corporation. And he’s literally sitting across the desk from Thomas Whitely and he is the head of the Emulsion Research Laboratory at Kodak, has been for decades. Kodak lifer, you stab him in the arm he bleeds silver. And he says to my dad who was from Xerox and had been to Xerox park, he was talking about this stuff years before it went mainstream. And he said to my Dad, what do you see coming in the future? And my Dad lays it all out for him – things will go digital that’s absolutely clear, 8mm film has had it, lays it all out – like the future. Because he’s a scientist and they are paid to be close to disruptive changes, right? They are paid to look at what’s coming. They see technological roadmaps and see where things are likely to head. So Whitely, what’s his response to this? What do you think his response to this is? Wolfgang, go back to the lab where you can do minimal damage! Thank you for your input!

So I was with my Dad last weekend and said didn’t it bother you that you saw this so clearly and the company took no action? Didn’t it drive you crazy? He looked at me said no, it’s a pity for them, it’s a shame. And he said something interesting to me. I said, why didn’t you take more action? Or start a conversation? And he looked at me and said that’s ridiculous, I’m a scientist, he’s management! He asked my opinion, I gave it to him. What he does with it is his problem. Someone always sees it and when you dissect cases when things have been disrupted, what you see is someone is there. And the question I think this raises for us is, how good is your organisation at getting that insight into a place where someone can take action on it?

One of the tools Michael and I have been working on is an innovation maturity scale assessment. It begins with level 1, a real focused just on exploitation. We don’t do innovation at all – we’re not peeking round corners, we aren’t looking for early warnings. There are companies like that – regulated utilities. I’m a regulated utility – once I’ve negotiated what I will get paid from the local regulator, the rest of my life is about efficient operations, I don’t need to think about heavy duty innovation.

As you move up the scale, you see a different kind set of activities going on. So level 1 is almost hostility towards innovation, total exploitation focused. Level 2 is very interesting and I think a tonne of companies are in level 2. We call this innovation theatre. And you all know what innovation theatre is like I’m sure. You take a team of people, senior executives and you send them off on a Silicon Valley tour and they get their picture taken next to the FaceBook sign and they get to hang out with the cool kids. And you have innovation bootcamps. I love this. You get a bunch of people in a room, they are standing up and putting post-it notes on whiteboards and doing the music thing. And it’s great, a lot of fun and they pay me well, it’s wonderful! But it never goes anywhere because to build real innovation proficiency, you have to have ideas, of course. But you also have to have an incubation process where you will take those ideas and form them into something that you can take to market. And then you need an acceleration process. And for many of you this is a huge deal! Now you all know about technical debts and you have to refactor that, lots of people don’t think about organisational debt. So in the beginning you hire willy nilly and everyone is in it for the cause. Nobody is sitting there rationalising salaries or thinking about what job titles people need or thinking about your hiring practices but if you are going to be a fully-fledged member of the organisation, all that stuff has to get fixed so you accumulate these things. So as you move up on the innovation maturity scale, you start to see what I call localised innovation so it takes root in some part, opportunistic innovation but these lower levels, you’re depending on typically a senior sponsor – a major champion. It’s not embedded in the organisation. To get mature where you have this consistent looking at what’s going on in the outside world and using that to inform the choices you make you have to have governance processes, metrics, the right kind of culture. The ability for someone to say I see something brewing in Indonesia that could have effects for our business down the road. And it’s not until you get to levels 6-7-8 that you start to see innovation as a real proficiency. And so we’ve developed some ways to measure that, figuring out where the organisation is on that and then figuring out what steps would you need to take to move up. The other comment I would make is that you don’t go from a level two to a level eight in six months, it’s a journey. A lot of these things require heavy organisational shifts. This is a quote I often use which is if we don’t make small amounts of resources available for experimentation, our ventures get big before they get smart. So what you end up with is big heavy duty unsuccessful failures. And this is a great quote from Andy Grove I think we all should take to heart. Snow melts from the edges. And what he meant by that is to really see what’s going on, you’re not going to sit in HQ and get the message, you will have to get out in the world and see where the changes are beginning to take place.

Michael Sikorsky: So business of software, we’re talking innovation maturity, early warning signals, what’s really going on. I will start with an old parable. So the inventor of chess goes to talk to the emperor of India. The Emperor of India is so impressed with the invention of chess he says you name whatever you want, I will give it to you. The inventor says I just want 1 grain of rice on the first square and keep doubling after that. And so the part of the story that’s not always told is that when they got to the 2nd half of the chess board, the emperor killed the inventor because he’s so offended. In fact if you do the math and get to the 64th square, that square alone would have more rice that’s ever been harvested today in all time.

So the reason I think about this stuff all the time is in our business, we actually touch the frontier all the time and the signals are there but it’s interesting once you have some scale in your company that we’re entering the second half of the chessboard. When you look at all the analysis and how fast they are coming in and stuff, you feel it and be like maybe we are in the 32nd square. The point is that it will get worse and worse so you have this idea how fast technology accelerates and then you have kind of where we are now and how fast humans can adapt to it. What do we actually do? What do I try to do?

And so I’ll pause on the yak for a second. What would a yak in summertime help me understand how to handle the 2nd half of the chessboard? Actually it doesn’t help me at all, but winter yaks do. So if you just bear with me for a second, there’s this beautiful story about in Nepal why they have fluid property rights. Why do they have to have fluid property rights? Makes no sense to lots of people, but turns out how the snow falls in the mountain is different every year and if we don’t work together as a team, some of our yaks don’t get fed and the other yaks – I don’t have enough yaks to eat all the grass that I have. So the people in Nepal have worked this out. So if you actually take a step back and think about it through our lens if you’re a founder or CEO, how do you lift up and let everyone basically have more and more autonomy? So Rita says snow melts from the edges. Are you seeing this? If you don’t have small bets for experiment, how will you get there?

And the reason I love thinking about this working – and by the way, this work is from Lin Ostrom, she won the Nobel prize for this thinking. She has this 8-step framework on how you design for local autonomy. Of course you still have to have necessary regimes, but this is kind of the thing that I think about it’s sometimes the last thing we talk about inside the Business of Software.

In fact there’s this beautiful story where Sheryl Sandberg goes to Google and they talk about this massive reorg with Eric. And this massive reorg is take all 200 engineers and have them report to 1 person. That’s classic in our business. The architectures that we designed for our software, so magical and beautiful and this is decoupled. Then I’m like now just for fun, I want to see how your talent architecture looks like. I don’t even know what you’re talking about, what do you mean? Like everyone is through me, it’s good, right? Even look at Jason’s opening speech, maybe be an editor, don’t try to write it all. So I look at this as how do we get out of the way? Especially if you want to scale your company, just be around for a long haul. So how do we get out of the way? For example, internally in our company we think about it we made this construct of FTT, follow the talent, so that’s the guiding light, our north sta. And of course you have to do all this work and install all of work constructs in order to do that. And so I think this is a beautiful quote on Erica here. Especially I think it’s part of the reason why it’s so interesting in our world. By the time you decide you want to start your company, it’s so weird to say the next thing I want to do is let everyone else make the decisions and make sure they caught all the problems. I had a north star and over time you realise actually I want all my teams to have their own north stars and drive it that way.

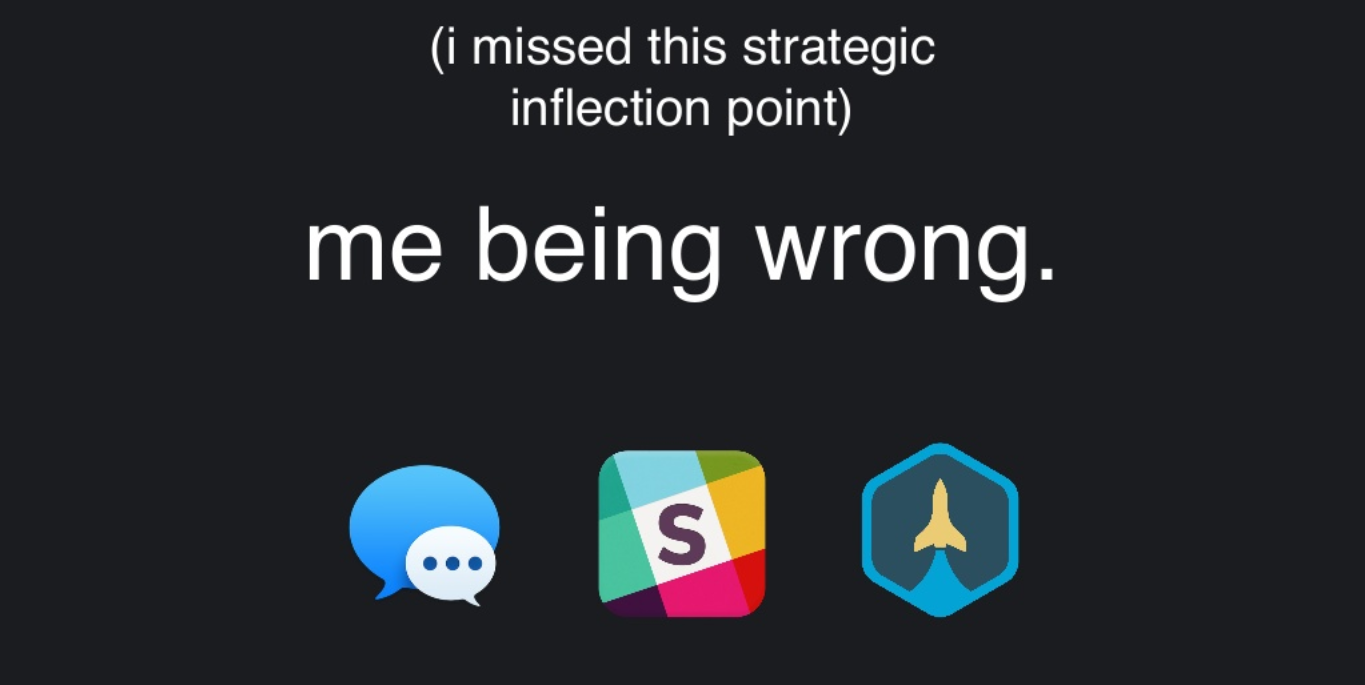

I want to give you an example – I love iPhone and I love imessage. As an example, in our team, they adopted slack. This isn’t my decision, I don’t even get a say, I called it wrong. This is so annoying! I have another new thing to learn to talk into. I don’t get it, but this is the cool part in our world in FTT, actually I don’t get a choice either. I guess I’m on Slack now. And then what’s crazy now if we even have a product now built on top of Slack. For example, this is me being so wrong. I was saying like whatever, if I had an opinion, the first thing I’d do is block slack. And then look, it’s the fastest growing enterprise company and it’s got all this attention this trip. And I missed the strategic inflection point. The company didn’t, I did. That’s like the whole point, is that actually why did I not care about Slack at that moment? It felt like I had 1000 pieces of communication I wished I would have gotten out and I have another channel. How do I even have less communication? I don’t even care, I will just use iMessage cause I don’t make decisions anyways.

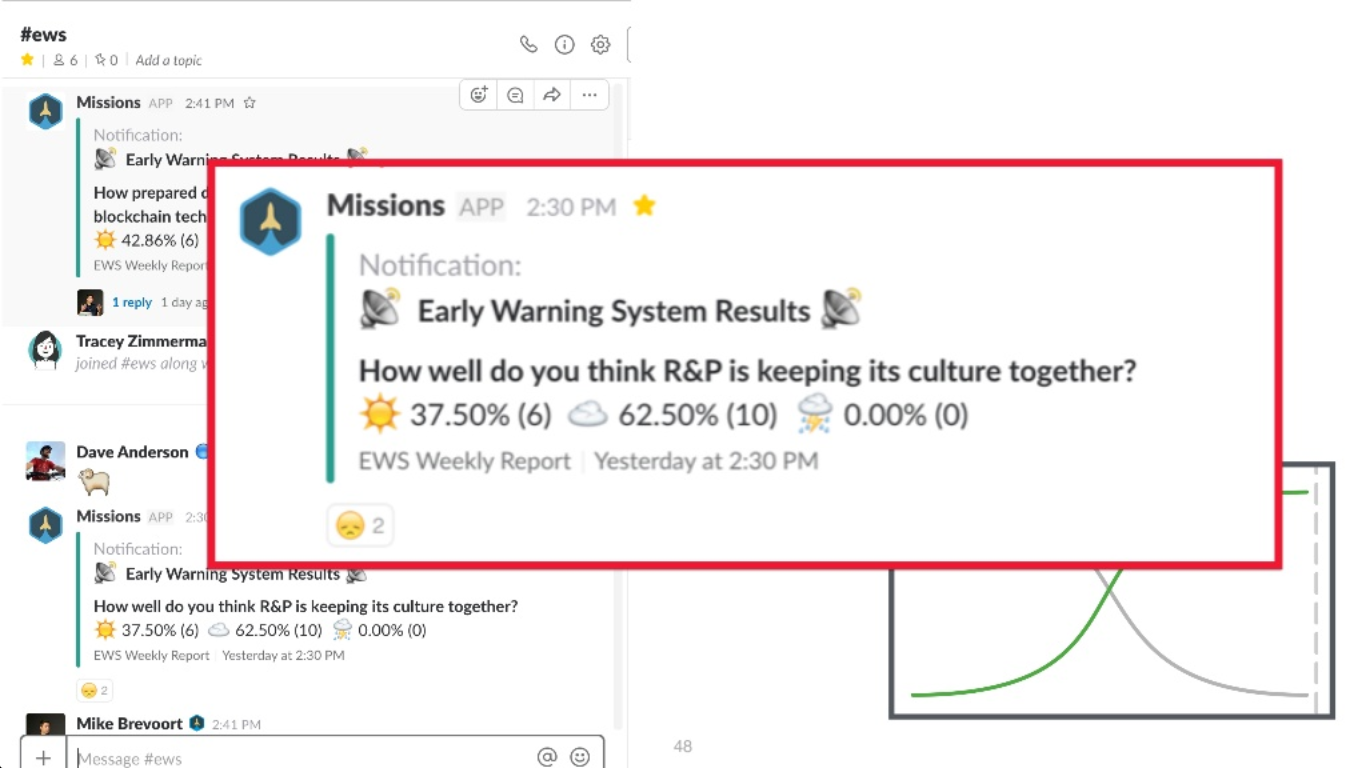

So one of the other things we did is we have an early warning system and because I just want to know what’s happening so the snow melts from the edges. So this is an example of what happens in our company and Slack. I ask people, Sunny, Cloudy or Stormy? That’s all I want to know. Every week a new question goes out, it randomly picks a bunch of people and then it posts in a channel called EWS which is the only channel I care about. Cos then I’m like, I wonder what is happening! And so as an example, I’ll show you another less flattering thing. We had a lot of growth this year and we’re like how is our culture coming together? So I’m happy that we got no stormies. Look at that, 37% think it’s good but the majority is like we’re losing our north star. If I ask people that directly, I get a filtered response. When I say you just have to pick a weather indicator, it’s amazing what comes back and just –

Rita McGrath: So I used to be in IT myself and I’m sure you’ve had this experience. What’s the product’s status? It’s great! What’s it now? We will miss our deadlines, the budget was blown. When did this happen? When I was reporting in it, it was stream A was on track, B was behind but on average we were great. This gets you out of that and lets you get to where the data live and that’s an important point.

Michael Sikorsky: For example, when I speak to a project manager, all projects are green, green, green and then it’s red! Where is yellow? When you ask all the talent, you get a lot of project managers that say it’s all sunny and then the talent say it’s stormy. We have to dig in. And just so you know, if you want, you can download this and install it in Slack.

Rita McGrath: So this is a little gift for you, you can actually use this. You can implement it tomorrow.

Michael Sikorsky: Yes I love it! And you can ask different questions, if you’re caring about technology inflection points, you can ask questions about that and whatever it is. This is an example and to show you how – Rita talks about the scale and how hard it’s to embed this in the backbone of the company. This is the last fun moment, but this is in our DNA, and then sometimes in 2014, it broke. Not having this innovation proficiency in our DNA but just our scale changed, we have offices all over the world, we just start failing and people have no idea how you work on a project, it’s just like we start to crumble in on ourselves.

For example, to give you a real life org thing that we’re installing it’s called funlabs. What it does for us is it’s trying to move us up on Rita’s scale. We try to get everything such that it’s how we work, not I got dinner with the right people this night and we start brainstorming and that’s how it got kicked off. Who sent who a text when everyone was in a good mood and now the product didn’t make it? We don’t want to be like that. Even with our team members, we wanted to have in our org the principles of least astonishment. So you don’t have to agree with everything we will do, I have no clue and don’t know how that decision gets made. For us, we think about funlabs as this new way that we basically solve our innovation problems and scale for the whole company. The way we think about it, and again this is DNA stuff – money, meaning, morale, we want to give every talent all 3, and this is one way to get there.

This is our last slide, this is like while we’re dancing. But for us, this is the thing that I found. It’s always really hard because even kind of Jason mentioned I still get to be the founder, this is the part I find really interesting. The best company I’ve ever been a part of is the one I tried to make the least decision about what we’re doing. I’m like that’s amazing what you come up with! I’m like yes, I will support you. Let’s just put a structure around it. So for me, when I think about how you follow the talent architecture, your strategy for watching for the inflection points and installing innovation, you can have a fun company.

Rita Gunther McGrath: Tell them about the yaks! That’s an actual example!

Michael Sikorsky: Yeah! I put in a chicken. I thought a chicken was awesome yesterday but like my team basically took a polish pass on the deck cause I’m not an artist and the thing they only cared about was this shave money, dollar shave club and that’s now my favourite thing in the deck too! Just comes out of nowhere.

Mark Littlewood: I think that was a highland cow and not a yak.

Michael Sikorsky: Can we pretend it was a yak? The research was it was a yak.

Mark Littlewood: The two things I’m good on are where London is and what highland cows look like. That’s my contribution.

Michael Sikorsky: Ok so we have to tell Adobe cause I taped in yaks –

Mark Littlewood: I might be wrong, I usually am.

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.

Q&A

Audience Question: Kudos bout the weather indicators. Once you get the answers, what do you do? What kind of action do you take?

Rita McGrath: Once you’ve detected a possible inflection point?

Audience Question: No, when you…

Michael Sikorsky: So here’s like the non-answer answer but there’s this beautiful quote; Business is always hard cause I always have to apply judgment. That’s the thing when you’re at the CEO or founder level, you always have to apply judgment and prioritise. Rita has tools for this innovation portfolio, how much money do we have in core investments, how much do I have for stepping stone options in the future? Someone has to take a step back and go across all the stuff we’re investing in, do we write how the volume knob set up right? There’s no guarantee you do, that’s the judgement piece, that’s the part that’s always hard which is why you want to floss it, because basically you’re always wrong but you keep trying to iterate to your hoping that you’re better off after.

Rita McGrath: There’s an example Michael was showing about the culture piece. That’s an early warning. Now you have to get to the root cause. Is it that people don’t understand what we’re trying to do and they’re confused? Is it they’re not being well led or the local leaders of the teams haven’t been good about doing what it takes to keep the culture where it is? Now you need to a diagnosis and find the root cause and then you can take action. I wouldn’t leap to action I would give it some thought before saying why are people signalling this to me? We look at a diagnostic for team effectiveness and from that very simple diagnostic, it’s 20 questions and you can get zeroed in on what’s going on in your teams. Is it I don’t know if we have the right people in the right roles, is it I don’t know what information people need? And so that would be a follow on to something like this. So once you’ve got the signal then you do a deeper dive to figure out what’s the cause.

Audience Question: Hi! I’m curious about the example you gave around autonomous vehicles and the timings and things. Can you talk a bit about how you judged the timings of the different stages?

Rita McGrath: Sure! We start with let’s say we have something we’re worried about 2-3 years out and now we want to say 6 months before that, could that even be possible? What would have to be in place? Then you work backwards. It’s not precise and the guy that died in the Tesla was last year so that might have been even in the past a lagging indicator. So it’s a bit heuristic. The principle is we don’t want to be leaving it to the 6 month mark before we start looking at it in terms of our strategic plans. I do this a lot with senior teams and they will say two years ago, this thing happened that we should have been paying attention to and here we are now in trouble because we didn’t. I think what the most important thing is and I should reinforce this, someone in the organisation has that critical piece of information, but they’re very often not sharing that. So the data are spread throughout individual minds and so forth, the evidence is there. One of the critical pieces of this methodology is make it one person’s responsibility to look after that scenario. If someone picks up a piece of information at a trade show or hears something from a customer, that has a place to go. You’re looking at the autonomous car early warning system. I heard something from a customer this morning that might be interesting. Don’t make it heavy and a big scenario of planning but those light touches can get you much more aware of what’s going out on there.

Michael Sikorsky: I thought it was neat when Mike was talking about Freshbooks and he was like I want to give my competition, I want to surprise them at time zero. If you think about all the work that happened, it was basically saying here you go, now respond! You didn’t know even know it was us. He did a lot of setup work to do that.

Audience Question: Thanks for a great talk! I’m interested in the middle ground, the ideal optimal time to act on the signals. It’s a problem to the right of that for your large organisations where you’re advice helps drive up that innovation. What about the smaller organisations where the danger signs on the other side, you were saying about the problem where the infrastructure wouldn’t be ready for their ideas yet. The main one is you think you have a signal, but you’re just wrong. You thought of this idea and it might be right, but you’re decades and not years away. Have you got advice for that side? For example, on your chart of innovation would you say don’t go to number 8, go to number 6?

Rita McGrath: Possibly and I don’t want to confuse two things, being mature in innovation isn’t equivalent to how soon something is ready to be incubated. So for the smaller organisations I think a couple of principles there is you want to be very conservative with your resources until you have a high level of certainty that you know what will happen. I developed a technique years ago called discovery driven planning which says we we are going to do is very systematically convert our assumptions to knowledge and only when we’ve done a fair amount of that work, will we spend real money. That’s what I would advise for big or small firms, but it’s a useful way of saying we won’t spend a lot of resources investing in internet retail in 1995 because it’s just not a good experience yet. And we got to make too many assumptions relative to what it would cost us to get into that market. The overarching ideas is take it step by step through checkpoints and test your assumptions as you go, keeping your risk and costs as low as possible until you have a strong signal. And many entrepreneurs, I study a lot of failed ones, they start off with too much money and too many resources and people. The things get big before they get smart and when by the time you figure it out, you spent the money and invested in the wrong organisation and you find yourself in big trouble.

Audience Question: I love the storm warning metaphor but I’d like to ask about the climate change. You had a chart about the capacity for human adaptation versus the pace of change of technology. This is something I’ve been thinking about for a while that we could be an existential threat to those of us in the room that being able to have a business of software because of threat pace of changes that it’s dumb luck that you stumble upon changes but even thinking about systemising that. I was wondering if you could give some comment to an event zero, what happens when the tech line gets way too far away from the human line.

Rita McGrath: I will offer an opinion. I think what we’re always facing is that our institutions lag our reality. We don’t know how to regulate blockchains or ICOs or ordinary banks. There’s an institutional set of frameworks that always lag what’s actually going on. As leaders, we need to try to explain to the people that have the kind of policy frameworks what needs to be done to keep us safe. What are the guard rails we need to create? In a very fractious political environment, it’s really hard to build consensus and I’m worried about it. If we can’t take on some of the big challenges in a coordinated way, I think it’s very bad news. I’m optimistic and this is said about America and it’s true about humanity. America will do the right thing after it’s exhausted all other options. I think humanity is like that too. So I’m an optimist but I think it’s a very challenging situation.

Audience Question: So what are some examples of organisations that have gotten the early warning signs right and have executed on it great? They’ve detected it and really like not sort of fallen behind on that curve?

Rita McGrath: I mean in software, an example I think it’s very interesting is Adobe which went from boxed software which they charged a certain price for to software as a service. They saw that changing infrastructure coming, realised their existing business was getting commoditised and committed the company to shifting in that way. Couple of things to remark on about this thing. They spent a lot of time at the executive level soul searching, saying are we sure this is the way to go? This wasn’t just a technology shift, but a fundamental business model shift. They were committed to it and I see many companies that recognised the early warning but to make that commitment and do it, that’s hard. People don’t want to. When it comes in to putting your product at the bottom of the screen, people go no, we don’t want that. Now couple of things Adobe did that were smart that I think is useful for you to bear in mind. They took the time to explain to external constituencies, stock analysts, investors and customers what metrics they should be evaluated on as their business model changed. They took the time to think that through and explain it to people. If you will evaluate a SaaS business the same as a box service you will fail. You won’t understand what they’re trying to do and you will make the wrong decision. Adobe went through a period where their revenue went down, they predicted it and warned people about it, they lost many customers and picked up many. If they weren’t to explain it, they could have been in very bad shape. That was a very interesting example of a company that said the cloud is coming, the nature of competition is changing, here’s how we will respond do it.

Michael Sikorsky: All these companies we love are around and keep doing it over and over. They had different patterns. In a small company, they have a hackathon and do their small experiments today or yesterday’s sales force announced a 50 million fund to invest in AI. So how do they pull that in? That’s just one of the tools in the toolbox. You kind of see it in our business, I think we’re really good at catching it, it’s harder for us to build the architecture in our companies. We’re always catching it.

Michael Sikorsky: One of the big issues with big companies is resources get trapped. So the division A thinks it’s entitled to all the profits division A generates. If it’s going into competitive erosion or will make something obsolete, the results that could be repurposed to discovering something new are held hostage and that’s a big problem large companies wrestle with which is an opportunity. If you try to be disruptive and these guys are lumbering along unable to move to respond, that’s an opportunity.

Audience Question: We mention the iPhone as one of the examples of an inflection point and it was something Apple forced as it. How do you divide position, allocate your resources between creating your own inflexion points versus trying to react to outside ones?

Rita McGrath: That’s a function of your strategy and some companies are leaders and that’s what they want to do. Corning would be an example, their thing is we want to be ahead of our customer and create the next generation of advanced materials for displays and other stuff. Therefore, we will in charge of the inflexion points and we will have scientific talent and will do the manufacturing very close to HQ in the US, so we’re on top of technical advancements. You’re around creating the next inflexion point. Other companies are more reactive and I pick on my friends over at Walmart. If what you’re all about is overwhelming the world with massive amount of operational excellence and execution that’s a different thing and you will be more reactive. You could argue that Walmart, in its day, created its own inflection point in the retail landscape. So I think that’s a strategic point, where do you want to compete and how are you going to win?

Mark Littlewood: That’s awesome but we really have to wrap up!

Rita McGrath: Thank you!

Find out more about BoS

Get details about our next conference, subscribe to our newsletter, and watch more of the great BoS Talks you hear so much about.

Rita McGrath

Rita McGrath is a longtime professor at Columbia Business School and one of the world’s top experts on innovation and growth. She is also one of the most regularly published authors in the Harvard Business Review.

Her work and ideas help CEOs and senior executives chart a pathway to success in today’s rapidly changing and volatile environments. McGrath is highly valued for her rare ability to connect research to business problems and in 2016 received the “Theory to Practice” award at the Vienna Strategy Forum.

Recognized as one of the top 10 management thinkers by global management award Thinkers50 in 2015 and 2013, McGrath also received the award for outstanding achievement in the Strategy category. McGrath has also been inducted into the Strategic Management Society “Fellows” in recognition of her impact on the field. This will be the second time she takes part in Business of Software Conference USA – she discussed how entrepreneurial business owners benefit from an understanding of the new strategy playbook back in 2013.

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.