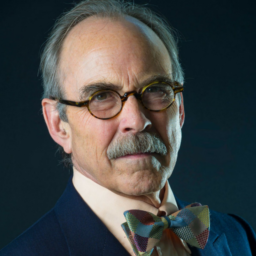

Bill Janeway, Founder of Warburg Pincus’ High Tech Investment team and investor founder of such companies as BEA Systems and Veritas Software is also a Cambridge academic who has analysed the economics of stock market bubbles over the years.

Are investment bubbles a good or a bad thing? The answer may surprise you. (No! It really might, this isn’t buzzfeed).

In this talk from BoS EU 2015, Bill argues, very cogently, that ‘productive bubbles’ are not only a good thing, they are essential to enable the creation of huge, market-transforming, disruptive ideas.

Slides

Transcript

Bill Janeway: Thank you.

Mark Littlewood: Welcome!

Bill Janeway: Mark. Mark if you’d have gone to RADA or LAMDA they’d have told you never go on the stage with an animal or a child [audience laughs].

Mark Littlewood: Well actually Arthur’s kind of combined the two quite successfully: [audience laughs].

Bill Janeway: I do want to say how much I enjoyed James talk having been working with companies using Agile and seeing it developed and transform the productivity of software development. I should also say that I guess that it’s now time to turn off your limbic system. This is all prefrontal cortex. And we’re gonna talk about bubbles. We’re gonna talk about what I hope will convince you that the subject here is not a contradiction in terms.

“Bubbles can be, can be, productive.”

This talk is divided into four segments.

First, I’m gonna give you a little theory on the dynamics of asset pricing and how they drive bubbles.

Second, I’m going to construct a bridge between what’s going on in financial markets and the financial system with the respect to pricing asset and real investment in real things including virtual real things, software, in the economy of production and investment and consumption.

Third, I’ll give you some historical examples of bubbles that in fact prove to be productive.

Finally, I’m gonna close by talking a little bit about the current event of relevance namely the what is now known as the unicorn bubble and give you a point of view about that.

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

So, the first point is: not, all, bubbles, are, alike.

Two dimensions at least, the two dimensions I talk about here I show you the object of speculation on the y axis and the locus of speculation on the x axis. In the lower left hand quadrant the great credit bubble of 2005-08 leading to the global financial crisis and the great recession took over the banking system, both the regulated and unregulated banking system. And left us with a lot of beach houses in the Nevada desert and the functional equivalent of that across Europe and parts of Asia, radically unproductive and when it burst the economic consequences were devastating. The critical factor was the extreme leverage of the credit system. A tiny amount of capital in some cases 2 or 3 percent on which a mountain of leverage was built. So when the asset prices declined slightly the collapse in credit was extreme and starved the real economy for working capital.

On the other hand, the dotcom telecom bubble located in the stock market and the junk bond market not only funded the build out of the infrastructure of the internet but it also funded the first great wave of exploration of what to do with this new transformational infrastructure. What would be the content of this new economy and when it burst the economic consequences were limited and contained within the scope of conventional policy.

Again, the critical factor, the relative lack of leverage by public market investors buying tradable securities. So let’s talk about the objects of speculation. Charlie Kindleberger wrote the great book, this is simply a listing and by the way you’re gonna have slides with a lot of words on them these slides are gonna be posted, you can read them. A written test will not be taken for at least a week [audience laughs].

And the references are provided for you to follow-up. There’s a reading list embedded in this, in this talk.

Kindleberger doesn’t even include tulip bulbs in his lengthy compilation of why any tradeable asset can be the focus of a bubble. The great Walter Bagehot had his own version 150 years ago. I loved this quote. That people won’t take 2 percent. That’s what we’ve been having now. You’ll come back to that at the end of this talk. And they’ll find, they’ll, they’ll seek something impossible a canal to Komchatka, sounds like boo.com to me [audience laughs].

Well recently a great figure in Hong Kong, Nick Sibley was the, the public voice of Jardine Fleming. When Jardine Fleming was the dominant financial player in the markets of Hong Kong and then Tokyo. Nick was the bigger than life about 22 stone of him. And he had this wonderful, wonderful line about how giving capital to a bank is like giving a gallon of beer to a drunk. You know what will come of it but you can’t know which wall he will choose [audience laughs]. Now, what’s going on here? There’s a great economist named Hyun Shin he’s the Chief Economist at the Bank for International Settlements. He wrote the best analytical, accessible study of what went on in 2008 and what led to the global financial crisis.

As he points out it’s that prices in markets play two roles. They tell you something about what’s going on. They are backward looking. But they’re also forward looking because they’re inducement to action. When what George Soros called “reflexivity” means that the response to the signal changes the signal. That is fundamental in the financial market. What it leads to in is that locally rational behavior produces an incoherent systemic breakdown and particularly for a bank when asset prices increases the value of its asset rises. That all spills over to augment its equity. But if it’s got a target leverage ratio say of, it’s very conservative, it’s only 20 to 1.

That means every additional pound of equity means it could increase its assets by 20 pounds. So the price, the increase in the price of assets leads banks to buy more assets which means making more loans. The demand curve inverts. If you read, if you took Economics 101 the one thing you know is that when prices rise the demand is supposed to decline. Not in financial markets. Not in bubble conditions [papers rustling]. And when the banking system through the application of advanced information technology implementing what was known as “modern finance theory” started to move assets from being held to maturity, loans on banks books, into securitized tradable entities such as collaterized loan obligations and more abstract and opaque instruments it meant that theses prices became easier to observe moving up generating more demand. And as Shin puts it “in the eyes of a bank’s management a bank with surplus capital is like a manufacturing plant with idle capacity. The motivation is to use up that capacity.

Now there’s a long literature about stock market bubbles in attempts by economists to explain how it could be that the prices of financial assets would decouple themselves from the underlying cash flows of the business that the shares represent ownership in. Finance theory tells you that there is a fundamental value of every share. It’s the expected net present value of the future cash flows. And yet we see prices again and again move away. Well, one explanation, in a way a canonical explanation is that as prices move around the arbitragers, the investors who are supposed to rationally know what that fundamental value is don’t dare to sell shares that are rising too high or buy shares that are falling too low because if they do it too soon and they’re behind the market their investors will take the money away.

They will be punished for being right too soon. Or put it the other way, they can’t afford to be wrong long enough. Now seventy-five years ago a local hero John Maynard Keynes defined the limits of arbitrage of without reference by slight omission in talking about how difficult it is. And this was in the 30’s, how difficult it is to act as that long-term investor holding out against the mob against the either the extraordinarily over optimistic speculators bidding shares up or the panic-stricken limbically dominated investors going into flee, fright and freeze. as happened in the winter of 2008-09.

There’s a real world example that I call the Inverse Schleifer Vishny model because it had to do with investors who were looking at the dotcom bubble.

Two great investors, two investors in the real world whose track records were just about identical. One was Warren Buffett and one was a fellow you probably haven’t heard of, Julian Robertson who created the tiger fund which was among the very best performing hedge funds for twenty years leading up to 2000. But they had a fundamental difference. Buffett at Berkshire-Hathaway runs the largest investment trust in the world. If you don’t like what he’s doing with the capital at Berkshire-Hathaway you can’t ask for your money back. All you can do is sell his shares. And that’s what people did because in 1995-6 both Buffett and Robertson said, “this new tech stuff this internet thing, I don’t get it. I don’t understand it. I’m not gonna play.”

So over the next three, four years Berkshire-Hathaway stock actually declined while the NASDAQ went up by a factor of 5 and the S&P by a factor of 2 ½. Julian Robertson on the other hand was running a hedge fund. Yeah, you were locked in but you were locked in for 3 months. His investors because of his track record gave him the benefit of the doubt year after year until ironically on March 31, 2000 two weeks before the all time peak in the NASDAQ they closed him down and took all their money out. That’s the lesson of the limits to arbitrage.

And there’s, there’s data. The most interesting factor from this very recent study from the IMF and this is perhaps the greatest challenge to mainstream modern finance theory. Over the last two generations the proportion of investment funds run by professionals, trained rational professionals, has gone in the U.S. from something like 5% to 70%. And over that period of time the volatility of the stock market has risen by an enormous amount. The extreme ups and downs have increased.

Andy Haldane the Chief Economist at the Bank of England ran a study back in 2010 that looked at the variance in stock prices relative to the variance in the fundamental, the underlying cash flows of American business. And up until the 60’s stock prices were twice as volatile. This is if you like Keynes’ world. But since then, since, since 1990 over the last 25 years they become six to ten times more volatile. As people are managing, as professionals manage other people’s money, not their own they can afford to be wrong for a shorter and shorter period of time.

Finally on this segment Jose Scheinkmen is another great economist arguably the best financial economist in the world today. His lectures were summarized in a small book published just last year, “Speculation Trading and Bubbles” and what he talks about, what he hones in on is the phenomenon that Hyun Shin in talking about banks identified. The signature of a bubble is that as prices rise, demand increases, trading volume which can be observed, goes up. This is the signature of the bubble, when the demand curve inverts and instead of demand declining as prices rise, demand increases. And this, this mechanism, this mechanism as you can see is functionally exactly similar to what Shin was talking about with a bank balance sheet. It has the same effect in generating, in generating bubble and asset prices.

So How Does This Relate to Software?

Okay, but then this is all going on in the financial markets and the stock market maybe even in the banking system but what does that have to do with employment, investment and building software and building buildings in consumption in the day to day life of the economy? Well let’s go back to our local hero. Keynes again defined an entire research program in a couple of sentences. This is what I call Keynes’ bridge. How the price changes in the stock exchange inevitably exert a dis, an influence, a decisive influence on the rate of current investment. Now note here this simple clause, that identifies, that’s the case for why there’s a leverage buyout industry that there’s an arbitrage between the value of a business in the market and the building a business, a new business. And similarly this is what venture capitalist, what I’ve used to live for.

The IPO. The chance to get revalued in the public market with a new company. But the point here is that it’s about these volatile valuations in the market play a critical role of, in governing the flow of investment dollars, pounds, remnimbe in the real economy.

Now there’s an excellent paper that came out a few years ago that talks about a game. A game played across Keynes’ bridge between speculators in the market and entrepreneurs thinking about how much they should commit and invest in a new venture where any idea of the expected future cash flows is uncertain to unknowable. And for those who with academic bent I’ll just note that these highlighted “as if’s” are what economists have to do in order to pay obeisance to the neoclassical gods who dominate the journals, the learned academic journals in economics.

The point here is that this game involves speculators and entrepreneurs watching each other. The entrepreneur sees the speculator bid the price up. Hey, that’s a signal. Not only is capital cheaper but maybe they know something about the future that I can take advantage of. I invest more. The entrepreneur hires more people, writes more code, hires more sales guys, buys more search engine optimization. To get to market the speculator sees that happening, “hey, look at Uber, look at Air BnB” and says “hey, this has to be worth more because they, entrepreneur obviously knows more about the marketplace than I do.” So this game goes back and forth. And of course, this game is likely to be played more intensely during periods of intense technological or institutional change. Now again, it’s-it’s-it’s kind of funny that the authors of this paper, should, should explain the problem by talking about information that is highly dispersed.

Productive Bubbles

The information isn’t dispersed at all it’s highly dismissed until you go through the looking glass, build the company trade, its shares, you have no idea. That fundamental uncertainty if there is one great contribution in the global financial crisis, one great positive contribution it was to shake up this kind of economics to the core and bring decision-making under conditions of radical uncertainty to the forefront. And that’s where a couple of other guys at Harvard Business School did some really great work on recognizing how really risky start-ups may require a bubble to get funded at all. Because only in the bubble are investors likely to believe that they can get a return even if it’s by selling shares to others before they have to find out whether this is boo.com or whether it’s Amazon.com over the longer term than they can afford to be wrong on.

One way to put this is that the bubble by creating an environment in which risk-taking is rational solves a coordination failure. It solves a failure which you can think of in these terms. If I’m invited to be the first round investor in your start-up and I know that you only want five-million pounds now but you’re gonna need 25 million pounds to have a hope of getting a positive cash flow. Well, how do I know there’s gonna be the next 20 million or even the next 5 million behind me? And if I think that there might not be, that’s a really good reason for not investing today even though it looks really attractive and your last time out you made a lot of money.

In a bubble you stop worrying about whether there’s gonna be more money behind you. The coordination failure through time is eliminated. That’s the functional role that bubbles can play at the frontier of the innovation economy. And this is simply a-a follow on to suggest theoretically that you should expect to see in bubble conditions riskier start-ups, further out crazier ideas, ones that might require so much money to get going. “Geez we’re gonna start a new automobile company. From scratch?” That only under something resembling bubble conditions would anybody take it seriously. And then Nanda and Rhodes-Kropf went out and actually looked at the data and what they found was that going back now 15 years start-ups that were founded during the dotcom, telecom, internet bubble at the end of the 90’s had a, a bimodal distribution. It wasn’t a normal distribution.

More of them failed completely. But those that succeeded, succeeded bigger. There was an actual empirical demonstration of the phenomenon of financing risk that they talked about and the coordination failure that a bubble solves. Okay, now for some history. Now for some history. And let’s start 50 minutes away or 15 minutes plus a short tube ride to the London Stock Exchange. London’s propensity for bubbles persisted from the 1720’s, the, the South Sea bubble, the Great South Sea bubble, it was reawakened after the Napoleonic wars. Every decade from 1825 to the First World War there was some kind of maniacal, maniacal bubble, Bull Run as it was called, on the London Stock Exchange.

And it covered everything from the productive, the great railway medias of the 1830’s and 40’s that built the British Railways to silver mines in Nicaragua. That railroad to watch it that Bagehot talked about. There were railroads in obscure parts of the world that were funded but, but in 1883 and then again in 1900 the city of London got introduced to arguably the two most important new fundamental technologies of the second industrial revolution. The first was electricity the second was the automobile. In each case the first moving entrepreneurs were something between reckless exploiters of ignorance on the part of greedy investors and outright scoundrels.

And in each case what begin with a super hot IPO I mean an IPO with the stock price of the first day trading up 75, 100 %. You know, what you expect in a bubble? To bankruptcy within a year or so.

David Kiniston the great historian of the city of London suggests that in, somehow the, that the city of London got vaccinated against investing in advanced technology at the frontier of innovation. Much more comfortable in investing in rubber plantations in Malaya or waterworks in Argentina. That was the one where the, the first time Barrings tried to go bankrupt. At the same time in the U.S., the same time in the U.S. the New York Stock Exchange had been all about the railroads. Totally dominated by railroad bonds and then by railroad shares. But after in the, in the, in the run up to the First World War and then into the 20’s it all changed. It became hot new technical technologies stuff.

Even as early as 1915 there was a, this stock market boom in automobiles. But as just sort of a pause for thought this is something I keep trying to push my economic historian friends to look at. Is that there have been a lot of stories about how and why the leadership in innovation economy passed from Britain to the United States. Germany having taken itself out of contention through the worst 30 years of any modern state beginning in 1914. But having been potentially the leader at the end of the 19th century. And one hypothesis I have is the access to speculative funding for new technologies and new industries and new markets that London seemed to have been vaccinated against before New York fell in love with’em.

So the auto boom fifty security issues, twenty new companies most of them went bust. One of them was Chevrolet sounds to me a little like the internet right? Sounds to me a little it, bit like the PC industry, a hundred years later. During the 20’s the mobilization of capital overcoming that coordination failure led to massive investment in electrification in the United States. Now electrification is an extreme example of the challenges to rational stock market, bond market investors, enormous capital just to produce anything, a flow of electrons. The marginal cost the incremental cost of the incremental electron is even cheaper than an airplane seat it’s zero. Sounds sort of like bits going across the internet?

So if you have competitive conditions and prices move to marginal costs, as they’re supposed to in the economic textbooks you wind up with what we call in the States we call checkbook poker. The guy who has the most money wins because everybody else goes bankrupt along the way. They can’t service the debt that they incurred to build the generating plant or the distribution network to deliver this service whose marginal cost asymptotically approaches zero. However, in the context of a bubble you don’t really worry about that because devil will take the high most and the first movers will win and during the 1920’s the hottest stocks, the greatest growth stocks in the country were the new electricity companies, Florida Power and Light. And before the frenzy ended 13 to 33 million of kilowatts were installed and running and delivering electricity turn, delivering electricity the way the internet now delivers bits, across the country.

Perhaps the sexiest micro bubble within the great bubble of the 1920’s was aviation after Charles Lindbergh flew the Atlantic. And 124 public offerings of stock conducted in barely two years raising more than 300 million dollars. Three-hundred million dollars think 30 billion something like that in today’s money in two years for this one industry. And then finally the consumer, the killer app of electrification in the home was radio. When all you had to do was plug it into the wall and the world came to you advertised by every manufacturer of soap imaginable. There were a couple of different waves I’m not gonna go through this in detail.

It was all turned around. The other dirty secret of technological innovation that I’m not talking about today, the role of the government in building platforms and key players in the U.S. Radio Corporation of America was the American national champion which worked where the United States Navy and the Department of Commerce assembled all of the patents to fight what appeared to be British dominance through the Marconi patents and produced an American company capable of, of winning. And RCA became first for radio and then for television the dominant technological player over the course of 60 years. 1929 stock market busts, 1929 to 39 the great depression, five, six years of World War II this was the period of financial repression. No bubbles. No bubbles.

It took until the early 1960’s in the context of the cold war with the US pouring billions and billions of dollars into science, technology, infrastructure, computer science creating research Universities in the U.S. distributing and, and demanding an extraordinarily loose intellectual property environment. If you took money from the government you had to license your patents even to your fiercest competitors at a fair and reasonable price. If you sold something to the defense department that mattered you had to put a competitor into production. You had to create a second source.

This was how national security trumped conventional economics, conventional business practice and arguably accelerated the computer revolution by a good generation and created a reservoir of accessible technology available to entrepreneurs and the venture guys who backed them. That fed the computer revolution as it moved beyond the scope of producing microprocessors that would be the guidance systems for minute men ballistic missiles and became the basis for the digital revolution beginning in the 1970’s and 80’s in which we’re no more than halfway through.

So the first, the first, the first post-war bubble didn’t happen until the early 60’s it was called the onyx. It was about electronics. This would seem to be magic and there was another wave at the end of the sixties. But what I want to show you now is how there’s a, there’s a kind of a resonance. It’s not that as I said all bubbles are not alike but bubbles in the stock market tend to look like each other. And this is an interesting comparison that I did these are three companies, three very different companies. The Radio Corporation of America, 1926 to 1932. This is leading up to 29 the, the first peak and then the second peak and then back to where we began.

The other two and I guess the reason I’m standing here are the two most important companies that I funded for Warburg-Pincus in the course of the 1990’s, BEA systems and Veritas Software.

Two of the companies that produced critically fundamental software for enabling the internet to function as an environment for commerce, for transactions not for just information distribution. They went through very much the same comparable boom and bust and I can tell you that just about here, just about here, boy did the demand curve invert.

As the price went up here at Warburg-Pincus we did two distributions of two billion dollars a piece of freely traded shares. And the price rose between the two and continued rising between the second one. During this bubble on the other hand remembering we’re in the upper right hand quadrant of the chart, during this bubble John Door of Kleiner-Perkins liked to say that we created six trillion dollars worth of wealth, the largest creation of wealth in the history of capitalism.

And then in two years we liquidated 6 trillion dollars worth of wealth but we didn’t have a financial crises [audience laughs].

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

We didn’t have a great recession. The Fed dropped rates, Bank of England dropped rates a bit and the economy continued to function. So it’s not just that the productive bubble leaves good stuff behind it’s also that when it bursts the, the, the consequences are not disastrous for the economy at large and for the economic system. There’s a study that I find enormously compelling in explaining how a bubble can leave good stuff behind. This is an empirical academic paper it examined, it is an excruciatingly, challenging, empirical task I don’t think this could have done, could have been done by an Agile group I’m afraid [audience laughs].

This involved taking the seven high-tech sectors in the U.S. economy. Identifying every company in those sectors that was less than 15 years old during the, in, in the period 1995-1990 2000. Then going into databases and finding out how much money did they spend on R&D and how much cash did they raise from the stock market through issuing shares and IPO’s and follow on offerings. And then looking at their total cash flow what they generated from operations plus what they acquired from outside. And this is what you see. So way back here, these companies and these high-tech sectors are investing in R&D collectively 2, 3 billion and it rises very gradually through the eighties and into the early nineties. It gets up to around 20 billion in ’94 and then it triples in 5 years.

And it triples in 5 years because new share issues explode. And the total cash flow available as the demand for what these people do is generating more revenues at the same time as the stock market is saying “give us stock to buy” produces this enormous explosion. Then the share issues collapse and R&D starts to decline while cash flow goes actually negative. I mean this includes all those telecom equipment suppliers that went bust if they didn’t sell out in time to Marconi to the enormous benefit of Cambridge and Cambridge University because Marconi paid in cash and one of the founders Robert Samson is chair of the Cambridge angels. the others paid an overpriced stock and the stock went down when the, as the company as the demand went down.

But this is a wonderful, empirical examination of how a productive bubble can leave really good positive results. Now this is another quick take on what only could have come out of a bubble. For Amazon to get to positive cash flow on operations and to have a choice about whether to report profits or not. A choice, 2.2 billion dollars of capital raised if they hadn’t done, if his CFO hadn’t convinced Jeff Bezos to do the last 650 million dollars convert in Europe, Amazon would’ve gone bust by the autumn of 2000.

The bubble gave us e-commerce well ahead of when. Now Brad De Long the great economist, I’m not gonna, you can enjoy reading this on your own I don’t want to stall over it. But what he’s talking about here is in the aftermath of the dotcom bubble people are saying, “Oh my God, it was great while it lasted now it’s gone.” But he’s saying there’s something got left behind. And in fact, even if the companies go away what they invest in, what the speculators fund sticks around just as the case with the railways. He puts it a little provocatively about how the American entrepreneurs picked the pockets of the London investors who were the primary sources of capital in the 19th century.

Picking the pocket, I mean they were, they were willing participants in the process of funding the build out of the American railway system. But the point he makes here is that after the bubble was gone the infrastructure was there. And we got the chance to discover what it was really good for. The killer app of the railroad age mail order retail created a national economy. Vintage 1880 every town in America had a shoemaker. By 1920 all the shoes in America are made in Brockton, Massachusetts. That’s creative destruction at work. Well 25 years after the end of the great dotcom internet bubble Uber and AirBnB and the disruptive web services that only a ubiquitous digital network supporting transactions as well as information in real time with minimal friction could make possible this phenomenon we call the unicorn bubble.

In Conclusion

And this is where I’m going to close. Now the first point and the critical point about this bubble and this is different, this time is different, is this bubble is not taking place in the public liquid markets. This bubble is taking place in a private market, the investors, the mutual fund companies like Fidelity, the hedge funds even some sovereign wealth funds are doing something quite unusual. They’re paying premium prices, valuations above the valuation of the great internet service companies available in the public market, Google, Facebook to buy shares that they can’t resell.

Now one of the ways to think about why public market investors pay ridiculous prices for shares is that with that share comes a kind of implicit option. The option of selling to an even crazier optimistic investor if you decide that this is as good as it gets. Or it’s good enough for me. These guys investing in Uber at 50 billion, they’re there, they’re there. They don’t have a liquid market. But on the other hand we can see even in the private market the signature of the bubble. Just in this two year period Goldman counted an increase, fourfold increase in the amount of private investment in these tech company equity at these super premium prices and the number of transactions tripling.

Morgan Stanley narrowed it down more and they still got a tripling in the value of the investments over this just twelve month period. Now on the supply side meaning the supply of unicorns this does reflect the new economics of the new digital economy. The frictions that inhibit growth are vastly reduced. The cost of launching startups, web service startups with open source software, renting compute cycles, storage from Amazon or the others, the increasing number of other cloud service providers, marketing through social media without having to hire sales guys all of this means that the sheer number of startups of hopeful monsters in the Darwinian scent and the reach, the potential reach of each of them has grown enormously.

In this last years as we, as we both learn, learn to make use of the environment of the internet on the one hand and as from the point of the view of the user just like electricity in the 1920’s it disappears. You don’t have to worry about amperage, voltage and tenents and the equivalent of those in the computing world except when it doesn’t quite. It’s not totally mature by the way electricity didn’t quite disappear in Britain the way it did in the United States. When I came here 50 years ago as a graduate student I bought my, the first purchase I made was a desk lamp I brought it home I took it out of the box I was already to plug it in and guess what? At the end of the cord there were three wires connected to nothing.

In Britain you had to know what the plug was and you had to buy your plug separate from your appliance. Something about coordination failure there that may also be related to losing leadership in the technological economy [audience laughs loudly].

Now of course every bubble, even the South Sea bubble begins with a story. South Sea bubble ended the collapse of the, the Spanish Empire opening up for British players to seize what had been Spanish monopolies and actually one part of that story was true Britain got control of the slave trade from Africa to the New World which it had been a Spanish monopoly.

Well there are plausible stories about AirBnB and Uber and the other Uber for X kind of competitors and they are operating in this environment where friction-free deployment and usage under the con- with very low cost to develop leads to a potential scale that is unbounded. Venture guys out in the valley today are saying to the entrepreneurs who come in they have a trick question. They say, “how big is your market?” The entrepreneur tries to answer that he tries to provide some metrics some counts. The venture guy says, “get the hell out of here if there’s any limit to your market I don’t wanna talk to you.”

So that’s also a signal, if you like, of a bubble. On the demand side remember what Bagehot said people can’t take two percent? Institutional investors have been living with two percent at best since 2008. And that is one reason why the spillover into the private market even accepting a liquidity in order to get the hope of some kind of super return that will make up the compressed return from conventional return even though the stock market’s been doing just great. But what’s not been doing great is the market for new companies. The IPO market has been very, very depressed. This is a chart from a recent web report which actually I put this up here it’s hard to get ahold of this it sort of comes and goes on the internet. I’m not quite sure what’s going on maybe the NSA doesn’t want us to have it [audience giggles].

But it’s produced interestingly by Andreessen Horowitz the hottest venture capital firm in Silicon Valley and absolutely at the core of the unicorn, at the center of the unicorn phenomenon. And at, they’re very reflective, very analytical, very cold clear-eyed view of the unicorn bubble. And what they point out here, this is back in the dotcom telecom days and the this is the dark is the IPO’s, the upsurge in late stage private investment in venture backed companies is here. But this was, these were venture guys chasing just before the IPO that was supposed to take place and of course it disappeared when the IPO market closed and the bubble burst. But here look at the ratio of IPO volume to private investing volume and ever since 2000, the volume, the number of venture backed IPO’s has been very low. They threshold for being able to go public has increased radically. IPO’s now take at least 100 million dollars if not 200 million.

One explanation is the enormous concentration among banks. You won’t get Goldman-Sachs attention unless you have a minimum of 5 to 10 million of fees and you need a big deal for that. There are only 7 global banks essentially running IPO’s. There used to be a whole ecosystem around the venture capital community in the U.S. and you could go public with a 20, 30 million dollar company in a 20, 30 million dollar deal and that was what we took for granted in the 80’s and 90’s. So there’s a bunch of institutional factors at work here and the one thing we know is that at some point and it won’t be tomorrow because there’s latency in the institutional process of mutual fund companies creating special funds, sovereign wealth funds, hiring guys to chase these kinds of investments. This is gonna go on for a while.

But at some point two things will happen. Supply, remember Keynes’ bridge, if you can start a company and raise capital at extraordinary valuation there are gonna be more of these offering themselves as candidate Uber’s on the next way. As more of them grow the market test will come in two ways. The market test for those that actually go public is what do they trade at relative to their last private round. Well you’ve got some outfits out there like Box which are sixty percent below what the private investors paid and they paid in big volume. For every IPO that’s gone, every IPO that’s validated the private valuation there’s at least one that has undermined it by as much as 50 to 80 percent.

Well that feeds, that will feed back but second sooner or later as my psychotic mentor used to say thirty forty years ago, a great turn-around artist masquerading as a venture guy, “corporate happiness is positive cash flow.” Corporate happiness is positive cash flow. That’s what buys you autonomy, autonomy from the volatility, the manic-depression, the limbic system of the stock market. And these companies even Uber will be challenged to demonstrate predictable, sustainable, positive cash flow from operations. Now some of them will get acquired but unfortunately for, at these valuations there are very few potential acquires. You know there’s this new acronym FAGA? Facebook, Amazon, Google, Apple and maybe Microsoft under its new leadership? FAGAM?

There aren’t very many potential acquirers that can pay 10 billion dollar valuations and there’s no one who can pay 50 billion except maybe Apple. But hard to believe Apple’s gonna buy Uber. But this existence of the FAGA companies of course is what’s driving the other acronym FOMO, Fear Of Missing Out. How will I kick myself if I had the chance to buy into Uber at 20 billion when it turned out to be worth 200 billion? Now when it ends, when it ends there will be consolation for society at large if not by those motivated by FOMO to sacrifice liquidity in pursuit of the next FAGA.

The vast majority of these companies will not be around 10 years from now. But there will be some stunning winners like Amazon that emerged from this and once again we’ll be able to have observed the role of productive bubbles in funding economic development at the frontier of technological innovation.

Thank you very much [audience claps].

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

Mark Littlewood: Question? Put your hand up. Lawrence. Great.

sp3: Is this what helped the mobile industry above all? Is it what helped the mobile industry because every succeeding generation to digital then 2G, 3G had inferior products that the industry had to get through? And it has and we have a fabulous infrastructure around us. So was there a bubble on the outside as well as internally in product groups for example?

Bill Janeway: Well with mobile, mobile communications I think it’s fair to say did not directly involve bubble funding partly because of the institutional sources. That is the, well let me back up on that, back in the 90’s of the first generation of mobile companies they definitely got a push forward. But mobile has a unique characteristic, it involves spectrum. Spectrum is limited. Spectrum auctions which raised tons of money, that spectrum auctions in effect you might say from time to time, there have been at least two examples I can think of where the prices paid for spectrum were ludicrously too large. and there were occasional efforts of venture guys to put together consortiums to bid against the big boys, the established incumbents to get access to spectrum.

But where you have a regulated market with spectrum limited with, with the resource limited you don’t have that sort of boundless phenomenon. I’m hesitating because I think we can see some of this going on. I mean there’s, there’s going to be I mean India has been weird because every time somebody thought that they got spectrum that would give them a monopoly rents because you’re bidding, you see your bidding there for visible monopoly rents. then the Indians would open it up and somebody who hadn’t ate, that’s why they have to keep redoing there auctions because they got corrupted. I think we’re still, where we are now in the next generation, something big has changed in this scope of technological innovation that includes mobile. Through the nineties you had the opportunity for new companies like my guys BEA and Veritas to become stand alone independent players in building up the infrastructure for the digital economy.

Today there was a lot of technology that was sort of the residual of what the defense department had been responsible for. There was a lot of accessible technology that you could acquire you didn’t have to build everything up from scratch. Today the entry ticket to play in the cloud is so big that absent some state intervention that says we’re gonna build a public cloud and compete with the private cloud with the private sector, only a small number of companies have the resources to do that. The ma-ma, the mobile infrastructure however is still immature for the kinds of applications that transform the enterprise world. They certainly are good enough for the consumer world and it’s going on. But the old-fashioned -ilites of reliability, scalability, availability and secure-ility are still inadequate.

But what I expect to see and I think this is more generally the case and this may affect a number of you here in the audience. In the absence of an IPO market, in the context of big companies dominating the provision of infrastructure services [inhales deep] entrepreneurial startups and the venture and angel funding of those startups that are delivering real technology to enrich the environment, the operating environment, not AirBnB but the real underlying technology we should be thinking of ourselves as undertaking and funding distributive research and development for big companies; because while the cost of startup with open source software and cloud services is very, very low.

The risk and cost of going from a working prototype even a venture that has generated some market recognition to a full functioning susta-sustainably profitable cash flow positive business is huge. And the capital behind that if you’re not, if your market actually is bounded if it’s not limitless the cost and availability of the capital is highly problematic in this environment. That might not, that unicorn bubble is limited to destructive web services by and large, not the underlying technologies. So the challenge, the challenge facing entrepreneurial startups today is to sell in time to sell before running, trying to run all the way.

Now there will, there may be a few, there will be a few but the access to the public market, the access to cheap capital, the ability to build an independent standalone business I think is much more restricted than it was 25 years ago.

Mark Littlewood: I would love to extend questions over the entire lunch but can we invite you to lunch and ask people to come and uh- Bill Janeway: Sure.

Bill Janeway: But you play one on television [audience giggles]?

Mark Littlewood: Okay, no and I have ADHD and I bought Bill’s book [microphone thumps] a couple of years ago and I opened it up “Oh [sighs]” [audience laughs] I think it’s amazing. It’s an incredible book and for me to, I mean it, for me to it’s a, it’s a sort of very academic book but it’s put stuff in a very, very simple approachable way so if you haven’t bought that and you’re not sparked by after Bill’s talk you’re a fool [audience laughs].

Bill Janeway: And by the way you get a signed copy on receipt of a receipt [audience giggles]. It’s not called doing socialism it’s called doing capitalism.

Mark Littlewood: Yeah [laughs out loud], I think you signed it before but Bill thank you so much for making bubbles entertaining [audience claps loudly] and funny.

Bill Janeway

Bill Janeway has lived a double life of ‘theorist-practitioner’, according to economist Hyman Minsky. As ‘practitioner’, Bill’s been an active investor across five decades.

As ‘theorist’, he’s an affiliated member, Faculty of Economics, Cambridge University, board member of the Social Science Research Council and the Fields Institute for Research in Mathematical Sciences. He’s also a co-founder and member of the Governing Board of the Institute for New Economic Thinking (INET). His book, Doing Capitalism in the Innovation Economy: Markets Speculation and the State, was published in 2012: the second edition will be published in 2018. You can see him talk about the value of bubbles to society at BoS Conference Europe 2014 here.

Next Events

BoS Europe 2025 🇬🇧

🗓️ 31 March – 1 April 2025

📍 Cambridge, UK

❗️3 weeks to go

Spend 2 days with other smart people in a supportive community of SaaS & software entrepreneurs who want to build great products and companies.

BoS USA 2025 🇺🇸

🗓️ 6-8 October 2025

📍 Raleigh, NC

❗️Early bird ticket available

Learn how great software companies are built at an extraordinary conference run since 2007 to help you build long term, profitable, sustainable businesses.

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.