Joe discusses why managing an effective external board for your organisation starts with understanding and managing your own internal board.

Your mind has a number of relatively discrete and often conflicting subpersonalities affecting how you come to decisions. The strongest personalities change in the moment. Understanding which personality is speaking and the history that informs them, helps you to understand why they give the advice they do.

You can learn to manage your mind, the voices you amplify and control in different contexts. The same is true for external boards – each member comes with unique history and perspective. Joe shares how understanding your inner board allows you to manage your board’s voices, amplify the right voices at the right time and know when you need to find new input.

Slides

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

Transcript

Now I know what you’re thinking. And yes, I’m wearing a bum bag. Okay. Full questions later about what’s in it at the bar if you’re interested.

So hello, everybody, right? My little girl. She’s not quite sure what it is that I do as a job. So if it’s okay with you, can I take a selfie of all of us together? Would that be alright? Do you mind that everybody? All right, hello? Can you all get in then a little bit? Can you see yourselves there? There we go. There we go. Perfect. I’m gonna post that on LinkedIn. And you can tag yourself in there. So thank you very much. So I think it’d be great. Great to give a round of applause to Mark and Kirk and Jed and Jo and Violet for organising a great day. So thank you everybody. So far, it’s been fantastic. BoS is such a great community.

Hey, yo.

And I’m really proud to be part of BoS and one of the things that I’d like to introduce to BoS now is the concept of a ‘Hey, Yo.’ What a ‘Hey, Yo’ is, is that’s where you can take advantage of the rest of community by asking the question or an ask of that community. So ‘Hey, yo’, it’s asking for something. So if you’re looking for an introduction to a particular customer, you can ask a hey, yo to the community. If you’re looking to hire a particular person, you can ask a hey yo to the community, you’re looking for a particular piece of advice, you can ask a Hey, yo to the community. So in the BoS slack group for this conference, use the hashtag Hey, yo BoS, and ask BoS for a favour because I’m sure there’s somebody in here who can help you. So I encourage you, after this talk, please not now. But go to the Slack channel and post your Hey, yo, I’ll post mine there as well. But I want you to think about what it is that you would like from the community.

Okay, so a bit about me then. So I’m an executive coach. And what’s been interesting when I introduce myself as this I normally get a roll of the eyes. Sometimes I get: well, that’s really, really interesting. But do you know the punchline to this joke? Anyway, so I work as an executive coach, I coach founders from early stage right through to executive 14, one out of 500, fortune 100, footsie 100 companies, so right through to CEOs, all the way up to that stage I work with, through high growth, startup, all those sorts of phrases. So here’s one of those things that we always talk about as coaches. Okay, so how many coaches does it take to change a light bulb? One, but the light bulb has really got to want to change.

I started this journey in tech about 15-20 years ago. So I’ve written a book on psychology, my background is in psychology, I used to do a lot of behavioural design work, I work for large major corporations like eBay, Disney, I lead the redesign of Trainer in 2010, Marriott in 2014, MoneySupermarket 2012; large scale, big commercial web projects, etc. And as I mentioned, these days, I tend to work with CEOs now of larger organisations. And I’ve seen throughout my career, probably a lot of you have before, you’re a founder of just really awful bad mistakes and choices that were made. And what I’ve always wanted to do is to get to the root of those decisions and those choices. And what I’m gonna talk about today is how to do that. What does power actually mean for an individual as a CEO of a corporation? For you as a founder? And how does that fit in with your world, your internal world, as well as your external world of managing a board? We’re talking about this today.

Okay, managing your internal board and external board of directors. Now, I know you all know what an external board of directors is, you’ve probably got an inkling about what your inner board of directors is, as well. Now, if you don’t manage a board, this talk is still gonna be relevant to you. Okay, there’s still gonna be a lot to learn because the same could be true of managing your senior team, managing your employees, the concepts will be the same.

Show of hands, then, hands up. If you’ve checked your email during one of the talks that have happened today. Honestly, I’ve done it. Right. It’s about half of you. It’s pretty good going. I’m very impressed. Normally, if I ask a question like this it would be a lot more people. Why? Like, surely people you work with know that you’re at a conference. Sure, there’s nothing that important that’s come in within the last 20 minutes or so in terms of that, yet you’ve done it. Okay. And there’s probably something if you’ve just checked it in the last 20 minutes or so. Something you do quite frequently, probably check your email 5,6,7,8,9,10,12 times a day. Okay. Somebody maybe you’ve never thought about? How many of you know it’s probably not a good idea to be checking your email during a talk? Show of hands. All right. So on the one hand, you’ve got this conflict here thinking that I might miss something. If I don’t check my email, I’m going to miss something or that time many years ago, I didn’t check my email and something slipped through all that time. I luckily enough, checked my email before I went to bed on Saturday night, and this email had come in and I did something about it and crisis was averted.

The Furious Worker.

One of your boards of directors, tells you that this has been a good thing in your life. Okay. Yet, there’s another part of you in conflict with that, maybe the core of you telling you that it’s a bad idea. Okay. Other board, other people, my board of directors, I have what I like to call the furious worker, and the Furious worker is a great ally on my board. The Furious worker comes in and gets helps me get shit done. Okay. I worked with a founder fairly recently, actually. And it’s quite a period of high growth at the organisation. One Friday, he finished work early. Came back on the Monday morning, absolutely proud. He’s like, You know what I’ve done over the weekend, folks, guys, I’ve designed a brand new feature for the app, I spent the whole weekend designing and building this amazing feature for the app, worked like 12 hours both days to do this, this amazing new features and here it is. And he presented this to an engineering team of about 20 engineers at that point. And they were all like: what have you done? And this furious work had been something that stood him in great stead early on when he was an early stage startup founder. Okay, the furious work is what helped him produce and build the most amazing startup in the world. But again, there’s a dark side of that, that that skill that he had used, his furious worker came in and took over when he was in periods of stress or periods of challenge, or periods of problems.

Anybody else got a furious worker out there, that when you’re a little bit stressed, you sort of work really hard on something without really knowing what you’re working on? Or why you’re working on it. Okay. Again, it’s a board of directors that’s helped us probably at some point in the past, but again, we now know that probably it’s not a good idea. And it certainly isn’t, if you’ve got a family, to be working on weekend on a brand new feature. Again, it’s useful and it’s somebody great to have on your side. But again, not somebody really, really want to be taking over when things get really really difficult.

Imposter Syndrome: the Imp.

I have another board member on my board of directors, this is him: my imposter syndrome, and he’s with me here on the stage today. There’s been whispering in my ear all day: Joe, you’re not good enough to be doing this. What are you doing on stage here? People are gonna think you’re awful at this, you’re not worthy of being up there. Anybody else have an impostor syndrome in their background as well. So it’s something we all know. Okay. Now, Imp has caused me great problems today in terms of making me quite nervous before I went on stage. If you’ve seen me pacing beforehand, you know that I was quite nervous – fine now. But it was also the person that’s helped me build a great book, a great presentation. I didn’t start this last night at 12 o’clock, the night before, and we’re going all night to pull in the light to direct the presentation, it has helped give me the time to prove what I’m doing. So again, there’s a good side, the dark side to one of my directors, which again, is in this is one of my favourites.

The Money Chaser.

Actually, another one of my board of directors, again, that I hear about from a lot of founders that I work with, this is the one, that: everything’s gonna be alright. If I can just earn or just exit and get 10 million. Anybody familiar with this one, if I just can get this business in, or I can get this big deal, if I can sit next 100,000 pounds with a business or I can sell this company for 10 million, everything’s going to be fine. Anybody had that feeling? Like it just did a lot of money and exit great, everything’s gonna be fine. And this money chaser for me is going to be a great problem in my life, okay, alongside the furious worker.

So I founded a startup in 2018. I’ve not talked about this publicly, by the way. So this is a big deal for me. Three friends of mine, three co founders, we raised quite a lot of money. And we immediately the three of us, when we raised money for this business realised it was a bad idea that we shouldn’t be doing this, that we weren’t set out to be founders in quite that way. And we gave the money back. And it was a big deal for me in my life, when that happened. And I you know, set myself up as a failure, the imposter syndrome was coming in, all of these things were going through my head. But what was going on at this point was this part of me was talking with this board member, my board of directors was speaking to me right there and saying: Look, if you just found a unicorn, everything’s gonna be fine. If you find a billion dollar company, everything’s gonna be fine in your life. I mean, how hard is that? I mean, ridiculous voices and these things these boards of directors tell us in our life, and what’s problematic about this particular member of the board as well, this is based around anxiety, which we all know. Okay. And this also can be exacerbated by cultural events in the world like, you know, COVID-19 or wars that are happening around us that can spur on these elements of some of our board of directors and make this feeling more acute.

Neurodiversity: Joe’s Dyslexia.

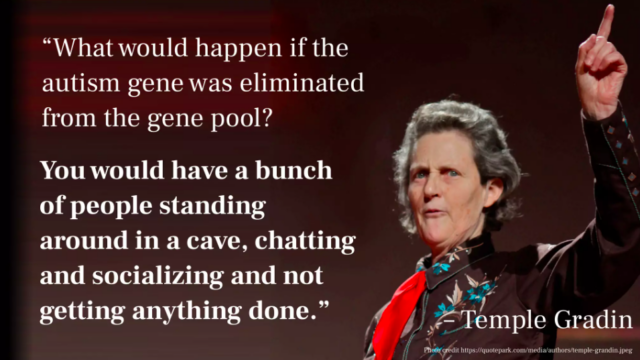

Finally, I suffer from dyslexia, and have done obviously, since I was born. And Dyslexia has always been a part of me, but it’s always been a part of me that has driven me to do much more. It’s that: screw you. Or to my teachers it’s that: do you think I can’t do it because I’m a bit stupid? No, I’m going to show you what I can do. Okay? Anybody else dyslexic here or identify themselves as you’re a diverse ADHD or autism or something like that, okay? Again, it’s a board of directors that can stand you in great stead when they’re on your side, but when they’re not on your side can cause you great problems in life.

So these are my internal board of directors. And what’s interesting about the bad side of them, which I’ve talked about here, there’s also the good side, this is temporal grading, talking about autism right here. And I love this quote, it’s fantastic. And this is absolutely true of everybody in this room, okay, when we are great people talking and chatting. But we’re also people who are very focused on what we do in terms of building tech and SaaS companies as well. Okay, if we weren’t doing what we’re doing, if we didn’t have elements of the autism spectrum on what we do, we would get nothing done.

So again, lots of these boards of directors, our internal board of directors can be people that can help us and support us throughout. So here’s my internal board of directors, okay, I’ve got about 10 more, and I’m always on the lookout for them. But they’ve helped me be the success that I am, and also points in my life that caused me to hold me back from all of those difficult situations and challenges that perhaps I should have jumped into. So they’re both protectors, but they’re also enablers for me. And what’s interesting about when I talk again, to a lot of the founders that I work with, when we talk about their external board or their board of directors, there’s a lot of fear there. Okay.

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

Board Meetings of Dread.

So when I talk to a lot of the founders I work with, this is what I hear when they talk about their board of directors, their actual board of directors, their external board of directors, okay. They say things to me, like: I hate board meetings, I hate the board meetings, I hate the grilling, I don’t think it’s fair to put my senior team in front of the board. They want to protect their senior team from that, honestly: I’m intimidated every time, I hate the preparation, that detail I need to go in. Okay, so I hear lots of fear and worry, particularly around the board meeting. And this is typically from founders, when they hit kind of Series A, we’re taking some significant investment, and they’d have to get very serious about the Board of Directors they take on, it starts to become a burden to them and a challenge but not in the right way for them. Something that worried and intimidated about it.

Again, it doesn’t have to be like this, it doesn’t have to be like this at all. And so you can start Googling for how to deal with this, okay, and that’s the best place to start for all of us. That’s where we start. There’s not an article on Stack Overflow, maybe there’s something in the Harvard Business Review about how to manage a board. And you come up with articles like this, okay, from this very smart Yale professor, Jeffrey Sonnenfeld. And he says, you know, in his Harvard Business Review article, which is called: What makes a great board. This is what he tells you to do. Okay? It’s not about tightening procedural rules. To be a strong, high functioning workgroups whose members trust and challenge, over engage directly with senior managers and critical issues facing corporations alike. Great, thanks, Jeff. But what does that actually mean? How do you do this? And every time we read articles like this, and there’s so many of them out there, when it comes to managing business and managing the world of business, you read so much of this stuff, they tell you what you should be doing, but not how to do it. And it reminds me very much of this, this image, you know, this one? You know, it’s like, classically, this is many, many Harvard Business Review articles, right? They’re always like this. And then you ask them or give me the debt theory, what’s the dept to do this sort of stuff and the debt simply isn’t there? Okay. They just asked you to draw the fucker out. Okay.

Let’s talk about that today, then. So let’s talk about situations of managing a board. So how do we do this? So let’s take a typical board. This is the board of a FinTech, SaaS startup, okay, they’ve taken some venture money. They’ve been told to get a board of experienced industry veterans to help direct and manage the business. And I’m going to talk about four specific directors that are on this board. Okay. They’re all stereotyped. But they’re all best examples of actual board members that I’ve met and I’ve worked with and the people that I’ve met, that I coach I’ve worked with as well. So if you’ve got a board like this, I do apologise. Now nobody’s board is probably this intense, but here’s some examples of some of the things you’re going to hear from your board.

So let’s talk about the first one. This is the insurance big week. So this is a CEO, she’s now in semi retirement. She was CEO of an insurance company in the UK for many years. She is excellent. She’s had a strong career of building a solid, process driven insurance companies. Okay, great. So be great to have on board. Okay, and you present to her and you say: hey, things are going well in our business. Here’s the sort of things that she’s going to say back to you: okay, we need to consolidate and protect, we need to minimise risk and we need more process. Ever come across anybody like this? Often, if you’re hiring a senior management team for the first time, you can hire people like this, okay. They’ll come in and they’ll say: we need more process. You’ve probably heard this time and time and time again.

Insurance Bigwig.

So why is she saying this? Where’s this coming from? insurance business, this is what They do that. I mean, if you hire a big four insurance business, you’re going to hear this. Okay? So it was no great surprise there. But again, it’s hard to know what to do about that. This is all this person says to you. Now, she’s built her whole career on this, this is her winning strategy is to implement process to consolidate and protect and to minimise risk. Her whole career, this has been her winning strategy. So this is what she’s going to tell you to do. Challenging, really challenging. And we can define her as simply being a classic type of a manager here. Okay, this is what managers do, they manage and talk about risk.

Merrill Lynch Exec.

Others that we have the Merrill Lynch executive, I’ve deliberately chosen Merrill Lynch here because the bank isn’t around anymore. Let’s talk about the Merrill Lynch executive, this is the things they’re telling you when things are going well: the team is too inexperienced, our competitors are breathing down our neck. What more could we be doing to improve this stuff right now? Okay. So driven person coming from a very driven financial institution, that’s where this person is coming from. Okay. So you understand what that advice is, and what that support is that this person is telling you right here. And this is often we can describe this person as being a critic, okay? They’re telling you things that are not great about the work that you’re working on, telling you the weaknesses of what your are. And again, this is really useful stuff for you to hear. But it’s no doubt that many of the people I work with, say things like this, if that’s what they’re hearing from their board is we need more process, we need to do more, you know, competitors are breathing down our neck. This is great advice from the right sorts of people at the right time. But it’s really strongly intimidating. If you’re a first time founder, certainly a first time CEO, being told these things by these people, it’s really challenging to be put in this position.

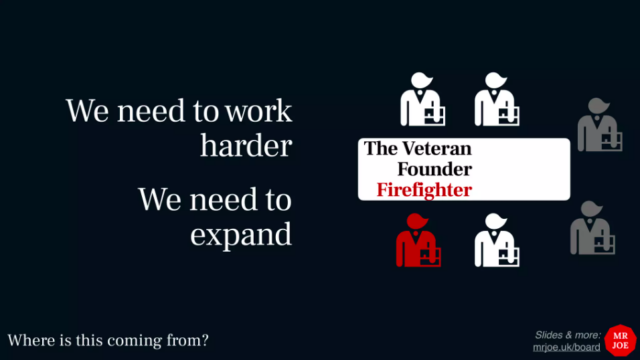

The Veteran Founder.

Okay, let’s keep going. So, other people then who are probably more on your side, we have the veteran founder, Okay, anybody have a veteran founder on their boards? So people who’ve come in the next two before, okay, again, fantastic people to have cause they’ve got some amazing experience. Okay, here’s some of the things you can hear from them. We need to work harder, we need to expand, okay. Similarly, they’ve got a very similar playbook for the success that they’ve worked on. Typically, that’s built around working hard, working long and expanding and growing in terms of what we’re doing. That’s how they’ve built their business. That’s where this is coming from for these folks. You can define these folks as firefighters, okay. They’re amazing people to have on your side, when there’s a problem. Having somebody like a veteran founder on site can be amazing for the strength of your company, because they are there and they are going to work hard for you on your behalf. Having a firefighter on your team is a fantastic person to have.

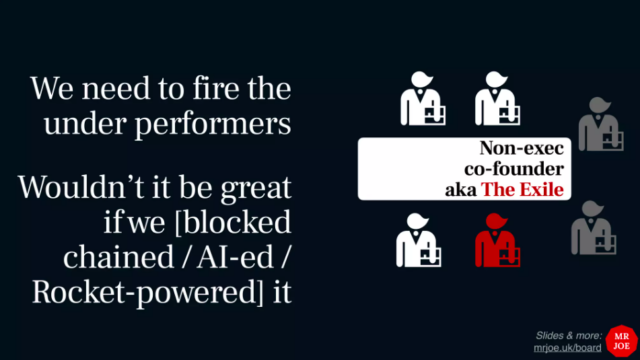

Non-Exec Co-Founder.

Okay, then finally, we have the non exec co founder, so a non exec co founder. He’s got some equity, but perhaps he’s not the executive board anymore. And they’re saying things to you things like this: we need to find the underperformers. And would it be great if we Blockchain rocket powered? Ever had advice like this recently for anybody in your board, you know, sprinkle a little bit of blockchain in their way of the AI stick at it. That’s just AI, it’s Rocket Power it again, these the sorts of things you can hear from your board members. And again, obviously, this means nothing. And you as smart tech founders, no, it is not that simple. But again, this is the sort of advice that you can end up getting from your internal board members. Again, extremely, very, very extreme. But again, you’ve got to understand and know how to manage these things.

Okay. And these non exec co founders, typically called the exiles and their exile for a particular reason, because again, if somebody’s telling you to blockchain it all the time and AI and rocket pairing and firing everybody, that’s not somebody you want on your executive team, they’re still somebody you end up having to work with.

And you can see the value there. Because they’re going to come and they’re gonna occasionally sprinkle some fairy dust to some amazing ideas for you. There’s real value. But again, how do you manage challenging difficult people like this? So the first thing you could think about is, well, we can ignore them. Right? Great advice. Thank you very much. And ignore it. But what happens if we ignore these four very strong personalities? What’s going to happen? Are they going to sit down and take that hold their tongue? No, they absolutely are not. And you can end up with a situation like this, where they start shouting louder and louder and louder. If you ignore them. If you don’t, don’t take on their advice, they’re going to shout louder and louder and louder. And this is the points when they do get more challenging for a founder, where they do start to really be much more critical of everything you’re doing. They’re critical anyway, but they’re doing it much more of a lead the crushing of leadership skills, crushing the position, you’re in crushing all of these things that you do not need. If you try and squash them down and you don’t listen to them.

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

Okay, so we have these four folks, on our board, okay, all extremely useful, giving us very strong advice exactly when we need it. But again, always we can see the dark side of where these folks have come from the advice that they’re trying to give us here. So what happens in the conversation when things aren’t going as well as expected? What’s the advice you get from these folks, when things are a bit wobbly? Or things aren’t going well? What do you hear from them?

Let’s start with the first one. AKA the Merrill Lynch exec, aka the critic, where they tell you when things aren’t going well. Which is extremely useful, I told you, so competitors are breathing down your neck, you should have done this, you should have done this. This is your critic here. And your board member being a critic telling you: I told you so. Okay. And that’s again, strengthening their position. Now, their advice may not have been the right advice for you to take when things were going well. But when things are going badly, they’re going to tell you, you should have taken their advice. And again, they win power over you and that winning strategy that they’ve already got strengthens their position based on what they think they know from before. And then you hear from the insurance big week: hey, we need to consolidate and protect, we need to minimise risk, we need more process. So when things are going badly, they’re winning strategy comes out again, and this is true of so many of us humans, okay, when things are going well, we have a winning strategy. And that winning strategy is what drives us forward, that gets strengthened and strengthened and strengthened in us. And then when things go badly, what do we do? We go back to a winning strategy and hope that that’s gonna help us get through this. Okay? Most executives do this, most humans do this.

Okay. Now, again, for a senior person within insurance, short of the 2008 financial crisis is probably not too much of a challenge that they’ve ever really faced on a large scale, certainly not the challenges they’re facing in the organizations you’re in and the size of the businesses you’re in right now. It’s not the same sort of thing for them. Okay. So when they come back with a winning strategy, when things are going bad, they’ll tell you the same thing. Just not exactly what you need. The same is true of the veteran founder, we need to work harder, we need to expand, they’ll tell you the same things about how to do it because again, that’s a winning strategy.

The same is true of the Excel: we should have blockchain at this, blockchain it now, we need to tie them into POM. The advice is the same when things are good and when they’re bad. So the question comes down to, what do we do?

Listen.

Okay, this is the advice we’re gonna get from these folks. We need to understand what’s coming from, what it is, how do we deal with this? So here’s some very, very simple advice. Okay. Listen, and thank them for their comment. Always listen and say thank you for your input. They’re okay. Not rocket science, but believe me, just thank them for their input. That’s very helpful. Thank you very much. Okay. And then understand why are they saying this to you? No, that’s extra. Course you need to sound sincere with that, not sincere when I said thank you there.

So work on sincerity skills, understand why they’re saying this to you. Okay, where’s it coming from? What’s the point of the reason? What’s their background? Why are they saying? Where’s this coming from? Understanding what their winning strategy is and why they are giving you the advice they are giving you. Okay, understanding that from where it is.

And then obviously asking the question, is this the right thing to do? Ask yourself that, okay, is this the right thing I should be doing at this point? Really questioning, is this the right thing we should be doing, talking to the rest of your executive team about this, taking this advice onboard. Rather than dismissing it or thinking it’s not relevant. Is this the right thing to do right now, dealing with these difficult situations and challenges. And then obviously, deciding what you should do based upon that as well.

But again, the key is listening, understanding where that’s come from, taking that forward, is it the right thing to do is the thing we should be doing going forward. Okay. Listen to these folks. Because again, there is a winning strategy that each of them have got, understanding what winning strategy is can help you build and grow and strengthen your business when things aren’t going well you can understand why they’re telling you that particular winning strategy and if you should listen to that winning strategy by understanding the context of where they’ve come from.

Okay, so you get these four examples of types of directors that sit on your board. Okay, you will know this gentleman. Of course, would you like Elon Musk on your board? Hey, there’s lots of reasons why it’d be great and lots of reasons why it wouldn’t. Now we can take that same criteria that we’ve used for external board we can start to look at our external board again. So if Elon Musk was going to be on your on your board, which type of board member would he be? Which of these do you think he would fit to? Is your manager consolidating protect and process – he doesn’t strike me as that at all. Which ones of these is he? Definitely an Excel, crazy ideas, which else?

Well, honestly, he’s probably all of them. I could have spent ages building the slide look at him and we learn a flame thrower. He’s telling you Tesla’s stock price is too high in my opinion. Why is he done that? Was he that clever? Is that mean? Is that really what he’s doing. Does he really think about what he’s doing before he tweets? Elon Musk says that he tweets 50% of his tweets when he’s on the toilet having a poo. All right. That’s one of his tweets. So what’s interesting about Elon Musk, and what you see about this is lots of these types are coming through from him. He’s not just one type of person, okay, he’s not just an excel, he’s also a critic, Tesla’s stock price is too high. Okay. He’s also an excel, because obviously is telling you to build, you know, how much effort has been put into him building a flame for everyone in his businesses, when he could be, you know, building an amazing electric car company or putting people on to Mars, there’s a lot going on with the different types that he is in terms of his personality.

And once you start to see the directors of others, you can start to see yours as well. So I’ve pointed out some of the ones of Elon Musk right here. And it can start to help you understand how people have built some of the successes that they have, you cannot start to understand how Elon Musk has built his success, because he’s like this, okay, he has crazy ideas, I’m gonna build a space company and send people to the moon. I mean, if somebody is to tell you that that’s a crazy idea that comes from a place of an exile is coming up with amazing ideas that need to push everything forward. But again, it works for Elon Musk for so many different reasons. And so you start to see these boards of directors and other people, you can start to see them in yourself, too.

So here’s Justin Kan, he’s the founder of Twitch, which has over a billion dollars. And what’s interesting about this, as you look at him, and you understand that one of his directors is imposter syndrome. Right? Yeah, he’s built a billion dollar company and sold a billion dollar company. And it comes back to the idea that your external board of directors can both be an amazing thing to help drive you forward, but can also be holding you back. The same is true of your inner board of directors, too, is imposter syndrome is a feature, not a bug for so many of us. It makes us work harder, think harder, prepare harder to do the things that we should be doing. It’s not something that’s stopping us. And it can be something that stops us. But it is a feature as much as it is a bug. And so we read things from people about squashing impostor syndrome or banishing their ADHD is embracing these parts of you that’s going to help you be stronger and be better at what you do. These are the parts of you, these are the directors of you, that have made you the success that you are now they shouldn’t be driving you all of the time. Because again, if imposter syndrome was driving me right now, I would not be here. But impostor syndrome has helped me be much better at what I do. That was a great talk from Jason Cohen and WP engine from from BoS 2017. About healthy, wealthy and wise we talked about a different lens of looking at these things in as well. Fantastic. And he comes up again with some similar examples.

So again, this is back to my internals board of directors. I said understanding here. I’m gonna mix my metaphors quite brilliantly here. So here’s my internal board of directors. And I’ll ask you the question, who’s driving the bus at any one point in terms of these as well. So by understanding and identifying your internal board of directors, you can understand who is driving the bus at any one time. I mentioned, if my imposter syndrome was here, right now, I will be on the stage. There’s lots of these, it’s about control and how these come out and when these come out.

So you recognise this from a couple of weeks ago. So this is Will Smith at the Oscars when Chris Rock said something quite disparaging about his wife, who stood up, came to the stage, slapped him. Please don’t repeat that today. Okay. Hopefully I won’t say anything that’s gonna offend you that much. Okay. But we can start to look at this incident through the lens of what I’ve just talked about here as well.

Internal Family Systems.

So the things I’ve been talking about here today, managing external board and more importantly, managing your internal board is based on a theory called internal family systems by a gentleman called Dr. Richard Schwartz fantastic stuff, okay. He’s a therapist, has been for many years, he looks at Trauma specifically, this is quite deep stuff. What’s interesting about this, as I mentioned, I’ve got a background in psychology, my background’s in neuroscience, in fact, there’s a lot of amazing science behind this stuff. And his book is called No Bad Parts, which is again, the same as what I’ve been saying to you here as well. There’s no bad directors on your internal board of directors. There’s nobody there that’s intrinsically bad. We all bring value to what it is that you do. Okay. Be that your imposter syndrome, your dyslexia, your furious worker, they all bring value to you at some point.

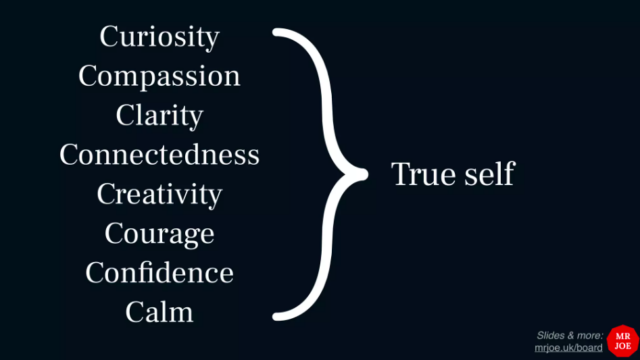

But again, you’ve got to be making sure that that particular director isn’t driving the bus or being aware of who’s doing what at any one time. Now, what’s interesting and amazing about this theory, is when you start to look at what happens when you take away these onion layers of all these, these parts of these directors is you end up seeing what’s underneath. And what’s underneath here is what they call the true self. And what’s interesting about that is you look at these words here. And these words, these nine C’s are great words to live by as a leader, as a human being, generally, you know, curiosity, compassion, clarity, connectedness, creativity, courage, confidence, calm. I get people approaching me wanting things like clarity. I know that organisations that are extremely successful have a high amount of curiosity about their customers, okay? To be a great parent and husband or wife, or even indeed, employer. Compassion is extremely important to you. Okay? So there’s lots of amazing things that sit underneath our friends here, our internal board of directors, and they can get in the way of the work that we do, connecting us to our true self underneath. And that’s exactly what’s going on here. Right.

So is Will Smith a violent person? Well, it depends on how you look at it, there’s a part of him that is but him as a whole, probably not. There’s a part of him that reacts to situations with violence came maybe that’s part of his upbringing, maybe that’s come from somewhere in his past, but that part of him or that director there that caused him to go on to stage and hit somebody has come from somewhere that’s been strengthened by an experience he’s had in his life. That’s caused him to realise that that’s a strategy that can work as a part of him in control here.

Now, what’s interesting about Will Smith is this comment that Denzel Washington made to him directly after this when he was trying to get him to calm down, okay? ‘In your highest moments, be careful, that’s when the devil comes for you.’ And what’s interesting about this is you can start to look at other CEOs and other leaders in organisations who’ve made really bad, awful decisions, and start to look at it and go, Well, why did they make that choice, which part of them was talking or which director was talking when that choice is being made. But you look at the horrific stuff that’s happened here in the UK with P&O Ferries, where they made all their staff redundant. On the same day as hiring a whole load of new casual staff, you can look at other huge corporate malfunctions in the past and understand well, which parts were in control of the leaders of those organisations, and what got out of control.

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

Out of Control.

Okay, so this is what happens when those directors or those parts of you get out of control, if you can end up reacting like this, okay? Doing the things that you you’re not happy about that behaviour that doesn’t make you stop shouting at your staff or do the things that you know, you shouldn’t be doing. Okay? This stuff can get out of control. Because understanding again, who’s driving the bus in this situation? When understanding if you take two people, and looping back to that first question, they asked you about checking your email, checking your email might seem fairly harmless, something that you do, but you can end up finding yourself doing stuff like and I’ve been guilty of this doing stuff like this. Yeah. Checking your phone, checking your Instagram, checking your email, when you know you’re playing with your kid in the park. You know, we’re supposed to be having some family time at home and you’re thinking about work elsewhere. Again, I didn’t have to ask you because I know you will have this. All of us do is highly driven people. And this is what can happen when your parts start to take too much control of you, when one of your board of directors is exerting too much control.

Too Much Control.

Now I talked to you about your external board, the same danger comes from external board if they’ve got too much control, if there’s too much process, there’s too much focus on competition. If there’s too much focus on building rocket powered flame throwers, you’re not going to have a successful business. All of these things come from balance. Anytime one of our directors gets out of control, internally as well as externally, we need to connect with our inner self and understand how to manage that particular situation. Okay. Because these folks, again, I’ve got superpowers and again, with your internal Board of Directors, I asked you the same question, what happens if you ignore your internal board of directors? So what happens if you ignore your internal body? For example, it’s like the money what? Who’s anxious about money? Okay, so if I just can make 10 million, everything’s going to be fine. What happens if you ignore that particular inner board of directors? What happens? Do they go away? The same happens if you ignore it, external board of directors in the same way, these parts shout at you, they push themselves out in different parts, they maybe that’s three o’clock in the morning or points when you’ve most don’t need it is that anxiety comes back to haunt you. So again, it’s understanding where this is coming from. Okay. It’s that part of me that caused me to lead me to start that hopefully billion dollar unicorn when we gave the money back. That was me trying to deal with my anxiety about working hard to deliver a unicorn company that I could sell and live off the profit profits forever. That was driven by my anxiety, a lot of that journey, just the last place I wanted to be as a founder.

And so again, squashing them down means they just come up in other places, most unexpected ways. And again, that’s not the way to deal with them. You just do this with you and the board of directors. Listen and thank them for their comment. Kind of strange talking to yourself like this. And now obviously, that’s the first sign of many other things going on. But again, when you look at the work that Dick Schwartz has done, it’s all about doing this talking and acknowledging your internal board of directors, as well as your external board of directors. Listen to thank them for what they’re telling you. Okay? Understand why they’re saying this to you. So why do I need 10? million? What am I most worried about? Why is this happening here? Why are they saying this to me? Is this the right thing to be doing right now that why am I checking my email right now Where’s this coming from? He’s telling me to do this is this the right thing to be doing right now, having that conversation with yourself around that, and then understanding and deciding what to do about it.

Now, this stuff’s not just going to happen overnight, you’re talking to you, it’s a muscle you need to exercise. But once you start to do it, you start to see more of this in your life, okay. And to use a, an overuse of energy in this world of the tech world, this is your underlying operating system of these nine cities, if you can get back to this, if you can get over those parts of you that are in control, or there’s directors of either in control a lot of the time, you can work in your underlying operating system. And this is a lovely place to be if you can really be here. And what’s interesting about these nine C’s as well as these are also extremely strong leadership traits. Okay, who wouldn’t want to hire a leader that has all of these things? Okay, extremely strong leadership traits. And so again, when you’re with your external board of directors, you want to be more like this, right? You’d want to be Will Smith slapping, not not the over going to do that, or Elon Musk with your crazy flame thrower.

But again, having this when it comes to managing your external board, having these nine C’s, you can see how that’s going to be a, of course, your external board of directors wants clarity. They want creativity in the things you’re working on. They want confidence, they want calm, they want you to be curious about your customers and the business you’re in. This is exactly what they want, and they need as well. Alright. And consequently, if you’ve got children, you’ve got kids, this is what they want from you to your partners the same way all adds up into the same thing.

Practical Advice.

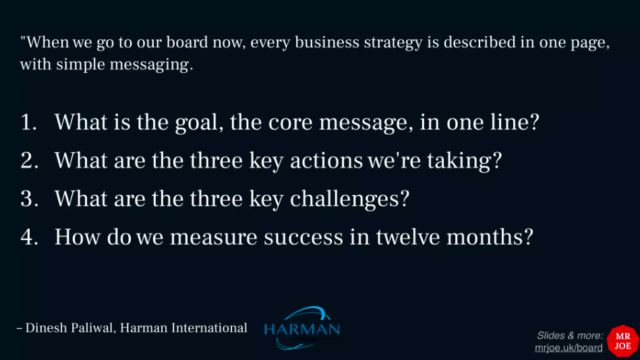

Okay, so some practical advice, because I realised I’ve given you quite a lot here of talking about how to manage these teams. So that leaves you with leave you with something extremely practical to manage your external board of directors. Okay, this is a fabulous, quote, great book called The CEO test. If you’ve not read it, read the CEO test if you’re a leader. Fantastic. And this is a great quote from that. This is from a gentleman called Dinesh Palwal, who is the CEO of Harman International remake hifi. Get sold, bought by Samsung. And this is great advice. When we go to our board. Every business strategy is described in one page with simple messaging. What’s the goal? What’s the goal, the core message in one line? What are the three key actions we’re taking? So he goes to his board with this every single time? What are the three key challenges we’re facing here? How do you measure success in 12 months, he goes to them with his very, very, very simple board overview, one page, extremely simple, right.

Great stuff. Now, again, this is a bit like You’re the fucking owl, because this is quite difficult to do. Okay. But again, I’m giving you guidance on how you the approaches, you need to take the Managing Board, you start with this, you’re gonna be in a much stronger position as you go through. And he goes on to talk about this actually, okay, my board members read that. And it’s much easier for them to understand simplifying the message is not an art, it’s a practice, and it doesn’t happen in one day, it doesn’t come naturally to most of us, it’s work and you have to spend time on it. This takes time, it’s a muscle that you need to build, you can’t expect to get this right all of the time. But it’s well worth putting the effort in to do that. And interesting how the best way to do that is to come back to this again, these nine C’s is to get to that particular statement, you need the curiosity to understand what’s going on we have more challenges are you need the creativity to understand how you can overcome those challenges.

All of these things can help you define and decide this stuff. And also, what’s interesting about this as well, is the word that when i The people I work with they come to me ask this is this stuff we end up working on together. When I’m a coach, is this individually? Is this stuff for the people I work with, okay? What’s the goal, the core message for your business? In one line? What’s the goal, the core message for yourself? What’s the goal, the core message for your relationship all is happy. This can work on so many different levels when you start to break it down. Because this is extremely strong, useful advice. And it can help you deal with these folks as well. If you’re giving a very strong core message and infant furious worker and all these folks are getting involved, you can come back to this and go no, no, no, no. This is what we’re doing. And this is what we’re working on you guys. Leave me alone for now. And as you can help me do this, please leave me alone. It’s a looping back to that first quote that I started with then.

This is the reason why people make great decisions, okay, is they understand the strengths that come from the directors that they’re working with both externally and internally. Okay, and that power comes from making a choice based on clarity, connectedness, calm curiosity, all of those nine seats that I’ve talked about here, okay. And we can easily swap out the word person here for director or part at this level here, okay? So when the wrong persons in control bad decisions get made, okay? When the smartest person is in control the right decisions tend to get made at this point as well.

Joe’s Homework for You.

All right. So before we finish that, my challenge to you is, is weave together, I’ve identified and showed you some of my internal Board of Directors, I would love you to think about yours. So for the next week, keep a little note on your phone every time you think an internal board of directors is coming up and telling you to do something, make a note of it, like just write it down, and just spot it coming towards you. Right, just noticing it. And that’s the first stage of understanding who they are and working with them is to understand who you’re in a board of directors is an email it to me, I’d love to know who they are, because I’m always collecting it. And it’s lovely to hear who they are really, super interested in who your internal board of directors is as well. Okay, don’t forget your Hey, yo, folks, as well. So thank you very much for the Hey, yo, ask, what’s your big ask, add that into the BoS channel today as well. And, yeah, thank you very much for your time, everybody, thank you.

Resources are all there. So if you want to grab all of that all of my links, videos, everything’s there. So just take a photo of that, and it will magically, magically appear on your phone.

Q: Fabulous, some questions. So how many types of board member do you think people have?

I’ve identified four types there. So may not have explicitly said it. But there’s four types really, that we mentioned that the managers, the firefighters, the critics in the excels, they are all the same examples of internal board members as well. So there’s four groups, there are more four groupings as well that are out there, too. But those are the four core ones that Dick Schwartz talks about, and they will fit into those areas as well. So you look at things like the way Will Smith slapped Chris Rock, that was a firefighter coming to the fore there. Okay, that was me dealing with an extremely difficult challenging situation. That was his his a director, that’s part of him that was a firefighter, just helping him deal with that situation.

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.

Questions from the floor?

Q: Yeah, I might struggle to articulate this actually. Because I think what I was gonna ask you changed as the talk went on. Experience is, clearly a hugely valuable thing. And it’s, you know, one of the main reasons you have a board, one of the main reasons you bring on board, senior leaders. But I guess, do you have any? So what I was gonna ask you is, do you have any tips for hiring people who aren’t just going to regurgitate that experience, but I’m not sure that’s really the question. What I really want to ask is to clarify what you meant. Do you mean to say that actually, somebody who does just regurgitate their experience actually adds value? Because for the nine things, they say they’re irrelevant. The 10 thing might save you, you know, or make you a huge amount of money.

Yeah, and there’s lots of reasons for getting done execs on your board. I mean, experience is one of them, connections is one of them. There’s lots of reasons for doing it. It depends on the experience you’re buying. So if you’re buying experience from a from a huge multinational bank, you know, what you’re getting yourself into, from that particular experience, they’re going to tell you about process and governance and all those sorts of things, you kind of know what you’re gonna get. It depends the experience you really truly think you need. So again, what situation where’s your business? Where’s your business in the world that you’re in? What sort of stage are you in? Would you say,

Q: We’re definitely sorry, we’re definitely in the sort of scale up phase at the moment. So we’re about 450 people, We’re way beyond starting at this point.

So then it depends what your biggest challenges are there. So if it’s hiring and retaining staff that somebody needs some support with on the board, if it’s somebody who’s again, experienced as a previous founder, who’s experiencing high growth, again, that’s something useful to have on the board. Probably people who are not so useful on the board at this stage are executives of large financial institutions, because they can’t typically in high growth organisations, they really can’t cope with the breakneck speeds of what you need to be doing and how you need to be doing it. And they can, they don’t know that, but they can end up freaking out a little bit. What’s interesting about folks like high IQ C suite folks of banks, they’re really great early stage, seed round, start early stage startups because they’re great on paper for your investors to go all look. So and so from bankers on the board. They’re extremely useful for that. But then again, they can hold you back when you’re in hyper growth, because they don’t, they’ve never been through that before. Most people haven’t been. It’s very unusual to find someone who’s been through a hyper growth company in the management team. So it’s understanding what you need at that point from those people and understanding how you’re going to get it from them and the right sorts of people to have there and understand If somebody’s not been in that situation before, taking their advice with a pinch of salt,

No problem. Any other questions?

Q:I wanted to ask you, you’re investing. You’re involved in picking people to put onto boards and things? What are the things that you as an early?

Q:I guess, help with introduction, I think that it’s very important. So I mean, going back to your point, experience in the field, I think is always very important. And I guess experience in whatever you need, whether it’s hiring or expanding know, your product, or if, depending on what your bottleneck is, I guess that’s one way of thinking.

Product word is it can be quite dangerous to have someone on the board who is a product expert, because again, they don’t, they don’t know, if you’re a product leader, the chances are of you knowing exactly what’s needed in that organisation at that time is quite challenging. Some advice I can give you for your board members, is many of them haven’t been on non exec board training courses. So the Institute of directors in the UK offered them Financial Times offers them as well, as those courses are actually really, really good for non exec members. They teach them how to be aware of their own biases and their own situation.

So some of those training courses are great if you’re non executive not been on them, tell them to go on a training course, because it can help them get there. The other strong piece of advice I’ve got as well is to get a good chairman or chairperson. Having a good chairperson can help understand and guide that process for you a little bit more as well. I know a couple of good chair people, if you’re interested who I can suggest, but they can also help steer those board meetings in the right direction and help you find non execs as well. So a good chairperson will know not only the experience that you need, but the right kinds of character that you need to match the rest of your board. Because again, character matching is also really extremely important too. So getting the right chair person involved can also be extremely important.

Q:On that point, actually, we quite often look for someone who can be a mentor for the CEO, especially early days, it is very important. So less of the industry experience than interpersonal.

I love that like a board member mentor is a really good idea. Because again, if you’re an if you’re in a large corporation, you’ve got lots of board experience, that stuff’s incredibly useful. If you’ve never been there before. That’s really good advice. I love that.

Q:And he should be choosing the makeup of the board long term CEO or chairman, or how does that relationship work? Typically, in terms of what he said, working? Well,

Good question. My experience is it’s good to have to do as a team, so the board should be choosing house needs to be on the board as well. Ideally, with the chairman and the CEO. We’re doing it also the on the board itself understanding what their strengths and weaknesses are. Because again, one of the best things you can do with the board is to help them understand themselves about what strengths they’ve been on what weaknesses they’ve got, so that you know who else to bring in in terms of that as well, having open, calm, curious conversations with the rest of your board to help do that can really, really work. But Anybody got into any internal Board of Directors questions?

Q:Yeah, how many are you allowed?

As many as you need? There are a lot, I mean, you can start to really break it down. I’ve sort of approaching 15, which is quite a lot of people on the board. What’s interesting about the internal Board of Directors stuff, because well I’ve just finished with this is a lot of it can seem like approaching what you see in the media is called split personality, you know, sort of approaching my limits. It certainly can be seen as that you think I’ve got these voices in my head, and maybe I should squash that down. All of us experience this, all of us experience different perspectives from different parts of our mind talking at any one time, okay? It’s not something for you to worry about. This is perfectly normal that every human being has this, were different voices speak to us at different points. Okay. You’re not crazy, you’re not going mad if you think some of these things are true about yourself here as well.

Q: What you said just suggested something to me. And that is. So if you’ve got an unruly group of any sort with lots of strong opinions, right, one thing to do is to bring them together and let them debate each other and have a bit of a workshop, right. So I could imagine doing that with a an external board of directors, let the some of them balance each other’s concerns and inform your strategy that way.

Definitely, if you can do it, I mean, the challenge you often have with a board of directors is getting them together.

Q: I was going to ask if that if that method if there was a method for the internal to bring out the competing voices, instead of squashing them and synthesise somehow.

It definitely do it in the challenges you can often have with the board of directors is you meet them quarterly. And often what you can find with certain board members is they’ll only come once or twice a year to your board meetings. That means in a bad way, but often those VC appointed folks as well anyway, so you can it can often be quite hard to get the consistency across all of those meetings. Now what your chairperson should be able to to do is to make sure that you’re reinforcing much more of a attendance at these meetings and making sure that people are always there because, again, to bought to build that high performing board, they need to be able to work together for a period of time. And actually, that means people have to come to things like you can do it, a workshop, or at the very least a certain number of board meetings every year.

Q: Joe, as a coach, how do you help people to recognise when one of the errant internal board members has snuck onto the driving seat, but you’re not fully aware of it? The blind spots is really driving.

I think what’s interesting is most people know what they are, you kind of know when you’re in that position. The challenge you often have is realising that that’s, you can change that. So a lot of folks, especially in senior leadership roles, think that you can’t you know, classic cliches that you can’t teach an old dog new tricks, they don’t think they can change their behaviour. And it comes back to that idea, again, that that behave has been so reinforced by so many winning strategies before by so much success before, this is definitely a challenge for you look at an early stage founder who’s then moving into hyper growth, the skills that got you to that point, to grow an early stage startup are not the same skills to grow a hyper growth company, they’re not the same skills to grow a large enterprise they’re not. So what ended up happening is the one of those parts that was your winning strategy early on, like the furious worker for Good is a good example of that, that furious worker, if you’re doing furious worker for 10 years to build an enterprise business, it’s going to be the end of view, and probably most of your personal relationships as well.

So the first thing is understanding that you don’t want that person in control a lot of the time, and that does come from a little bit of self awareness is understanding and thinking to yourself at any situation, who’s who’s driving the bus here, having that conversation with yourself can help you get to that point where you spot those blind spots. I can’t do it, I can help you do it. But it’s something you’ve got to do yourself by just asking yourself the question in challenging situation, we’re looking back on a challenging situation, who is or who was driving the bus at that point. Okay, which is also good, because that can help your inner critic from stopping you criticising yourself for silly things that you’ve done before. So there’s lots of ways of using this calmness to look back on previous behaviour and understanding which member of or which board was driving the bus at that point for you.

Q: Is it easier to fire an internal or an external board?

You can never fire an internal person and that’s one of the big mistakes that you’ll see a lot of therapists make a lot of coaches make a lot of you’ll see people on stage saying banish your inner demons banish your imposter syndrome. You can’t simply can’t do that. It doesn’t work like that. Right? But yes, you can. It’s easier to fire an external board member. Definitely. We could talk about that if you need to do that afterwards. I’m not an expert in that but have worked with with folks who’ve done that before. Thank you.

Mr Joe Leech

Founder, Mr Joe

Joe is a trusted adviser and coach to CEOs of start-ups, high growth tech and Fortune / FTSE 100 companies.

A recovering neuroscientist, then a spell as an elementary school teacher, from UX research, to design, to product management then to product and business strategy.

Joe is also the author of a book on psychology, and has has a background in Neuroscience and Psychology. Joe brings 15 years in tech, $20b in revenue, experience with 30+ startups & FTSE / Fortune 100 giants.

Want more of these insightful talks?

At BoS we run events and publish highly-valued content for anyone building, running, or scaling a SaaS or software business.

Sign up for a weekly dose of latest actionable and useful content.

Unsubscribe any time. We will never sell your email address. It is yours.