Dharmesh Shah, Founder/CTO, Hubspot

Hubspot, the company Dharmesh co-founded in 2006, has grown over time to become a publicly listed company with over 1,000 employees, revenue approaching $200 million and a market cap that makes it a public unicorn. In this talk, Dharmesh shares some of the things he got right as a technical founder but more importantly, some of the mistakes he’s made that challenged his assumptions about how to grow a big ass software business.

Slides, Video & Transcript below

Video

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.

Slides

Transcript

Dharmesh Shah: All right, hello BoS! I’m Dharmesh, some of you saw me speak at a BoS before. How many saw me speak before? My apologies! I’ve gotten a bit better but not by much. I’m the co-founder and CTO of HubSpot. How many customers? How many know of us? That’s a good sign. So to get things kicked off, in case you were doubtful, I love software businesses. I’ve been working in software a better part of 25 years now, I have start-ups of my own, HubSpot is my 3rd.

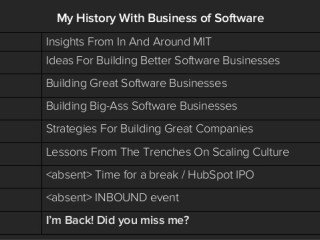

In 2007 when I heard they were gonna put together this event for people to talk about software, I thought that’s awesome! This thing should exist; am I glad they are holding the party. This is my son’s reaction. The problem was in 2007 they didn’t invite me, I didn’t know it existed and I didn’t learn about it until 2008. I did go in 2008 and I think the reason I didn’t know – no one knew me, I just started HubSpot. I had graduated out of MIT and was in the academic world in the early stages of HubSpot. I tried to take all the stuff I learned and distil it down into one talk back in 2008. It went pretty well but they kept inviting me back cause they didn’t think I got it right. We will give you the same titles, maybe I will do this again. Came back in 2009 until 2013. The only one that was different was the last one around scaling culture. In 2014 I was absent and although some say the audience is tired of me, it might have had something to do with this. HubSpot went live around 2014, around the BoS and it’s gone well. This is the gratuitous photo of the bell, why aren’t you excited? That’s me excited, that was awesome! So 2015 I was absent because it happened to coincide, HubSpot had an event, I was in front of 14,000 people and I freaked out. And here I am! I’m back, it’s nice to be back to BOS! [clapping]

I resisted the temptation to put the Jack Nicholson picture in there because I hate horror movies. So this is one of the few bragging slides I have and I’m not superstitious at all, in fact I believe strongly against people having strongly held beliefs that are not scientifically based. On this front, every time I’ve spoken to the BoS, I had this revenue slide even when we were private and the one time I don’t put it down there, the numbers will go the wrong way. So that’s why this is here. HubSpot has done reasonably well, the revenue is at 64 million per quarter and about 260 this year. Every quarter we’ve grown 50%, we have 20,000 customers, 1,300 employees and the founders are working and happy. My co-founder and I talked about this, this company is 10 years old now and the reason I’m happy is I get to do the things I love which is Python is my language –

So I will start with a confession and we will roll into the heart of the presentation here. Every time I’ve spoken to BoS and speak generally, you don’t know me that well, it doesn’t come from a place of arrogance. The reality as we all know everything is not awesome – there are lots of issues and we’ve discovered the – it’s not a good way to find land mines, to step on them. That’s what we’ve done across the 10 year history but what you see publicly is things we shared.

This time I will focus much more on the mistakes and the things that we got wrong that we later learned and we would do differently if we could. This is the title, lessons learned from 10 years of likely mistakes. Some can be good or bad for the company. This is the SEC required Safe Harbour statement because it’s a public company and I will paraphrase what it says, just because we’ve done well in the past doesn’t necessarily mean we’ll do well in the future. Don’t use past things for the future. The reason I put this up here is because the opposite is also true. Just because we’ve done stupid things in the past doesn’t mean we’ll do them in the future. Don’t sell your shares! I’m saying don’t do anything related to HubSpot stock based on anything I say in the next 50 minutes. I know this is odd structurally but if you have questions along the way, you can get my attention. You don’t have to wait until the end, I have some content and we can make it – some of it is good. Feel free to interrupt me or you can write it down, whatever you want.

I will talk on the early days of HubSpot, about 12 years ago I was a grad student at MIT and I met this guy, Brian, and he’s super clue-full and we were thinking of doing one start-up together. Brian had one problem and that’s that he was in business school and this presented a challenge because if there were a probability function to calculate the chance of success, let’s say it’s .01 and there are factors that diminish it over time. There’s one exponential factor that was in the tech sector and software and it’s well your overall probability of success goes down exponentially with the number of MBAs on the early team. The reason this was a problem, if I start a company with you, out of the gate we’re down to 50% to our chance of success. It occurred to me later that I too was in business school so now we’re down to 25%. Then we hire a VP of marketing, sales and customer success and engineering, all MBAs from MIT. And so the issue and I say this in jest, all kidding aside I love MBAs. It’s not because I’m one and my best friend and co-founder is one, but they were useful and I think MBAs are more useful today because there’s a lot of business stuff going into the company, it’s about getting distribution, measuring the client economics and MBAs – the good ones – are good at that. So that was not the issue here, I didn’t know this at the time cause we didn’t think of this at the time, but we planted the seeds of homogeneity – all from the same school and white, except me I’m almost white [laughing].

So it took us years and now we’re still working through. Once we recognised this was a problem, getting through it and trying to get the numbers back where we think it should be, and we all agree it’s a super smart and necessary thing to do and it’s hard. We’re collecting more data around our funnel and interview dynamics.

Anyone knows the – I’m not a sports guy and won’t say anything bad about the NFL but one of the good thing they did was for all coaches you have to interview a minority candidate. So it forces yourself to consider that option so we have that at HubSpot now and it’s going well. We’re trying to measure how people are doing at the front.

Speaking of people, I would say about 6 years into the company we used the word culture for the first time and I talked about this and won’t spend a lot of time on it. We documented our culture and it’s been reasonably popular and it captures the way we think about culture and how we operate and it’s been good for us. Promise did a much better job at this and we believe in this transparency and autonomy and who you work with is much more important than who you get. It’s not the perks or beers but who else they work with, who their peers are, that’s the number one thing. There’s some correlation between a happy employee – we do an MPS score, we’ve been doing it for 8 years now where every quarter we ask on a scale of 1 to 10, how likely are you to recommend us to a colleague? But there’s evidence to suggest that happier employees tend to make better companies. That’s one citation that works, and we’ve been watching those companies and said that would be cool! And the usual suspects show up, this is from last year and there’s a reason – the tech companies have a strong focus cause they get the model – this is my last bragging slide, last year HubSpot was number 4 in terms of the best place to work and the reason is we don’t cater dinners because we don’t. most perks associated with high tech companies, we don’t have this. The number 1 negative feedback we get is that HubSpot doesn’t pay as well as other alternatives. The perks aren’t there, the salaries that’s not the thing we lead with.

The problem with culture for us is that we started late. It’s not like we didn’t know it was important but we didn’t think about it, hence the diversity issues in the early years. Someone else mentioned this earlier today, just build a company that you want to work in. We did that and realised it doesn’t provide enough decisions – so that was a challenge there. This is our mission, doesn’t really matter for you. What does matter is because many companies deal with this identity crisis, you’re started a new company it’s like you’re coming up with a thing that will go on a shelf in a food store. Where does it fit? What’s the category?

HubSpot’s challenge when we started, we could call it internet marketing but that seemed to broad to us. There’s 1000 of those things and no one knows what that means. The closest fit was marketing automation but it was the opposite of what we were doing at the time. We were like we know, we’ll create our own category! I’m not saying it was a mistake, but we underestimated what that means to create your own category, it’s a very easy decision to make, it’s hard to execute on. I think we pulled it off reasonably well – the category we came with at the time called inbound marketing, we made it up. That’s one of the upsides. Downside is no one knows what that is and knows you made it up.

One of the things we learned early on is that there are 2 things that you can sell in the world, you could sell a tool that solves a problem people have or you can sell a transformation that says whatever you’ve been doing is wrong, you need to do it this way. They are different, as well as the approaches and the challenge that software companies often have transformations but then they pretend like they are selling a tools. Tools get bought because people knows they have this problem, but this one is better for me for these reasons. They will put it on their cards and buy it. If you’re talking about a mere religion change, it’s hard to pull that off, I don’t care how good your content marketing is. And this didn’t occur to us until much later but you should ask yourselves what are we? Where in the spectrum of tools where people get it versus transformation. So in order for us once we were in it, we were in it to win it

So, when we first started we raised $5 million and I never raised venture capital before and it was the two of us and a house plant in this room. It’s a software company, I don’t know how to spend $5 million. As it turned out we figured out how to spend it cause we raised another $100 in private money and we spent it around creating movement around this category we wanted to build. There was no playbook at the time, we wrote a book and started an event that now has 15k people attend, we have the community and blog and all these things to do it. One of the most important thing we did in terms of things as we didn’t trademark the category. Our goal was not to own it, but for the category to exist that we felt we fit in. So, we said we’re not gonna trademark this, we hope people use it and adopt it because we think these categories need to exist because there’s so many things and we put the dollars behind it to promote it. This is a tough one, so when we started, we started a small and medium business space, almost everyone said don’t do that! Our board, about half the management team [laughing]. It’s been tough because the reason people say this is because as it turns out historically there are very few software companies that succeeded in SMB. And the reason is the cost to acquire a customer – it’s high. Cause it’s expensive to reach them and the lifetime value wasn’t enough to justify the acquisition and the reason is if you’re back in the 80s or 90s you have to get on shelves, and the payment and business models didn’t have a subscription built in and that’s why people pushed back on us and said you won’t be able to pull this off.

So they pushed all the way to the analyst said we get you’re SNB right now, and then they would pause for a second and we too, but when are you gonna move into enterprise? This is what they said every time we had a meeting. I put this out there because a lot of you are in the SNB space, the good news is that there are now dozens of companies that proved this can work. We said we won’t go with it, the sub 5-10 employee market cause that’s hard. We won’t try to build a product that we think we can solve this SNB thing. We’re gonna resist the temptation to get pulled up into the enterprise and I mean that. In software there’s reverse gravity, you launch your product in SNB or small business and over time gravity pulls you up in the form of customers saying we want these features. We love the product but if it did that and that, it would be even greater! Then if you decide to go into enterprise, you will find in the company that every number you care about will get better. The market will send you validations, everything looks better as you slide up into the enterprise and that’s why every software company does that. We said we won’t do that and the reason was every software company does that and there’s a bunch of competition in the enterprise, we will stay here where it’s hard but we decided to go across which is the other option and we have SNB, we done reasonably well in marketing, same customer while still avoiding the enterprise. So there are other options. This is where I leave a note and pretending to make eye contact but I’m not. Do a quick time check [laughing].

Product (Mis)management

Product management, a lot of you are willing or unwilling product managers. It’s hard, and one of the first things you hear when you start a company is like focus on the one thing – the best advice I’ve given this 100 times is focus on doing one thing and doing it well. That thing! But HubSpot we’re a special little snowflake and we make our own rules so we said I know we’re supposed to focus on the one thing, we’ll do all the thing and everything someone wants to do in marketing, we will do them all right now, ASAP. That’s our postponing and our motivation here and I’m not suggesting you do this cause I think this was a pseudo-mistake. So in the first years, we said we will do SEO, social media and blogging. In each of these categories there were great companies out there doing well and we were stupid to say not only will we go into these categories, but we will try to compete with all of them at the same time! The reason was in SMB people’s issues was not a dirth of tools but trying to put all these things together was not trivial and they said they didn’t have the sophistication to say I will use WordPress and they didn’t have that and we wanted to serve our market and that was our rationalisation for doing all the things. So the problem wasn’t that we tried to build an all-in-one, but not making a proportional investment in the product to pull it off. Even in the average company and especially in software, good companies say it’s all about the product and then we’ll figure out if you build a good product, marketing and sales will get better. We will layer that in over time, we did the opposite.

So here’s what we did. So we split the company into these levels of progression. Level 1 when we started we will focus on sales and marketing, we will have 3 engineers and 20 sales people. And we did this because we were like we’re starting this company, it’s software. Each individual piece is – we’re not doing a new video codec but so we said ok, we will pause it to ourselves that if we stumble into the market, we will be able to do the software eventually but we don’t know for sure if there’s a market at al. So we’re analytical people and we sat down and said let’s spend our money figuring if there’s a market, and selling it will catch up. We did it for years. And here’s how many marketing leads we need, how much content we produce and what we do to get these leads. We knew our LTV/CAC was good. Every month we will hire a sales rep and it’s – the math is working so Brian and I, because we’re geniuses, we said we should hire 2 a month and eventually something will break nothing scales forever and so it didn’t and we kept doing that. And years into it we were like what have we done to the world?

Then we said this cannot continue, so we said we will stop the madness, we had $11 million left out of our last $12 million round and we will stop hiring sales people and we hit the level 2 when it’s all about the product and when it gets to 8 or 10, at the time the product was a 7 if you rounded up from 6.4 so it wasn’t great. But that worked and we built a team and said we will hire designers, product managers and engineers and get the product to be where it was. And level 3 we said we have that working now and it’s approaching good and not because we’re scaling. We saw our future – this is the number 1 thing we should be worrying about.

Another insight we had, this was a hard one, we had an SEO tool that did SEO things. It gave you keyword recommendations, tracked rankings for you and it did super well. People said go to google, type your phrase. Do you show up? No. do your competitors show up? Yeah. Well you need to change that and it was a very simple, valued proposition and the time was short, especially in niche markets. Nobody is ranking or doing anything, start doing these things and it will work. There are 2 kinds of needs that customers have, there are episodic needs that happen every now and then and there are eternal needs that it never goes away and the mistake we had made was not recognising the fact that SEO was an episodic need. People would love the story around SEO, go and do what we told them to do and 3-4 months later they would be like thank you for helping me optimise my website. I’m done! And they would cancel. Which is for a SaaS company that’s death. There’s no way we can build a sustainable business because they kept cancelling because they saw it as a one-time need, not a recurring need.

This is advice number 2, that at the product or feature level, one thing that’s great for marketing and sales, you need to supplement it with something someone will use every day and will stay with you forever because you need them to stay 5 years to make the model work. You should do an inventory of all the things your product does and put all the features in one of these 2 buckets and if most of the features go into the episodic bucket, then you’ve got a problem. And you know that because it shows up – it cannot not show up.

All right, the other issue we had, big mistake we made, we got into the inbound marketing business and everything that got people to your website, SEO, social media, blogging – as it turns out there was a related category called marketing automation we know what that is, we don’t do that. This is a rare show of discipline; we don’t do that. The one time we needed to do that we said no and multiple people ended up building up billion dollar companies in them.

We don’t do that cause we’re an inbound marketing company and that means things that pull people to your website. Then we had this conversation like who defined – we did. So we can go back and – the underlying philosophy which is an empathetic human based approach to marketing doesn’t just apply to the top of the funnel stuff, there’s a better way to do automation there’s no reason why we couldn’t do it, so we had to get over ourselves.

I changed the wording of this slide 10 times today in the back row during lunch and you need to do product management and feature selection. This is what all companies struggle with, so I’m not suggesting that they are taking over the PM jobs, that’s the last ones to go because lots of insight and creativity and human decisions that are hard for a bot to replicate. The thing I think we’re missing, most software companies, including us, we say that we’re data powered and driven, most product management teams aren’t and as evidence I provide to you this.

So let’s pick another often non data oriented discipline, let’s talk about employees teams. If there was an employee that didn’t show up for work, contributed no value, over time that person is not working out and they get taken out of the company. We almost as an industry never do that with product features. They should have to earn their day in the product day after day. Is anyone using it at all? When new customers join is this something that makes on boarding 3 times as long? There should be a covering cost for everything that’s in the product and the data would tell us this. We’re a SAAS business so we know this stuff and yet we don’t do anything about it. So one of my takeaways to you is if you could write a function to tell you which features or the LTV/CAC, what factors would go into the algorithm? Do people log on or use the feature at all? Do they get the benefit we’re trying to deliver? How do people or our employees feel about working on it? All these should go into the decision of whether a feature gets to live or not in the product and we’re terrible at this. We don’t use data for the most important thing our industry makes and that’s the product.

Perils of Pricing and Packaging

Pricing and packaging, bane of my existence and many people in software. I will tell you the quick story at HubSpot, we realised we had 2 co-founders both recent MBAs, just graduated. We were like we’ve got this all in one platforms and will someday do all the things. What should we charge for this platform? If it would take 6 MBAs 3 months to come up with pricing, how long does it take 2 MBAs? And that is 3 minutes. I will tell you, Brian we should start selling the product. Of course! The only way to see if there’s a market for it is if we start charging for it. So we need to know what to charge for it, we’re both brilliant that way. So what do you think we should charge? What do you think? How about $250? Ok, and that was our price for years. There was no supply demand curves, testing or reading things. Not starting at $250, that one word would have changed our destiny. No, it’s $250, that’s what it is. I don’t care if you’re Dunkin Donuts, you are not allowed to pay us a penny more. We charged $250, not per employee or anything, for the company. Done! Stupidest thing we’ve done in our company’s history. I can say that I was half the one that did it and so we said – we’re trying to create, the one thing entrepreneurs get good at is rationalisation, over time it’s like I know this seems stupid but this is why we did it. Our rationalisation was we tried to create this new category and have as many people using it as possible. If we make 500 or 250, when we only have 100 customers it doesn’t change anything. The pricing isn’t the issue, we want iniquity.

Michael talked about it, so that’s the low friction and relatively easy price. Then of course this is me. Of course, this is SaaS. The pricing has to be monthly, who would do an annual contract in SaaS? You don’t do that, especially in SMB or if you’re going out for iniquity. This is not the 2nd stupid things we’ve done but in the top 5. Not that we didn’t have annual contracts, but that we didn’t test it. Our assumption was nobody will buy and drive our sales by 97%. We made it up, then we started testing and said we’ll do both and then we make deliberate decisions. Right now if you’re all monthly, we’re all annual, you owe it to yourself to test it the other way. The data we gather about these customers is worth much more.

Another mistake around pricing and this I don’t feel badly for cause every company does this. This is the classic way to do pricing. The circle, I drew straight edges. You say I have this product for 250 and this pro version and it will have more things than the other things, everything that’s in 250 you also get in 500 but you also get some more stuff. Which sounds like a good thing, the reality though so that pricing assumes that people just want more features and as they get sophisticated they will move to the pro version of the product and that’s not always the case. In our case we had 2 different buckets of customers, very different personas and needs and it’s not that the bucket that was willing to pay $500 it was like I need different things. It was something the bigger customers just didn’t care about. Once we realised that, it made packaging and pricing simple and we went to this model, just don’t do the concentric squares or models.

So of all the things we talked about, that we’ve had multi hour debates and discussions, highly animated, pricing and packaging is the biggest thorn in our side. We had people we are not leaving this room until we decide what goes into x, what we will charge for it and all those things. If any of you happen to be in those meetings or unlucky enough to hold them, my sympathies with you. It’s hard but you have to do it. Not as much as the code, but relatively high. I will skip this part, and wind down so we can take some questions.

Retention, Retention, Retention

Talk about retention. I said this before, if you’re in a SaaS company if you don’t figure out retention, you’re dead and done. It’s a matter of time. So that we all know, that’s intuitive, we get that. What’s less intuitive is this thing, there’s this thing called customer retention and revenue retention. Both are retention on different things. I will give you a quick explanation, what percentage of those customers stay until next month – revenue retention is you were making 100k from your 100 customers and then you were making 90k from them. That’s revenue retention so you could lose the same percentage of customers but more or less revenue if those that cancelled were paying you more or less than the average. If you think about customer retention, there are lots of things that happen because the revenue goes down because you’re losing the big ones and are walking down the door – and this is the most subtle one. So we’re like oh, well we’re on a monthly thing. The customer had for the last 9 months the opportunity to cancel every month and they didn’t, of course they are happy. Why wouldn’t they cancel? They have the option, but they didn’t. the reality is we don’t understand why customers don’t cancel, it could be pure inertia, I haven’t gotten around to it.

So the idea here is that you should measure if you’re delivering value through something independent of cancellation. It happens after the fact, you need to know which customers are unhappy before the fact. Do customer surveys and what you have to do to find out if they are happy or not. And then the corollary – this is the subtlest one. So if you’re solving for revenue retention and raising money private or public, that’s the number that’s the most cited around retention. If you talk to any SaaS company with investors and they cite your retention number, that’s what people care about more cause it’s safer. The issue with revenue retention is people talk about net revenue retention and that is 10 customers cancelled from whom we were making 10k and we lost that revenue but of the customers that were left they are paying us more. Maybe just exactly 10k so that nets out and we have 100% revenue retention. The challenge here is that if you go down that path and are roughly good at sales as a company, you can sell your way through revenue retention issues, you sell the existing customers that are happy more stuff. Your product didn’t get any better, you sold the existing customers more stuff and your revenue retention is 100% but they aren’t any happier. Are you selling your way through to make the numbers look good? That makes sense, the business is growing.

Promise talked earlier about building 100-year company and we talked about that internally as well and we think that’s a noble thing cause it forces you to think long term and you think does this put us on that path? I had 15 minutes before I walked on stage here, this is the geek in me. I was like well 100 years seems daunting, I want to say a company will be around for at least 10 years, that I can think about. What are the things we’re doing right now? 100 years I have no idea what’s gonna happen. We’re happy and they are gonna take us out of the company either dead or crazy. That’s my idea after 10 years so that’s my message for you. Thanks for your time, I will take questions!

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.

Q&A

Audience Question: Thank you very much! I have a question about your 3 levels. How much were you actually selling first and were you fulfilling the promise that was sold?

Dharmesh Shah: It’s a good question and the answer is we weren’t. We told our early customers that the product was beta and we couldn’t oversell. That was a stupid thing to do – so one thing we’ve been good at, there’s lots of mistakes we’ve made, is we don’t announce product features, let alone sell them. When we have our annual conference we don’t talk about the product roadmap cause we don’t have one. We don’t think that’s a mistake and advocate that. We didn’t sell the things that didn’t exist, we said here’s what it does, we were very good at servicing them but the product started catching up.

Audience Question: How do you think about the trade-off between growth and profitability?

Dharmesh Shah: We had to deal with it all of our existence of the company and that kind of thing. Our take was interesting, we went public in 14, at that time, what investors and the street wanted to know was growth. Profitability didn’t show up, it was growth. This is when we were planning the IPO process. When we went public, investors stepped back and were like, we like growth but we want a path to profitability. And we told them we don’t really look at the ratio of that, here’s our projections. They were 6-8 years ago, this is how much money we will spend, it’s completely economics driven. So we didn’t spend like drunken sailors, we could have grown faster than we did, but we chose not to. We didn’t think that’s prudent. When it flipped, we want the path of profitability, we didn’t swing the pendulum at all. We didn’t change the numbers at all. My advice right now would be more leaning towards profitability but they want you to be able to say the word profit out of their mouth.

Audience Question: My question may be a stupid one, have you ever tested the different cohorts for monthly versus annual for churn rates? I assumed that monthly would be lower churn –

Dharmesh Shah: You were wrong, I was wrong too. If we had 100 questions or 500 around churn, all of you ask different things, did HubSpot look at this? We looked at it, analysing churn was something we were good at. So we looked at monthly versus annual and annual customers churn less frequently because they make a larger commitment and they have to make a decision. I was arguing against it but they make the commitment of time to learn the product and aren’t like I signed up and 3 months well nothing happened in your app. Did you use it? No, but nothing happened. I will give you a little one and you will get a kick out of this. If you plotted a histogram and here’s a churn rate by month., here’s the percentage from the 15th to the 20th of any month. The geek in me says they should be the same and they aren’t. why would that be? Why would the 28th be higher? The reason is that sales teams are human and they are optimised machines. If it’s approaching the end of the month they will get more aggressive selling the customers than at the beginning of the month. You sign customers that aren’t as good fits – so we’ve done things to reduce the incentives for sales people to do it like that.

Audience Question: Hi! How did you get there without all the perks?

Dharmesh Shah: We think the reason partly we didn’t make it in 2015 is the bar is 1000 employees so we weren’t eligible. We don’t have perks in the Silicon Valley style and also don’t have 5 square foot office space. I don’t want to mislead you that we’re frugal cause we’re not. The thing we do have is data. We were surveying our employees for a long time and we ask them are you happy here? If not why not? Every company meeting we have we go through – all this information is public at the company internally. Someone talked about that before, account balance and transparency is 100% is shared with all employees, with two exceptions. One is salary information and things that are illegal for us to share. When we go through it, every company meeting we’re like we surveyed you and here’s what you said were broken. And we have a person whose sole job is to fix these issues. And they don’t care about perks but what we don’t think we’re investing enough in education. I got thrown in management too quickly and I need you to help me. We fix them and the best people don’t care about perks as long as it’s a reasonably comfortable environment. It’s who you work around. If you get one thing right, get that right. The second thing is around autonomy. If you’re doing it right, it should be painful. My god, I have this thought in my head 50 times a month. This employee is about to do this, they just started 4 months ago and don’t know anything about the company. My co-founder goes through the same issue. We don’t say by the way – we make gentle nudges but don’t veto or dictate and it’s hard but that’s what they care about the most. Learn the things and make the investment themselves. Career path is important, we’ve chosen deliberately not to try to fix that too much cause we believe people define their own career path. We don’t know what you want to do 5 years from now. We tell you about the company but we won’t give you this career path.

Audience Question: Hi! For the SMB market $250 is a high price. Why and how have you resisted that pressure to go down market?

Dharmesh Shah: If I had one, I should put this in here, your price is defined by your model. How do you sell? If you’re selling over the web, then you can get away with $10. If you have an inside sales person that’s gonna make deals, the price has to be in the $200-300 range. So you can’t afford to sell a product with less than 200. The math just doesn’t work. In our world, the reason we ended up going in the mid-market is – by the way this was the number one most hotly debated issue is target market selection. I have 4 slides I took out because I just got over my little twitch as a result of having those conversations. Who is the customer and why are we picking them? In the age of the internet, for the first 6 years, we have these small business owners and then these mid-market VPs in marketing and CMOs. Two different customer personas and we had leads coming in from both. I was like we have leads coming in on a marginal basis. Why wouldn’t we sell them? They can cancel if they don’t like it. That’s number two if I’m keeping count, is around not choosing a target market. We debated this for years and talked about it all the time and we decided to decide because we weren’t emotionally capable of deciding. I was like not today but someday we’re gonna make this decision and lock ourselves in a room and not walk out until a decision is made and then we sleep on it and see if we regret that decision. We went back and forth for a while.

Mark Littlewood: It’s a tough question. What’s changed at HubSpot since the Dan Lyons book has come out?

Dharmesh Shah: Questions around that book which – how many people heard or read the book? Most of you, it’s a NY Times bestseller. I will tell you two things. As a team, we made a collective decision to take the high road on this and we’re not gonna disparage them or the book and he made some good point around the diversity. The team is more galvanised today than it was before, the stock price has been up every week since the book came out so it doesn’t seem the market was that impacted but it was the toughest time in my professional career cause it’s not fun having someone criticising everything you ever done. There are better ways to spend your time, but having said that, the company was fine and this was the test for me. I was at Harvard Business School and I was there to teach which we do every year. 900 MBA students are going through and someone in the preparation said ok, if someone asks about the book – when they said that my reaction is they are talking about the inbound marketing book, I’m not sure if the students want to hear that. Up until now I was over it. I’m happy to talk about it in private over beers, but the team has gelled, I was disappointed that we weren’t able to give the experience – we look at glassdoor maniacally all the time. On average people seem to be happy and enjoy it.

Audience Question: Hi! You said you don’t have a product roadmap?

Dharmesh Shah: No, which makes the executives, management, sales teams and the board and other people uncomfortable. Me also. I’m CTO so I have some say and some responsibility. The reason we don’t have it is because it doesn’t work for us. What ends up happening, I’ve been in software for 25 years, I know how to build commercial software reasonably well. The challenge is you start to believe the roadmap as that’s what’s going to happen. I’m not saying this will still be the case – right now we’re at 1400 employees. So it’s not like we don’t know what we will do but we don’t use it. Our CEO and I are allowed to talk about things in the future. The reason it works is in the SaaS world, is they are not in the enterprise software business but SMB grow fast and things change all the time. So it’s a good question and one that requires at least a beer to get into it deeply. What else?

Audience Question: Hi! Has she vested her share options or was she promoted in the team or have you kicked her into some HR role?

Dharmesh Shah: So, Molly is a teddy bear that we have that sits in customer meetings as a proxy for the customer. I was criticised in the book and it was like that doesn’t make sense and the reason somewhat smart people did it is like one of the mistakes companies make is they think they have the voice of the customer but they don’t. We would have Molly sit in the chair and when we were making a decision that we thought wasn’t in the interest of the customer, we looked at Molly and thought what would she say? It’s one thing to talk about customers in the abstract and we don’t think this and tested this, if she was a real person, what would she actually say? We felt that incited the right conversations so we’re bringing her more often as a result of the book. We didn’t kill that behaviour!

Thanks for your time, this was so much fun!

Learn how great SaaS & software companies are run

We produce exceptional conferences & content that will help you build better products & companies.

Join our friendly list for event updates, ideas & inspiration.